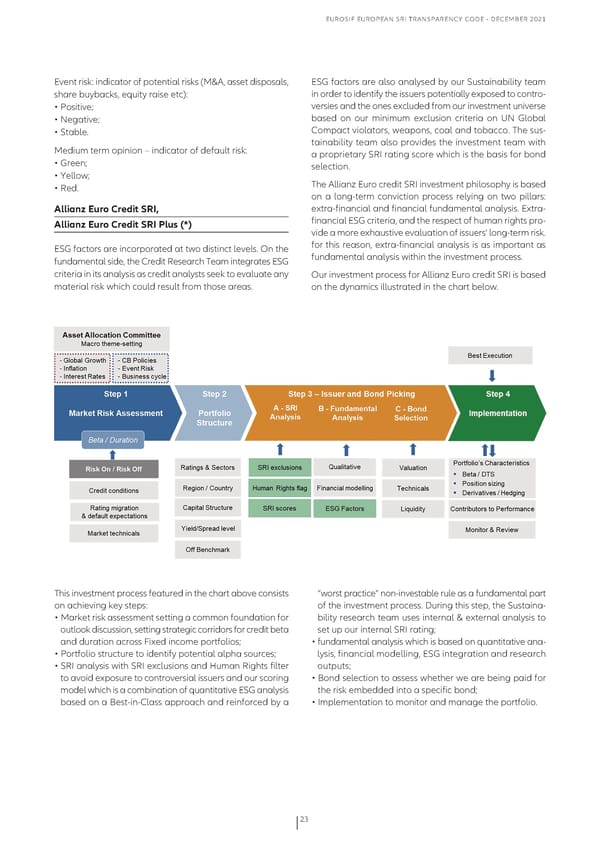

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 Event risk: indicator of potential risks (m&a, asset disposals, ESG factors are also analysed by our Sustainability team share buybacks, equity raise etc): in order to identify the issuers potentially exposed to contro- • positive; versies and the ones excluded from our investment universe • Negative; based on our minimum exclusion criteria on uN Global • Stable. compact violators, weapons, coal and tobacco. The sus- medium term opinion – indicator of default risk: tainability team also provides the investment team with a proprietary SRI rating score which is the basis for bond • Green; selection. • yellow; • Red. The allianz Euro credit SRI investment philosophy is based on a long-term conviction process relying on two pillars: Allianz Euro Credit SRI, extra-financial and financial fundamental analysis. Extra- Allianz Euro Credit SRI Plus (*) financial ESG criteria, and the respect of human rights pro- vide a more exhaustive evaluation of issuers’ long-term risk. ESG factors are incorporated at two distinct levels. on the for this reason, extra-financial analysis is as important as fundamental side, the credit Research Team integrates ESG fundamental analysis within the investment process. criteria in its analysis as credit analysts seek to evaluate any our investment process for allianz Euro credit SRI is based material risk which could result from those areas. on the dynamics illustrated in the chart below. This investment process featured in the chart above consists “worst practice” non-investable rule as a fundamental part on achieving key steps: of the investment process. During this step, the Sustaina- • market risk assessment setting a common foundation for bility research team uses internal & external analysis to outlook discussion, setting strategic corridors for credit beta set up our internal SRI rating; and duration across fixed income portfolios; • fundamental analysis which is based on quantitative ana- • portfolio structure to identify potential alpha sources; lysis, financial modelling, ESG integration and research • SRI analysis with SRI exclusions and Human Rights filter outputs; to avoid exposure to controversial issuers and our scoring • bond selection to assess whether we are being paid for model which is a combination of quantitative ESG analysis the risk embedded into a specific bond; based on a best-in-class approach and reinforced by a • Implementation to monitor and manage the portfolio. 23

Eurosif European SRI Transparency Code Page 22 Page 24

Eurosif European SRI Transparency Code Page 22 Page 24