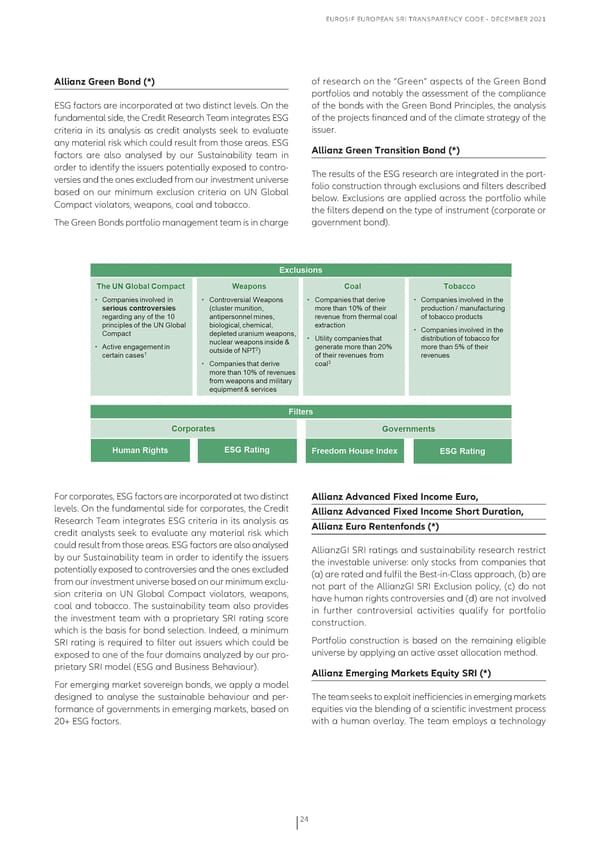

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 Allianz Green Bond (*) of research on the “Green” aspects of the Green bond portfolios and notably the assessment of the compliance ESG factors are incorporated at two distinct levels. on the of the bonds with the Green bond principles, the analysis fundamental side, the credit Research Team integrates ESG of the projects financed and of the climate strategy of the criteria in its analysis as credit analysts seek to evaluate issuer. any material risk which could result from those areas. ESG Allianz Green Transition Bond (*) factors are also analysed by our Sustainability team in order to identify the issuers potentially exposed to contro- The results of the ESG research are integrated in the port- versies and the ones excluded from our investment universe folio construction through exclusions and filters described based on our minimum exclusion criteria on uN Global below. Exclusions are applied across the portfolio while compact violators, weapons, coal and tobacco. the filters depend on the type of instrument (corporate or The Green bonds portfolio management team is in charge government bond). for corporates, ESG factors are incorporated at two distinct Allianz Advanced Fixed Income Euro, levels. on the fundamental side for corporates, the credit Allianz Advanced Fixed Income Short Duration, Research Team integrates ESG criteria in its analysis as Allianz Euro Rentenfonds (*) credit analysts seek to evaluate any material risk which could result from those areas. ESG factors are also analysed allianzGI SRI ratings and sustainability research restrict by our Sustainability team in order to identify the issuers the investable universe: only stocks from companies that potentially exposed to controversies and the ones excluded (a) are rated and fulfil the best-in-class approach, (b) are from our investment universe based on our minimum exclu- not part of the allianzGI SRI Exclusion policy, (c) do not sion criteria on uN Global compact violators, weapons, have human rights controversies and (d) are not involved coal and tobacco. The sustainability team also provides in further controversial activities qualify for portfolio the investment team with a proprietary SRI rating score construction. which is the basis for bond selection. Indeed, a minimum SRI rating is required to filter out issuers which could be portfolio construction is based on the remaining eligible exposed to one of the four domains analyzed by our pro- universe by applying an active asset allocation method. prietary SRI model (ESG and business behaviour). Allianz Emerging Markets Equity SRI (*) for emerging market sovereign bonds, we apply a model designed to analyse the sustainable behaviour and per- The team seeks to exploit inefficiencies in emerging markets formance of governments in emerging markets, based on equities via the blending of a scientific investment process 20+ ESG factors. with a human overlay. The team employs a technology 24

Eurosif European SRI Transparency Code Page 23 Page 25

Eurosif European SRI Transparency Code Page 23 Page 25