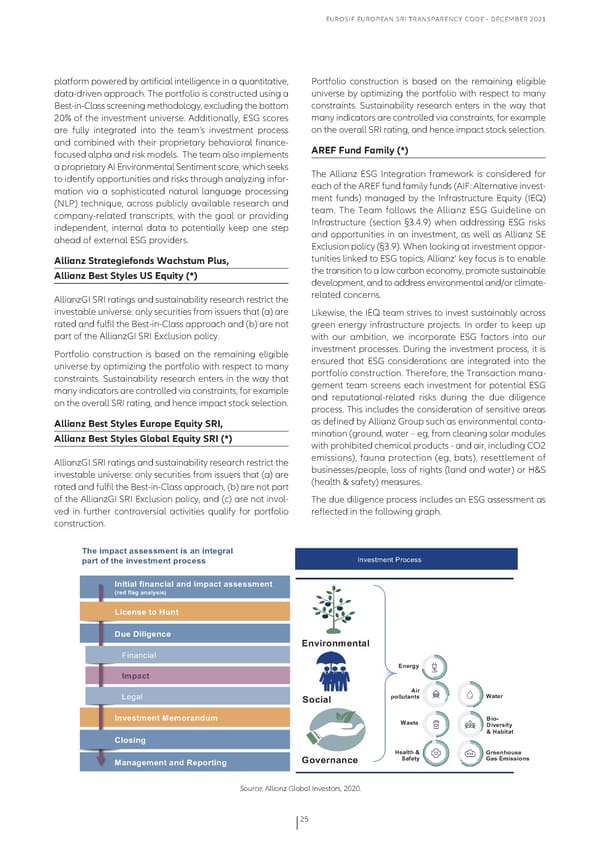

EuRoSIf EuRopEaN SRI TRaNSpaRENcy coDE - DEcEmbER 2021 platform powered by artificial intelligence in a quantitative, portfolio construction is based on the remaining eligible data-driven approach. The portfolio is constructed using a universe by optimizing the portfolio with respect to many best-in-class screening methodology, excluding the bottom constraints. Sustainability research enters in the way that 20% of the investment universe. additionally, ESG scores many indicators are controlled via constraints, for example are fully integrated into the team’s investment process on the overall SRI rating, and hence impact stock selection. and combined with their proprietary behavioral finance- AREF Fund Family (*) focused alpha and risk models. The team also implements a proprietary aI Environmental Sentiment score, which seeks The allianz ESG Integration framework is considered for to identify opportunities and risks through analyzing infor- each of the aREf fund family funds (aIf: alternative invest- mation via a sophisticated natural language processing ment funds) managed by the Infrastructure Equity (IEQ) (NLp) technique, across publicly available research and team. The Team follows the allianz ESG Guideline on company-related transcripts, with the goal or providing Infrastructure (section §3.4.9) when addressing ESG risks independent, internal data to potentially keep one step and opportunities in an investment, as well as allianz SE ahead of external ESG providers. Exclusion policy (§3.9). When looking at investment oppor- Allianz Strategiefonds Wachstum Plus, tunities linked to ESG topics, allianz’ key focus is to enable Allianz Best Styles US Equity (*) the transition to a low carbon economy, promote sustainable development, and to address environmental and/or climate- allianzGI SRI ratings and sustainability research restrict the related concerns. investable universe: only securities from issuers that (a) are Likewise, the IEQ team strives to invest sustainably across rated and fulfil the best-in-class approach and (b) are not green energy infrastructure projects. In order to keep up part of the allianzGI SRI Exclusion policy. with our ambition, we incorporate ESG factors into our portfolio construction is based on the remaining eligible investment processes. During the investment process, it is universe by optimizing the portfolio with respect to many ensured that ESG considerations are integrated into the constraints. Sustainability research enters in the way that portfolio construction. Therefore, the Transaction mana- many indicators are controlled via constraints, for example gement team screens each investment for potential ESG on the overall SRI rating, and hence impact stock selection. and reputational-related risks during the due diligence process. This includes the consideration of sensitive areas Allianz Best Styles Europe Equity SRI, as defined by allianz Group such as environmental conta- Allianz Best Styles Global Equity SRI (*) mination (ground, water – eg, from cleaning solar modules with prohibited chemical products - and air, including co2 allianzGI SRI ratings and sustainability research restrict the emissions), fauna protection (eg, bats), resettlement of investable universe: only securities from issuers that (a) are businesses/people, loss of rights (land and water) or H&S rated and fulfil the best-in-class approach, (b) are not part (health & safety) measures. of the allianzGI SRI Exclusion policy, and (c) are not invol- The due diligence process includes an ESG assessment as ved in further controversial activities qualify for portfolio reflected in the following graph. / / / / / / / construction. ?8(2$'3*-)2*55(55'(")2$52*"2$")(/%*+2 3*%)2&:2)8(2$"#(5)'(")23%&-(55 ! 1$:(5)2($)/;9#4(55 @"$)$*+2:$"*"-$*+2*"A2$'3*-)2*55(55'(")2 B%(A2:+*/2*"*+05$5C F$-("5(2)&274") =4(2=$+$/("-(2 !"#$%&"'(")*+ >&$*$4&*+ !"(%/0 @'3*-) 1$%2 6*)(% <(=*+ ,&-$*+ 3&++4)*")5 @"#(5)'(")2D('&%*"A4' 6*5)( ;$&< =$#(%5$)02 927*>$)*) G+&5$"/ 7(*+)8292 .%(("8&45(2 D*"*/('(")2*"A2E(3&%)$"/2 .&#(%"*"-( ,*:()0 .*52!'$55$&"5 / / / / / / Source: allianz Global Investors, 2020. 25

Eurosif European SRI Transparency Code Page 24 Page 26

Eurosif European SRI Transparency Code Page 24 Page 26