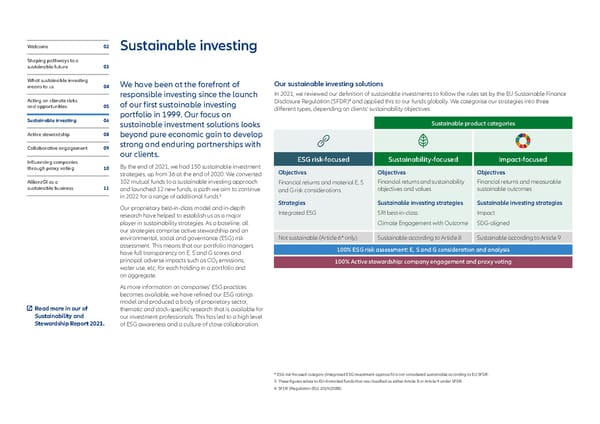

Welcome 02 Sustainable investing Shaping pathways to a sustainable future 03 What sustainable investing We have been at the forefront of Our sustainable investing solutions means to us 04 responsible investing since the launch In 2021, we reviewed our definition of sustainable investments to follow the rules set by the EU Sustainable Finance Acting on climate risks 4 of our first sustainable investing Disclosure Regulation (SFDR) and applied this to our funds globally. We categorise our strategies into three and opportunities 05 different types, depending on clients’ sustainability objectives: portfolio in 1999. Our focus on Sustainable investing 06 sustainable investment solutions looks Sustainable product categories Active stewardship 08 beyond pure economic gain to develop Collaborative engagement 09 strong and enduring partnerships with our clients. ESG risk-focused Sustainability-focused Impact-focused Influencing companies By the end of 2021, we had 150 sustainable investment through proxy voting 10 Objectives Objectives Objectives strategies, up from 36 at the end of 2020. We converted AllianzGI as a 102 mutual funds to a sustainable investing approach Financial returns and material E, S Financial returns and sustainability Financial returns and measurable sustainable business 11 and launched 12 new funds, a path we aim to continue and G risk considerations objectives and values sustainable outcomes in 2022 for a range of additional funds.3 Our proprietary best-in-class model and in-depth Strategies Sustainable investing strategies Sustainable investing strategies research have helped to establish us as a major Integrated ESG SRI best-in-class Impact player in sustainability strategies. As a baseline, all Climate Engagement with Outcome SDG-aligned our strategies comprise active stewardship and an environmental, social and governance (ESG) risk Not sustainable (Article 6* only) Sustainable according to Article 8 Sustainable according to Article 9 assessment. This means that our portfolio managers 100% ESG risk assessment: E, S and G consideration and analysis have full transparency on E, S and G scores and principal adverse impacts such as CO emissions, 2 100% Active stewardship: company engagement and proxy voting water use, etc, for each holding in a portfolio and on aggregate. As more information on companies’ ESG practices becomes available, we have refined our ESG ratings model and produced a body of proprietary sector, Read more in our of thematic and stock-specific research that is available for Sustainability and our investment professionals. This has led to a high level Stewardship Report 2021. of ESG awareness and a culture of close collaboration. * ESG risk-focused category (Integrated ESG investment approach) is not considered sustainable according to EU SFDR. 3 These figures relate to EU-domiciled funds that are classified as either Article 8 or Article 9 under SFDR. 4 SFDR (Regulation (EU) 2019/2088).

Executive summary - Sustainability and Stewardship Report 2021 Page 5 Page 7

Executive summary - Sustainability and Stewardship Report 2021 Page 5 Page 7