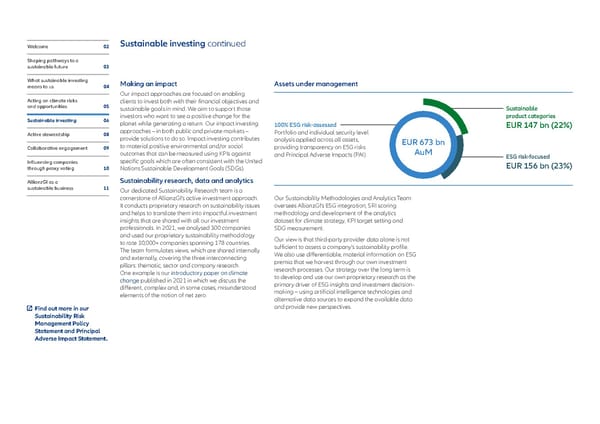

Welcome 02 Sustainable investing continued Shaping pathways to a sustainable future 03 What sustainable investing Making an impact Assets under management means to us 04 Our impact approaches are focused on enabling Acting on climate risks clients to invest both with their financial objectives and and opportunities 05 sustainable goals in mind. We aim to support those Sustainable Sustainable investing 06 investors who want to see a positive change for the product categories planet while generating a return. Our impact investing 1% ES risassessed EUR 147 bn (22%) Active stewardship 08 approaches – in both public and private markets – Portfolio and individual security level provide solutions to do so. Impact investing contributes analysis applied across all assets, EUR 673 bn Collaborative engagement 09 to material positive environmental and/or social providing transparency on ESG risks AuM outcomes that can be measured using KPIs against and Principal Adverse Impacts (PAI) ES risocused Influencing companies specific goals which are often consistent with the United EUR 16 bn (23%) through proxy voting 10 Nations Sustainable Development Goals (SDGs). AllianzGI as a Sustainability research, data and analytics sustainable business 11 Our dedicated Sustainability Research team is a cornerstone of AllianzGI’s active investment approach. Our Sustainability Methodologies and Analytics Team It conducts proprietary research on sustainability issues oversees AllianzGI’s ESG integration, SRI scoring and helps to translate them into impactful investment methodology and development of the analytics insights that are shared with all our investment dataset for climate strategy, KPI target setting and professionals. In 2021, we analysed 300 companies SDG measurement. and used our proprietary sustainability methodology Our view is that third-party provider data alone is not to rate 10,000+ companies spanning 178 countries. sufficient to assess a company’s sustainability profile. The team formulates views, which are shared internally We also use differentiable, material information on ESG and externally, covering the three interconnecting premia that we harvest through our own investment pillars: thematic, sector and company research. research processes. Our strategy over the long term is One example is our introductory paper on climate to develop and use our own proprietary research as the change published in 2021 in which we discuss the primary driver of ESG insights and investment decision- different, complex and, in some cases, misunderstood making – using artificial intelligence technologies and elements of the notion of net zero. alternative data sources to expand the available data Find out more in our and provide new perspectives. Sustainability Risk Management Policy Statement and Principal Adverse Impact Statement.

Executive summary - Sustainability and Stewardship Report 2021 Page 6 Page 8

Executive summary - Sustainability and Stewardship Report 2021 Page 6 Page 8