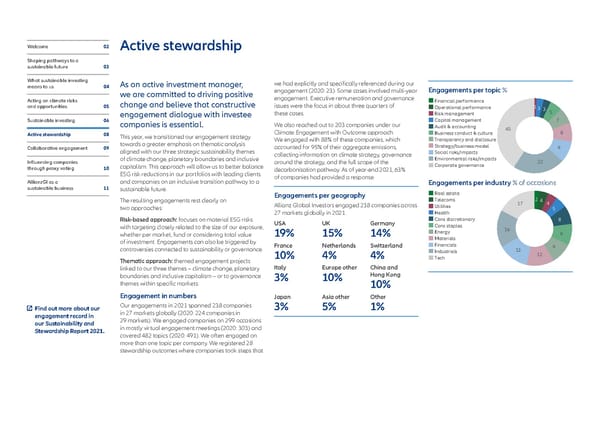

Welcome 02 Active stewardship Shaping pathways to a sustainable future 03 What sustainable investing As an active investment manager, we had explicitly and specifically referenced during our means to us 04 engagement (2020: 23). Some cases involved multi-year Engagements per topic % we are committed to driving positive engagement. Executive remuneration and governance Acting on climate risks change and believe that constructive Financial performance and opportunities 05 issues were the focus in about three quarters of Operational performance 13 3 engagement dialogue with investee these cases. Risk management 5 Sustainable investing 06 companies is essential. We also reached out to 203 companies under our Capital management 7 Audit & accounting 40 Active stewardship 08 This year, we transitioned our engagement strategy Climate Engagement with Outcome approach. Business conduct & culture 8 towards a greater emphasis on thematic analysis We engaged with 88% of these companies, which Transparency and disclosure Collaborative engagement 09 accounted for 95% of their aggregate emissions, Strategy/business model 9 aligned with our three strategic sustainability themes collecting information on climate strategy, governance Social risks/impacts Influencing companies of climate change, planetary boundaries and inclusive around the strategy, and the full scope of the Enironmental risks/impacts 22 through proxy voting 10 capitalism. This approach will allow us to better balance decarbonisation pathway. As of year-end 2021, 63% Corporate goernance ESG risk reductions in our portfolios with leading clients of companies had provided a response. AllianzGI as a and companies on an inclusive transition pathway to a Engagements per industry % of occasions sustainable business 11 sustainable future. Engagements per geography Real estate The resulting engagements rest clearly on Telecoms 17 2 4 4 two approaches: Allianz Global Investors engaged 238 companies across Utilities 5 27 markets globally in 2021. Health Risk-based approach: focuses on material ESG risks USA UK Germany Cons discretionary 8 with targeting closely related to the size of our exposure, Cons staples 16 whether per market, fund or considering total value 19% 15% 14% Energy 9 of investment. Engagements can also be triggered by Materials controversies connected to sustainability or governance. France Netherlands Switzerland Financials 9 Industrials 13 10% 4% 4% Tech 12 Thematic approach: themed engagement projects linked to our three themes – climate change, planetary Italy Europe other China and boundaries and inclusive capitalism – or to governance 3% 10% Hong Kong themes within specific markets. 10% Engagement in numbers Japan Asia other Other Find out more about our Our engagements in 2021 spanned 238 companies 3% 5% 1% engagement record in in 27 markets globally (2020: 224 companies in our Sustainability and 29 markets). We engaged companies on 299 occasions Stewardship Report 2021. in mostly virtual engagement meetings (2020: 303) and covered 482 topics (2020: 491). We often engaged on more than one topic per company. We registered 28 stewardship outcomes where companies took steps that

Executive summary - Sustainability and Stewardship Report 2021 Page 7 Page 9

Executive summary - Sustainability and Stewardship Report 2021 Page 7 Page 9