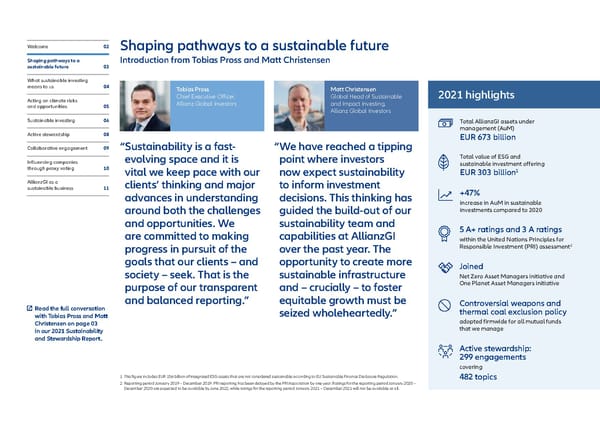

Welcome 02 Shaping pathways to a sustainable future Shaping pathways to a Introduction from Tobias Pross and Matt Christensen sustainable future 03 What sustainable investing means to us 04 Tobias Pross Matt Christensen 2021 highlights Acting on climate risks Chief Executive Officer, Global Head of Sustainable and opportunities 05 Allianz Global Investors and Impact Investing, Allianz Global Investors Sustainable investing 06 Total AllianzGI assets under management (AuM) Active stewardship 08 EUR 673 billion Collaborative engagement 09 “ Sustainability is a fast- “ We have reached a tipping evolving space and it is point where investors Total value of ESG and Influencing companies sustainable investment offering through proxy voting 10 1 vital we keep pace with our now expect sustainability EUR 303 billion AllianzGI as a clients’ thinking and major to inform investment sustainable business 11 +47% advances in understanding decisions. This thinking has increase in AuM in sustainable around both the challenges guided the build-out of our investments compared to 2020 and opportunities. We sustainability team and 5 A+ ratings and 3 A ratings are committed to making capabilities at AllianzGI within the United Nations Principles for progress in pursuit of the over the past year. The Responsible Investment (PRI) assessment2 goals that our clients – and opportunity to create more Joined society – seek. That is the sustainable infrastructure Net Zero Asset Managers initiative and purpose of our transparent and – crucially – to foster One Planet Asset Managers initiative and balanced reporting.” equitable growth must be Controversial weapons and Read the full conversation seized wholeheartedly.” thermal coal exclusion policy with Tobias Pross and Matt Christensen on page 03 adopted firmwide for all mutual funds in our 2021 Sustainability that we manage and Stewardship Report. Active stewardship: 299 engagements covering 1 This figure includes EUR 156 billion of integrated ESG assets that are not considered sustainable according to EU Sustainable Finance Disclosure Regulation. 482 topics 2 Reporting period January 2019 – December 2019. PRI reporting has been delayed by the PRI Association by one year. Ratings for the reporting period January 2020 – December 2020 are expected to be available by June 2022, while ratings for the reporting period January 2021 – December 2021 will not be available at all.

Executive summary - Sustainability and Stewardship Report 2021 Page 2 Page 4

Executive summary - Sustainability and Stewardship Report 2021 Page 2 Page 4