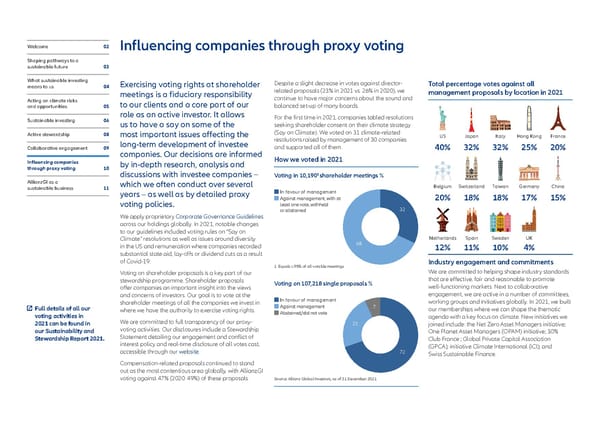

Welcome 02 Influencing companies through proxy voting Shaping pathways to a sustainable future 03 What sustainable investing Exercising voting rights at shareholder Despite a slight decrease in votes against director- Total percentage votes against all means to us 04 related proposals (23% in 2021 vs. 26% in 2020), we meetings is a fiduciary responsibility management proposals by location in 2021 Acting on climate risks to our clients and a core part of our continue to have major concerns about the sound and and opportunities 05 balanced set-up of many boards. role as an active investor. It allows For the first time in 2021, companies tabled resolutions Sustainable investing 06 us to have a say on some of the seeking shareholder consent on their climate strategy Active stewardship 08 most important issues affecting the (Say on Climate). We voted on 31 climate-related US Japan Italy Hong Kong France long-term development of investee resolutions raised by management of 30 companies Collaborative engagement 09 and supported all of them. 40% 32% 32% 25% 20% companies. Our decisions are informed How we voted in 2021 Influencing companies by in-depth research, analysis and through proxy voting 10 discussions with investee companies – 1 Voting in 10,190 shareholder meetings % AllianzGI as a which we often conduct over several Belgium Switzerland Taiwan Germany China sustainable business 11 years – as well as by detailed proxy In favour of management Against management, with at 20% 18% 18% 17% 15% voting policies. least one vote, withheld or abstained 32 We apply proprietary Corporate Governance Guidelines across our holdings globally. In 2021, notable changes to our guidelines included voting rules on “Say on Climate” resolutions as well as issues around diversity Netherlands Spain Sweden UK in the US and remuneration where companies recorded 68 12% 11% 10% 4% substantial state aid, lay-offs or dividend cuts as a result of Covid-19. Industry engagement and commitments 1 Equals c.95% of all votable meetings Voting on shareholder proposals is a key part of our We are committed to helping shape industry standards stewardship programme. Shareholder proposals Voting on 107,218 single proposals % that are effective, fair and reasonable to promote offer companies an important insight into the views well-functioning markets. Next to collaborative and concerns of investors. Our goal is to vote at the engagement, we are active in a number of committees, shareholder meetings of all the companies we invest in In favour of management working groups and initiatives globally. In 2021, we built Full details of all our where we have the authority to exercise voting rights. Against management 7 our memberships where we can shape the thematic voting activities in Abstained/did not vote agenda with a key focus on climate. New initiatives we 2021 can be found in We are committed to full transparency of our proxy- 21 joined include: the Net Zero Asset Managers initiative; our Sustainability and voting activities. Our disclosures include a Stewardship One Planet Asset Managers (OPAM) initiative; 30% Stewardship Report 2021. Statement detailing our engagement and conflict of Club France ; Global Private Capital Association interest policy and real-time disclosure of all votes cast, (GPCA); initiative Climate International (iCI); and accessible through our website. 72 Swiss Sustainable Finance. Compensation-related proposals continued to stand out as the most contentious area globally, with AllianzGI voting against 47% (2020: 49%) of these proposals. Source: Allianz Global Investors, as of 31 December 2021

Executive summary - Sustainability and Stewardship Report 2021 Page 9 Page 11

Executive summary - Sustainability and Stewardship Report 2021 Page 9 Page 11