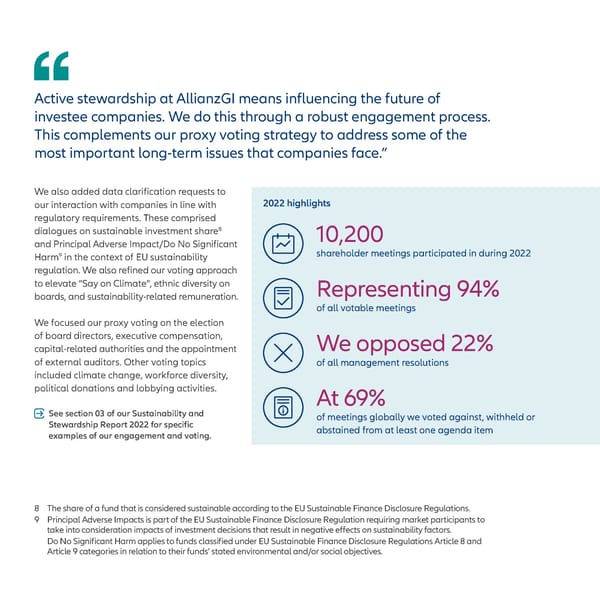

Active stewardship at AllianzGI means influencing the future of investee companies. We do this through a robust engagement process. This complements our proxy voting strategy to address some of the most important long-term issues that companies face.” We also added data clarification requests to our interaction with companies in line with 2022 highlights regulatory requirements. These comprised dialogues on sustainable investment share8 10,200 and Principal Adverse Impact/Do No Significant 9 shareholder meetings participated in during 2022 Harm in the context of EU sustainability regulation. We also refined our voting approach to elevate “Say on Climate”, ethnic diversity on Representing 94% boards, and sustainability-related remuneration. of all votable meetings We focused our proxy voting on the election of board directors, executive compensation, We opposed 22% capital-related authorities and the appointment of external auditors. Other voting topics of all management resolutions included climate change, workforce diversity, political donations and lobbying activities. At 69% See section 03 of our Sustainability and of meetings globally we voted against, withheld or Stewardship Report 2022 for specific abstained from at least one agenda item examples of our engagement and voting. 8 The share of a fund that is considered sustainable according to the EU Sustainable Finance Disclosure Regulations. 9 Principal Adverse Impacts is part of the EU Sustainable Finance Disclosure Regulation requiring market participants to take into consideration impacts of investment decisions that result in negative effects on sustainability factors. Do No Significant Harm applies to funds classified under EU Sustainable Finance Disclosure Regulations Article 8 and Article 9 categories in relation to their funds’ stated environmental and/or social objectives.

Factbook: Sustainability and Stewardship Report Page 14 Page 16

Factbook: Sustainability and Stewardship Report Page 14 Page 16