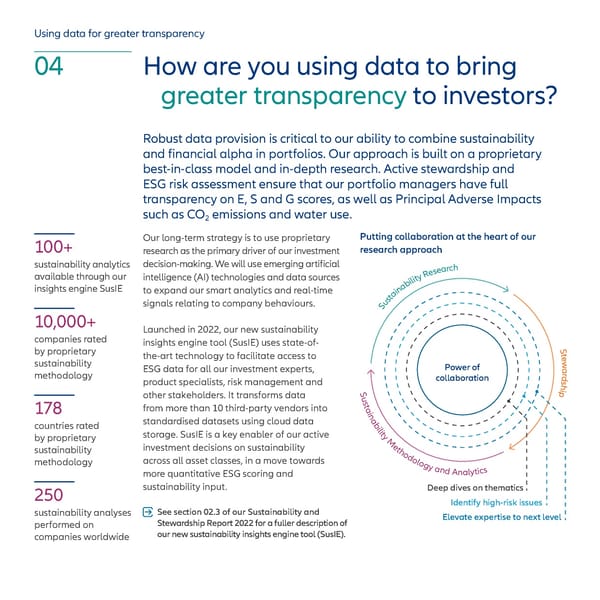

Using data for greater transparency 04 How are you using data to bring greater transparency to investors? Robust data provision is critical to our ability to combine sustainability and financial alpha in portfolios. Our approach is built on a proprietary best-in-class model and in-depth research. Active stewardship and ESG risk assessment ensure that our portfolio managers have full transparency on E, S and G scores, as well as Principal Adverse Impacts such as CO2 emissions and water use. 100+ Our long-term strategy is to use proprietary Putting collaboration at the heart of our research as the primary driver of our investment research approach sustainability analytics decision-making. We will use emerging artificial h c r a e s e R available through our intelligence (AI) technologies and data sources y t i l i b insights engine SusIE a to expand our smart analytics and real-time n i a t s signals relating to company behaviours. u 10,000+ S Launched in 2022, our new sustainability companies rated insights engine tool (SusIE) uses state-of- S by proprietary the-art technology to facilitate access to te sustainability w methodology ESG data for all our investment experts, Power of dra product specialists, risk management and collaboration hs other stakeholders. It transforms data Su pi 178 from more than 10 third-party vendors into stain countries rated standardised datasets using cloud data abili by proprietary storage. SusIE is a key enabler of our active ty Me sustainability investment decisions on sustainability thod methodology across all asset classes, in a move towards ology an d A ytics more quantitative ESG scoring and nal 250 sustainability input. Deep dives on thematics Identify high-risk issues sustainability analyses See section 02.3 of our Sustainability and Elevate expertise to next level performed on Stewardship Report 2022 for a fuller description of companies worldwide our new sustainability insights engine tool (SusIE).

Factbook: Sustainability and Stewardship Report Page 12 Page 14

Factbook: Sustainability and Stewardship Report Page 12 Page 14