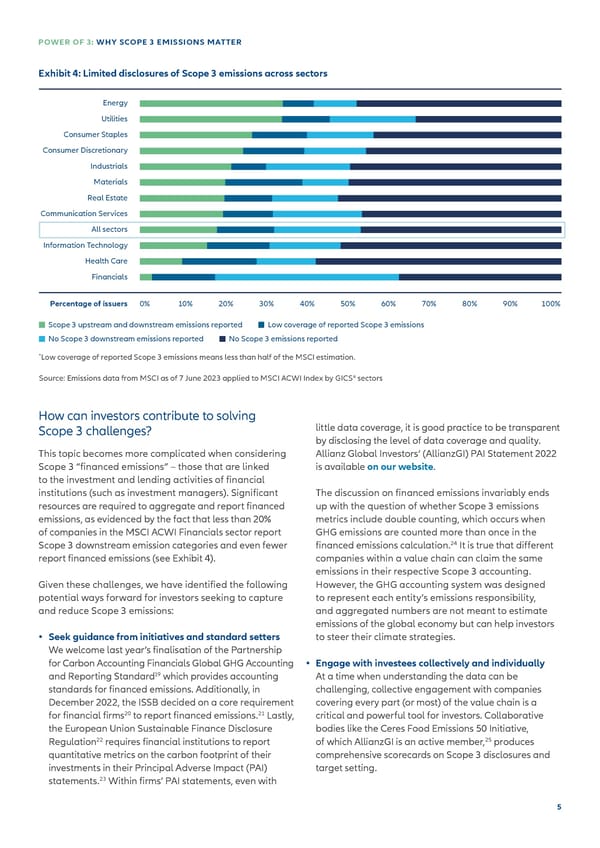

POWER OF 3: WHY SCOPE 3 EMISSIONS MATTER Exhibit 4: Limited disclosures of Scope 3 emissions across sectors Energy Utilities Consumer Staples Consumer Discretionary Industrials Materials Real Estate Communication Services All sectors Information Technology Health Care Financials Percentage of issuers 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Scope 3 upstream and downstream emissions reported Low coverage of reported Scope 3 emissions No Scope 3 downstream emissions reported No Scope 3 emissions reported *Low coverage of reported Scope 3 emissions means less than half of the MSCI estimation. Source: Emissions data from MSCI as of 7 June 2023 applied to MSCI ACWI Index by GICS® sectors How can investors contribute to solving Scope 3 challenges? little data coverage, it is good practice to be transparent by disclosing the level of data coverage and quality. This topic becomes more complicated when considering Allianz Global Investors’ (AllianzGI) PAI Statement 2022 Scope 3 “昀椀nanced emissions” – those that are linked is available on our website. to the investment and lending activities of 昀椀nancial institutions (such as investment managers). Signi昀椀cant The discussion on 昀椀nanced emissions invariably ends resources are required to aggregate and report 昀椀nanced up with the question of whether Scope 3 emissions emissions, as evidenced by the fact that less than 20% metrics include double counting, which occurs when of companies in the MSCI ACWI Financials sector report GHG emissions are counted more than once in the Scope 3 downstream emission categories and even fewer 昀椀nanced emissions calculation.24 It is true that di昀昀erent report 昀椀nanced emissions (see Exhibit 4). companies within a value chain can claim the same emissions in their respective Scope 3 accounting. Given these challenges, we have identi昀椀ed the following However, the GHG accounting system was designed potential ways forward for investors seeking to capture to represent each entity’s emissions responsibility, and reduce Scope 3 emissions: and aggregated numbers are not meant to estimate emissions of the global economy but can help investors • Seek guidance from initiatives and standard setters to steer their climate strategies. We welcome last year’s 昀椀nalisation of the Partnership for Carbon Accounting Financials Global GHG Accounting • Engage with investees collectively and individually 19 and Reporting Standard which provides accounting At a time when understanding the data can be standards for 昀椀nanced emissions. Additionally, in challenging, collective engagement with companies December 2022, the ISSB decided on a core requirement covering every part (or most) of the value chain is a 20 21 for 昀椀nancial 昀椀rms to report 昀椀nanced emissions. Lastly, critical and powerful tool for investors. Collaborative the European Union Sustainable Finance Disclosure bodies like the Ceres Food Emissions 50 Initiative, 22 25 Regulation requires 昀椀nancial institutions to report of which AllianzGI is an active member, produces quantitative metrics on the carbon footprint of their comprehensive scorecards on Scope 3 disclosures and investments in their Principal Adverse Impact (PAI) target setting. 23 statements. Within 昀椀rms’ PAI statements, even with 5

Scope 3 Emissions Page 4 Page 6

Scope 3 Emissions Page 4 Page 6