Snapshot

Sustainability Stewardship Report 2023 Summary

Our 2023 sustainability Shaping highlights at a glance1 combined AUM in sustainability, sustainability- and impact- EUR 199bn focused strategies. delivering sustainable funds2 – equivalent to 61% of 202 our mutual fund AUM. change companies engaged through 374 481 dialogues. Sustainability and Stewardship Report 2023 of all environmental Snapshot KPIs3 achieved in 4 100% our own operations. This is a summary of our sustainability journey in 2023. For the full picture, download our Sustainability and colleagues Stewardship Report 2023. dedicated Sustainability and Stewardship Report 2023. 45+ to sustainability.

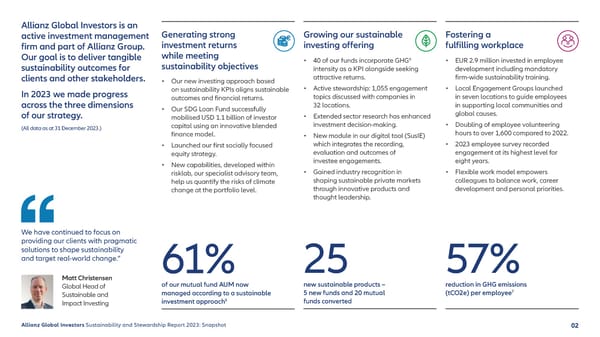

Allianz Global Investors is an active investment management Generating strong Growing our sustainable Fostering a firm and part of Allianz Group. investment returns investing offering fulfilling workplace Our goal is to deliver tangible while meeting • 40 of our funds incorporate GHG6 • EUR 2.9 million invested in employee sustainability outcomes for sustainability objectives intensity as a KPI alongside seeking development including mandatory clients and other stakeholders. • Our new investing approach based attractive returns. firm-wide sustainability training. In 2023 we made progress on sustainability KPIs aligns sustainable • Active stewardship: 1,055 engagement • Local Engagement Groups launched outcomes and financial returns. topics discussed with companies in in seven locations to guide employees across the three dimensions • Our SDG Loan Fund successfully 32 locations. in supporting local communities and of our strategy. mobilised USD 1.1 billion of investor • Extended sector research has enhanced global causes. (All data as at 31 December 2023.) capital using an innovative blended investment decision-making. • Doubling of employee volunteering finance model. • New module in our digital tool (SusIE) hours to over 1,600 compared to 2022. • Launched our first socially focused which integrates the recording, • 2023 employee survey recorded equity strategy. evaluation and outcomes of engagement at its highest level for • New capabilities, developed within investee engagements. eight years. risklab, our specialist advisory team, • Gained industry recognition in • Flexible work model empowers help us quantify the risks of climate shaping sustainable private markets colleagues to balance work, career change at the portfolio level. through innovative products and development and personal priorities. thought leadership. We have continued to focus on providing our clients with pragmatic solutions to shape sustainability and target real-world change.” 61% 25 57% Matt Christensen Global Head of of our mutual fund AUM now new sustainable products – reduction in GHG emissions 7 Sustainable and managed according to a sustainable 5 new funds and 20 mutual (tCO2e) per employee 5 funds converted Impact Investing investment approach Allianz Global Investors Sustainability and Stewardship Report 2023: Snapshot 02

2024 ambition Our actions Looking ahead is vital. Helping clients understand Here’s how we are Changing political agenda climate risk shaping an evolving A record election year could lead to delays in the 昀椀nancing and Our risklab advisory team examines how sustainability environment. implementation of transition plans. di昀昀erent climate scenarios could impact portfolio returns. Biodiversity takes centre stage Connecting climate Taskforce on Nature-related Financial Disclosures and Corporate and biodiversity Sustainability Reporting Directive will help accelerate the integration Our new biodiversity policy statement is of biodiversity into investment processes. essential to formally integrate biodiversity considerations into our strategies. Data-enhanced Sustainability blog ESG 2.0: focus on materiality engagement strategy Higher-quality data and new methods to capture the material risks Across all asset classes our investment Launched in 2023, our blog and opportunities will rede昀椀ne the concept of ESG.8 professionals can now access more explores the latest issues in engagement data to support decisions. sustainable investing. See our Sustainability blog here. Shaping the market Regulation of transition Regulations will continue to evolve, likely with a greater focus on We are already working to develop, Sustainability Now transition 昀椀nance for the EU and UK. build and propose transition strategies in both public and private markets. Read our new blog for fresh takes on sustainable investing – from renewables to rewilding. Finding a solution with impact Targeting real-world change Public markets start to incorporate concepts from private markets We explore how best to develop credible to solve challenges with scalable solutions that bring positive and robust public market strategies with environmental and social impacts. real-world impact. Allianz Global Investors Sustainability and Stewardship Report 2023: Snapshot 03

1 All data as at 31 December 2023. 2 According to the EU Sustainable Finance Disclosure Regulation. 3 KPI = key performance indicators. 4 As at 31 December 2023, measured against 2025 targets. 5 According to the EU Sustainable Finance Disclosure Regulation. 6 GHG = greenhouse gas. 7 Compared to the 2019 baseline. 8 ESG = environmental, social and governance. Investing involves risk. The value of an investment and the income from it will 昀氀uctuate and investors may not get back the principal invested. Past performance is not indicative of future performance. This is a marketing communication. It is for informational purposes only. This document does not constitute investment advice or a recommendation to buy, sell or hold any security and shall not be deemed an o昀昀er to sell or a solicitation of an o昀昀er to buy any security. The views and opinions expressed herein, which are subject to change without notice, are those of the issuer or its a昀케liated companies at the time of publication. Certain data used are derived from various sources believed to be reliable, but the accuracy or completeness of the data is not guaranteed and no liability is assumed for any direct or consequential losses arising from their use. The duplication, publication, extraction or transmission of the contents, irrespective of the form, is not permitted. This material has not been reviewed by any regulatory authorities. In mainland China, it is for Quali昀椀ed Domestic Institutional Investors scheme pursuant to applicable rules and regulations and is for information purpose only. This document does not constitute a public o昀昀er by virtue of Act Number 26.831 of the Argentine Republic and General Resolution No. 622/2013 of the NSC. This communication’s sole purpose is to inform and does not under any circumstance constitute promotion or publicity of Allianz Global Investors products and/or services in Colombia or to Colombian residents pursuant to part 4 of Decree 2555 of 2010. This communication does not in any way aim to directly or indirectly initiate the purchase of a product or the provision of a service o昀昀ered by Allianz Global Investors. Via reception of this document, each resident in Colombia acknowledges and accepts to have contacted Allianz Global Investors via their own initiative and that the communication under no circumstances does not arise from any promotional or marketing activities carried out by Allianz Global Investors. Colombian residents accept that accessing any type of social network page of Allianz Global Investors is done under their own responsibility and initiative and are aware that they may access speci昀椀c information on the products and services of Allianz Global Investors. This communication is strictly private and con昀椀dential and may not be reproduced, except for the case of explicit permission by Allianz Global Investors. This communication does not constitute a public o昀昀er of securities in Colombia pursuant to the public o昀昀er regulation set forth in Decree 2555 of 2010. This communication and the information provided herein should not be considered a solicitation or an o昀昀er by Allianz Global Investors or its a昀케liates to provide any 昀椀nancial products in Brazil, Panama, Peru, and Uruguay. In Australia, this material is presented by Allianz Global Investors Asia Paci昀椀c Limited (“AllianzGI AP”) and is intended for the use of investment consultants and other institutional /professional investors only, and is not directed to the public or individual retail investors. AllianzGI AP is not licensed to provide 昀椀nancial services to retail clients in Australia. AllianzGI AP is exempt from the requirement to hold an Australian Foreign Financial Service License under the Corporations Act 2001 (Cth) pursuant to ASIC Class Order (CO 03/1103) with respect to the provision of 昀椀nancial services to wholesale clients only. AllianzGI AP is licensed and regulated by Hong Kong Securities and Futures Commission under Hong Kong laws, which di昀昀er from Australian laws. This document is being distributed by the following Allianz Global Investors companies: Allianz Global Investors GmbH, an investment company in Germany, authorized by Allianz Global Investors the German Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin); Allianz Global Investors (Schweiz) AG; Allianz Global Investors UK Limited, authorized and regulated by the Financial Conduct Authority; in HK, by Allianz Global Investors Asia Paci昀椀c Ltd., licensed by the Hong Kong Securities and Futures Commission; in Singapore, by Sustainability and Impact Team Allianz Global Investors Singapore Ltd., regulated by the Monetary Authority of Singapore [Company Registration No. 199907169Z]; in Japan, by Allianz Global Investors 3 Boulevard des Italiens Japan Co., Ltd., registered in Japan as a Financial Instruments Business Operator [Registered No. The Director of Kanto Local Finance Bureau (Financial Instruments 75002 Paris Business Operator), No. 424], Member of Japan Investment Advisers Association, the Investment Trust Association, Japan and Type II Financial Instruments Firms Association; in Taiwan, by Allianz Global Investors Taiwan Ltd., licensed by Financial Supervisory Commission in Taiwan; and in Indonesia, by PT. Allianz Global Investors France Asset Management Indonesia licensed by Indonesia Financial Services Authority (OJK). Admaster 3455988 www.allianzgi.com/sustainability ADM-3532144