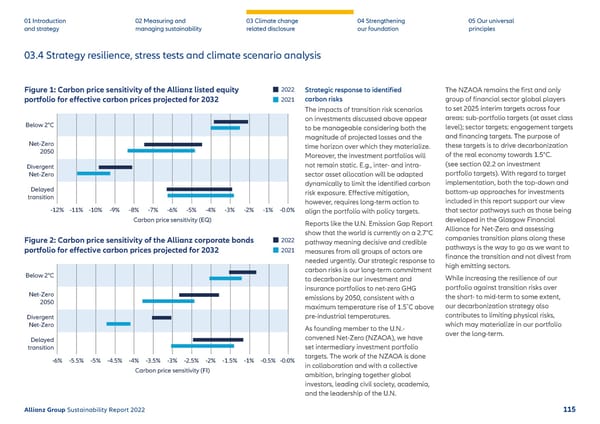

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Figure 1: Carbon price sensitivity of the Allianz listed equity portfolio for effective carbon prices projected for 2032 Carbon price sensitivity (EQ) -7% -6% -5% -4% -3% -2% -1% -0.0% -8% -11% -10% -9% -12% Net-Zero 2050 Divergent Net-Zero Below 2°C Delayed transition 2022 2021 Figure 2: Carbon price sensitivity of the Allianz corporate bonds portfolio for effective carbon prices projected for 2032 Carbon price sensitivity (FI) -3.5% -3% -2.5% -2% -1.5% -1% -0.5% -0.0% -4% -5.5% -5% -4.5% -6% Net-Zero 2050 Divergent Net-Zero Below 2°C Delayed transition 2022 2021 Strategic response to identified carbon risks The impacts of transition risk scenarios on investments discussed abo ve appear to be manageable considering both the magnitude of projected losses and the time horizon over which they materialize. Moreover, the investment portfolios will not remain static. E.g., inter- and intra- sector asset allocation will be adapted dynamically to limit the identified carbon risk exposure. Effective mitigation, however, requires long-term action to align the portfolio with policy targets. Reports like the U.N. Emission Gap Report show that the world is currentl y on a 2.7°C pathway meaning decisive and credible measures from all groups of actors are needed urgently. Our strategic response to carbon risks is our long-term commitment to decarbonize our investment and insurance portfolios to net-zero GHG emissions by 2050, consistent with a maximum temperature rise of 1.5 ̊C above pre-industrial temperatures. As founding member to the U.N.- convened Net-Zero (NZAOA), we have set intermediary investment portfolio targets. The work of the NZAOA is done in collaboration and with a collective ambition, bringing together global investors, leading civil society, academia, and the leadership of the U.N. The NZAOA remains the first and only group of financial sector global players to set 2025 interim tar gets across four areas: sub-portfolio targets (at asset class level); sector targets; engagement targets and financing targets. The purpose of these targets is to drive decarbonization of the real economy towards 1.5°C. ( see section 02.2 on investment portf olio targets ). With regard to target implementation, both the top-do wn and bottom-up approaches for investments included in this report support our view that sector pathways such as those being developed in the Glasgow Financial Alliance for Net-Zero and assessing companies transition plans along these p athways is the way to go as we want to finance the transition and not divest from high emitting sectors. While increasing the resilience of our portf olio against transition risks over the short- to mid-term to some extent, our decarbonization strategy also contributes to limiting physical risks, which may materialize in our portfolio over the long-term. 03.4 Strategy resilience, stress tests and climate scenario analysis Allianz Group Sustainability Report 2022 115

Sustainability Report 2022 | Allianz Page 115 Page 117

Sustainability Report 2022 | Allianz Page 115 Page 117