Sustainability Report 2022 | Allianz

Our ambition is to be a sustainability shaper for our clients. Our Sustainability and Stewardship Report 2022 charts our progress on this journey, covering our sustainable investment activities and commitment to active stewardship.

• ALLIANZ GROUP Building confidence in tomorrow Sustainability Report 2022

We secure your future Our purpose – ‘We secure your future’ – informs all our decisions every day and shapes our approach to sustainability. The very nature of what we do contributes to creating secure and sustainable economies and societies – pooling, investing and managing risks to help protect and grow lives, assets, and businesses. We create positive social and environmental impact through the way we run our organization and by using our insurance, investment, and asset management expertise. With our competence, expertise and global footprint, we have the ambition to be a catalyst for sustainable growth in the financial services industry and beyond. And we know that we cannot do it alone. Living our purpose depends on relationships. We believe that the best way to secure a better future is through strong partnerships. As one of the largest financial institutions in the world, we aspire to be a trusted partner. Your trusted partner. We partner with people, companies, institutions, and governments around the world to multiply sustainable action. We engage in public-private and p eer- to-peer partnerships to mitigate climate change, create economic growth, and support social resilience in communities. And we partner with our customers – individuals, families, and companies – to help them prepare for the future and support them in making sustainable choices. For more details, please see section 05.3 Stakeholder engagement. What we mean by ‘sustainability’ First, let’s be clear what we mean by sustainability. We define a ‘sustainable society’ as one in which all members meet their own needs without compromising the ability of future generations to meet their coming needs. Sustainability means leveraging and protecting our natural, social, and economic resources in a way that allows everyone to enjoy a decent life. Importantly, this understanding of sustainability can b e based on and verified by science. We can for example now scientifically see whether wealth is gained or lost, whether ecologies flourish or die and whether students are educated and ready for future jobs, or not. Such a framework highlights the collectiv e effort needed to drive change – governments, NGOs, the private sector, academia, and individuals all have a role. Unfortunately, given how ecological barriers have already been breached and social needs not met, our current global society is far from being a sustainable one. Much work and transformation is needed to provide future generations with a sustainable basis. Our role in this transformation is a natural one, guided by our purp ose. Allianz has been securing the future of our customers since our founding in 1890. We’ve learned from our history but are motivated by the challenges and opportunities of today and our future potential. Our ambition is to grow and prosper for generations to come. And our growth depends on the growth of sustainable economies around the globe. In short, sustainability is both responsible stewardship and in our commercial interest. This report brings together our strategy, ambition, commitments, and c ontributions to shape a more sustainable future. Allianz Group Sustainability Report 2022 01

Allianz Group Sustainability Report 2022 (,i:) (,i:) [fl A [fl [fl [fl A [fl [fl [fl [fl [fl About this report Our reporting approach This report is designed to meet the information requirements of our stakeholders, relevant regulations and sustainability rating and benchmarking providers. It focuses on the concepts and key performance indicators (KPIs) that reflect our most material sustainability issues and has been prepared in accordance with the Global Reporting Initiative (GRI) Standards. The new GRI Standard’s update 2021 was adopted for the first time. In line with our sustainability integration approach, responsibility for sustainability reporting lies with Group Accounting and Reporting which works closely with Global Sustainability to produce this report. For more details, please see the updated GRI content index. Communicating our performance Information about targets and performance are essential for enhancing the quality, reliability and comparability of sustainability reporting. We are committed to disclosing meaningful data to improve our sustainability disclosures for internal decision-making and for our external stakeholders. As an investor, we also rely on this type of information to integrate sustainability into our core business activities. As part of our commitment, following the description of our sustainability appr oach and strategies, we structure our annual Sustainability Report in two main sections, both of which are equally important for communicating our approach to material sustainability issues: Measuring and managing our performance Covering material topics and public targets and commitments that are integrated across Allianz and where we have established quantitative targets, KPIs and performance data. Strengthening our foundation Covering material topics and other topics related to ratings performance that are evolving towards fuller integration across Allianz and where our targets, KPIs and performance are continuing to evolve. For further information about our approach to reporting, please see section 05.2 How we report: transparent reporting, ratings and performance. We disclose our performance in se veral ways: Through tables and charts throughout the r eport. Data tables in the beginning or within each major chapter, which are referenced using a circle icon. We use the same numbering as last year to facilitate comparability. Conversely, this means that the numbering of the tables is not always ascending. (example – table ESG–1). References to external links are tagged using this icon. References to sections within the report are tagged using this icon (forward arrow). Our reporting ecosystem We pay special attention to transparency and making content easy to find. This report is part of a broader reporting ecosystem which covers sustainability topics relevant to Allianz Group. This year’s publications include: Allianz Group Non-financial Statement – Based on European Non- Financial Reporting Directive and non- binding guidelines for non-financial reporting on pages 57–75. Analyst Presentation – Presentation of Group financial results including non-financial KPIs to analysts. Explanatory Notes – Detailed collection including definition of our sustainable investment strategy, carbon footprint from our proprietary investments and own operations. Non-financial Supplement – Complete overview of sustainability-related KPIs. Published in Excel and PDF format. People Fact Book – Key Human Resources facts and figures, achievements in 2022 and an outlook for 2023. Tax Transparency Report – Find out more about our approach to taxes and relevant tax data on a country-by- country basis. You can find out further sustainability reports and publications in the download center on our website. 02

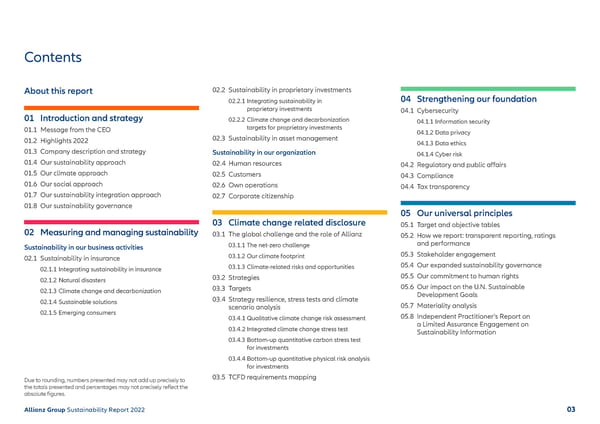

Allianz Group Sustainability Report 2022 Contents About this report 01 Introduction and strategy 01.1 Message from the CEO 01.2 Highlights 2022 01.3 Company description and strategy 01.4 Our sustainability approach 01.5 Our climate approach 01.6 Our social approach 01.7 Our sustainability integration approach 01.8 Our sustainability governance 02 Measuring and managing sustainability Sustainability in our business activities 02.1 Sustainability in insurance 02.1.1 Integrating sustainability in insurance 02.1.2 Natural disasters 02.1.3 Climate change and decarbonization 02.1.4 Sustainable solutions 02.1.5 Emerging consumers 02.2 Sustainability in proprietary investments 02.2.1 Integrating sustainability in proprietary investments 02.2.2 Climate change and decarbonization targets for proprietary investments 02.3 Sustainability in asset management Sustainability in our organization 02.4 Human resources 02.5 Customers 02.6 Own operations 02.7 Corporate citizenship 03 Climate change related disclosure 03.1 The global challenge and the role of Allianz 03.1.1 The net-zero challenge 03.1.2 Our climate footprint 03.1.3 Climate-related risks and opportunities 03.2 Strategies 03.3 Targets 03.4 Strategy resilience, stress tests and climate scenario analysis 03.4.1 Qualitative climate change risk assessment 03.4.2 Integrated climate change stress test 03.4.3 Bottom-up quantitative carbon stress test for investments 03.4.4 Bottom-up quantitative physical risk analysis for investments 03.5 TCFD requirements mapping 04 Strengthening our foundation 04.1 Cybersecurity 04.1.1 Information security 04.1.2 Data privacy 04.1.3 Data ethics 04.1.4 Cyber risk 04.2 Regulatory and public affairs 04.3 Compliance 04.4 Tax transparency 05 Our universal principles 05.1 Target and objective tables 05.2 How we report: transparent reporting, ratings and performance 05.3 Stakeholder engagement 05.4 Our expanded sustainability governance 05.5 Our commitment to human rights 05.6 Our impact on the U.N. Sustainable Development Goals 05.7 Materiality analysis 05.8 Independent Practitioner’s Report on a Limited Assurance Engagement on Sustainability Information Due to rounding, numbers presented may not add up precisely to the totals presented and percentages may not precisely reflect the absolute figures. 03

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01 Introduction and strategy The very nature of what we do contributes to creating secure and sustainable economies and societies – pooling, managing risks and investing to help protect and grow lives, assets and businesses. Allianz Group Sustainability Report 2022 04

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.1 Message from the CEO Building confidence in Allianz 2022 was supposed to be the year that the world would return to “business as usual,” as we started to recover from the depths of the COVID-crisis. Instead, new challenges to society mounted: the invasion of Ukraine in February 2022 created the biggest humanitarian crisis in Europe since WWII, forcing millions of people out of their homes and inspiring the rapid mobilization of will and resources to help them. Global economic growth slowed as tangible effects of climate change increased: a warming world experienced more frequent and severe natural catastrophes. Intersecting geopolitical, economic, and environmental challenges are weighed on individuals, institutions, and communities around the globe. Polarization in society became more entrenched and linked to negative financial outcomes for people, affecting their optimism and outlook on our future. 2022 was also a year that proved the r esounding value of sustainability. How an organization acts on matters of sustainability affects its ability to grow, access capital, attract talent, and enhance customer loyalty. Sustainably managing an organization’s resources and collaborating with partners earns trust and fosters stability in times of social, economic, and environmental volatility. Allianz’s strong financial performance in 2022, our outstanding emplo yee engagement results, and our status as Interbrand’s highest-ranked insurance brand in the world reflects our resonance with stakeholders, our reliability, and our resilience as a company. This report brings together our ambition, str ategy, commitments, and contributions to shape a more sustainable future. It details the work done across Allianz in 2022, in collaboration with our many partners, that helps build, grow, and protect more resilient lives, businesses and economies. In these pages, you’ll read about our operational progress towards net-zero and our business strategies to deliver climate solutions, such as adjusting our thermal coal investment and underwriting strategy to be more inclusive of low-carbon energy efforts. You will learn about our many programs to bring education and job training to the most vulnerable members of society, with a focus on preparing talented youth and people with disabilities for employment in a transitioning economy. And you’ll read about our industry leadership in blended finance and how we use it to unlock the power of public and private investment capital at scale, helping to build sustainable economies in developing and emerging markets. 05 Allianz Group Sustainability Report 2022

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Success in all these efforts is powered by the engagement of our employees. Having a qualified and diverse workforce is a prerequisite for being a trusted sustainability leader in our industry and beyond. This fact led us to introduce a global skills curriculum – Allianz Sustainability Training – a promising start to providing all employees with the understanding and tools needed to become Allianz’s sustainability ambassadors around the globe and to help lead Allianz into the transition economy. Further to our workforce development, we are applying our leadership and commitment to diversity, equity and inclusion, serving as an Iconic Leader of Valuable500 and as part of United Nations’ Human Rights Free & Equal LBGTI charter and its Women’s Empowerment Principles charter. In this report, we will detail the commitments we have made and the recognitions that we have earned in this important driver of sustainable performance. Our ambition is to be the trusted partner of our stakeholders, using our global scale and skills to help to solve society’s most pressing issues. At the same time, we know that we cannot change the world overnight or alone. We look forward to continuing to bring Allianz’s commercial expertise and scale to the table with policymakers, non-governmental organizations, and investees, to create solutions at the societal level and build community as well as individual resilience. Each of us is learning a little more every day and every year to shape our world for the better. We hope this inspires you to join us in these efforts. Please enjoy reading this Allianz Sustainability Report. We are in this together. Sincerely yours, Oliver Bäte Chairman of the Board of Management Allianz SE 01.1 Message from the CEO 06 Allianz Group Sustainability Report 2022

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.2 Highlights 2022 The following tables follow the logic of the International Integrated Reporting Council (IIRC) and provide an overview of the highlights of the reporting year. IIRC capital categories Outputs 2022 Outcomes Manufactured € 131.5 bn sustainable investments (proprietary investments) € 1,282.9 mn revenues from sustainable solutions for P&C In 2022, we increased our proprietary sustainable investments to EUR 131.5 bn from EUR 123bn in 2021. We expanded the scope to include supranationals we label as sustainable in line with EU SFDR Article 2 (17) requirements. In 2022, we generated revenues totaling €1,282.9 mn from 103 Sustainable insurance solutions and from Insurance solutions with a sustainability component through our Sustainable Solutions program in P&C. (2021: € 1,215.6 mn from 118 solutions) Financial € 14.2 bn operating profit € 6.7 bn shareholder net income € 2.5 bn corporate income tax Operating profit increased 5.7 percent to 14.2 billion euros. Net income attributable to shareholders incr eased 1.9 percent to 6.7 billion euros. Corporate income tax: Fair, effective and stable tax p ayments are beneficial for both government and companies. Intellectual Allianz Risk Barometer published DJSI: Top 5 1 (89 out of 100 points) USD 18.7 bn Brand value The Allianz Risk Barometer is our annual report identifying the top corporate risks for the next 12 months and beyond, based on the insight of more than 2,712 risk management experts from 94 countries and territories. Allianz received the 3rd highest score among the insurance industry in DJSI (S&P Global’s 2022 Corporate Sustainability Assessment (CSA)) with a score of 89/100 keeping the score equal to 2021, despite the impact of the Structured Alpha matter. Brand value up 23% to USD 18.7 bn (Source: Interbr and Best Global Brands Ranking 2022). 1 Top 5 of assessed companies, which are DJSI eligible at industry level; 3rd with a score of 89/100 – (score date 09th December 2022); 2022 achievements as per results of 31st December 2022. 07 Allianz Group Sustainability Report 2022

01.2 Highlights 2022 01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles IIRC capital categories Outputs 2022 Outcomes Social and r elationship 57 mn Emerging Consumers reached 58% NPS (Customer loyalty) € 42.82 mn Corporate Giving We insured 57.2 mn Emerging Consumers in 12 countries across Africa, Asia and Latin America in 2022. Organic portfolio growth across markets largely offset the maturity of government health schemes in India which had contributed 15.5 mn insured in 2021. Business segments with a net promoter score of L oyalty Leaders. In 2022 our Corporate Giving totaled € 42.8 mn. Our humanitarian eff orts for Ukraine resulted an increase of our total corporate giving in 2022 (€ 28.2 mn in 2021). Social Impact Fund is our program supporting str ategic opportunities to deliver social impact. Human 76% Employee Engagement Index 79% IMIX (Inclusive Meritocracy Index) 38.8% Female managers In 2022, two of the three main indices in the Allianz Engagement Survey (the Inclusive Meritocracy Index and the Work Well Index) reached record highs in Allianz Group history and the third index (the Employee Engagement Index) remained stable at the second highest level. Our high standards in leadership, performance and c orporate culture are reflected in the high rating in the IMIX (+1%p compared to 2021). The share of women has continuously increased to 38.8 p ercent in 2022 among managers (by +0.6%p compared to 2020) and to 32.4 percent among executives (i.e., top management, by +2.0%p compared to 2020). Natural 89% renewable electricity of own operations 1.0 t CO 2 e per employee carbon footprint of own operations 16.2 mn t CO 2 e carbon footprint of proprietary investments (listed equities and corporate bonds) 46.5 mn t CO 2 e Total GHG emissions 1 +12%-p 89% share of renewable electricity, up from 77% in 2021. Increase vs. 2021 was mainly achieved through a combination of strategic discussions with suppliers on ‘green tariffs’, expanding the use of on-site renewable technologies and the use of ‘unbundled’ renewable Energy Attribute Certificates. -57% GHG emissions per employee in 2022 vs 2019. +8% C arbon footprint per employee from operations increased from 0.9 tons CO 2 e in 2021 to 1.0 tons CO 2 e in 2022. 2022 saw an increase in business tr avel vs 2021, explaining the increase in carbon footprint per employee. 2021 was particularly impacted by COVID-19-related drops in business travel. Carbon footprint of proprietary investments (listed equities and c orporate bonds): -13% versus 2021 leading to an o ver achievement of our end of 2024 -25% absolute financed emissions decarbonization tar get (total -34.9% versus 2019). This was driven by allo cation changes, real world emission reductions as well as changes in enterprise values. Total GHG emissions increased from 19.3 mn t CO 2 e GHG emissions in 2021 to 46.5 mn t CO 2 e in 2022. This w as mainly driven by the scope increase in our proprietary investment portfolio (+ 30.1 mn t CO 2 e). 08 Allianz Group Sustainability Report 2022 (fr\ © 1 Total greenhouse gas (GHG) emissions include emissions from proprietary investments and own operations.

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.3 Company description and strategy Allianz Group is one of the world’s leading insurers and asset managers with 122 million private and corporate customers 1 in more than 70 countries. Our customers benefit from a broad range of personal and corporate insurance services ranging from property, life and health insurance to assistance services to credit insurance and global business insurance with total revenues of € 152.7 billion. As one of the world’s largest investors, Allianz manages around € 701.1 billion on behalf of its insurance customers. Our asset managers – PIMCO and Allianz Global Investors – manage € 1.6 trillion of third-party assets. In 2022, 159,253 2 employees achieved total revenues of € 152.7 billion 3 and an operating profit of 14.2 4 billion for the Group. Our strategic objectives : • Growth: We consistently seek to capture growth opportunities for our business, and to create growth opportunities for our employees. This is how we ensure our leading market position. Due to our full breadth of products and services, we offer comprehensive solutions that meet our customers’ needs and make us a trusted partner. • Margin expansion: We need to be profitable and efficient. To do so, we are continuously improving our productivity, including in our distribution channels, while seeking to grow in high margin business segments. Additionally, we will continue our transformation to be more simple, digital and scalable. • Capital efficiency: We consistently seek ways to use our capital in the most effective way and take actions when it falls below our RoE threshold. Thanks to our systematic integration of sustainability criteria in our business processes and investment decisions, we are among the leaders in the insurance industry in the Dow Jones Sustainability Index. For further details about the group’s Corporate Strategy, please see the Allianz Group Annual Report 2022 , section Risk and Opp ortunity Report p. 102 f. and the materials published as p art of our Inside Allianz Series. 1 Including non-consolidated entities with Allianz customers and excl. emerging consumers. 2 Total employees (core and non-core business). 3 Total revenues comprise Property-Casualty total revenues (gross premiums written, and fee and commission income), Life/Health statutory gross premiums written, operating revenues in Asset Management, and total revenues in Corporate and Other (Banking). 4 For details about Allianz Operating Profit definition, please refer to the Group Annual Report – Notes to the consolidated financial statements, note 4. 09 Allianz Group Sustainability Report 2022 (!)

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.4 Our sustainability approach Our purpose – ‘We secure your future’ – informs all our decisions and shapes our approach to sustainability. The very nature of what we do contributes to creating secure and sustainable economies and societies – pooling, investing and managing risks to help protect and grow lives, assets, and businesses. We create positive social and environmental impact through the way we run our organization and by using our insurance, investment, and asset management expertise. With our competence, expertise and global footprint, we have the ambition to be a catalyst for sustainable growth in the financial services industry and beyond. And we know that we cannot do it alone. U.N. SDGs guide towards sustainability The work we do in helping to build a sustainable society is guided by the United Nations (U.N.) Sustainable Development Goals (SDGs). While all the SDGs are important, we prioritize: SDG 8, Decent work and Economic growth; SDG 13, Climate Action; SDG 17, Partnerships. These align with our insurance and financial e xpertise and strategic business priorities. We believe this strategic focus best leverages our strength and scale for maximum impact, for both our business and society. SDG 8 is in line with our aspiration to b e a trusted partner for protecting and growing our stakeholders’ most valuable assets, SDG 13 is in line with our commitments to net-zero by 2050 and SDG 17 is in line with our belief that progress in reaching sustainability goals requires collaborative global action, beyond company boundaries. Embedding sustainability everywhere Success in reaching any goal requires effective measurement. As we learn and advance on our journey, we are fully integrating sustainability into our decision-making. Traditional financial metrics and sustainability inf ormation will become the basis of our combined performance measurement. This measurement appr oach will accelerate behavioral and cultural change in our organization. If all decisions are made and measured with sustainability fr ont and center, we will enhance how we manage risks and capture opportunities. It also drives us to create new sustainable products and services, collaborate with NGOs and governments, clients, and investee companies to direct capital flows towards sustainable outcomes, and ultimately deliver scalable, real-world benefits. Our journey towards fully integrating sustainability into all asp ects of the Allianz organization is ongoing and dynamic. We don’t have all the answers and there is still much to learn as the field continues to rapidly evolve. In this context, a qualified workforce is a pr erequisite for being a trusted sustainability leader in our industry and beyond. This led us to introduce a global sustainability training curriculum, the Allianz Sustainability Training, – a promising start to provide all employees with the understanding and tools needed to become Allianz’s sustainability ambassadors around the globe. 10 Allianz Group Sustainability Report 2022 • '•f ,', Jl'I I l :l ' Gt"\ ALS ' ~ ~ e .... .. , DEVELOPMENT 11 Ill, 1.1111 I ell ,'I

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.4 Our sustainability approach Stakeholders demand change towards a sustainable economy & society within planetary boundaries Sustainable economy & society Overshoot Ecological Barriers Overuse of natural resources, possibly leading to tipping points • Climate change • Freshwater change: green water • Stratospheric ozone depletion • Atmospheric aerosol loading • Ocean acidification • Biogeochemical cycle • Novel entities * • Land system use • Biosphere integrity Customers Employees Under-delivery Social Minimum Resources that a person needs in order to lead a minimally decent life in their society; examples showcasing a broad scale • Health • Energy • Water • Food • Education • Gender Equality • Social equity Shareholders Governments The model does not reflect Allianz. Source: Planetary boundaries – Stockholm Resilience Centre , Doughnut | Kate Raworth , Home | Sustainable Development (un.org) . * The novel entities boundary in the planetary boundaries framework refers to entities that are novel in a geological sense and that could have large-scale impacts that threaten the integrity of E arth system processes. Source: Outside the Safe Operating Space of the Planetary Boundary for Novel Entities | Environmental Science & Technology (acs.org) . 11 Allianz Group Sustainability Report 2022 'I' •v @ @ ~ ©

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.5 Our climate approach As one of the world’s largest insurers and investors, we are committed to limiting global warming and fostering a just transition to a low-carbon future. We seize opportunities to drive dec arbonization and climate resilience through our resources, partnerships, expertise, and influence. Our ambition is to be a trusted partner for our clients and investees across different sectors in the transition towards net-zero. Our climate approach is grounded in the A llianz Group Climate Change Strategy, which has been in place since 2005. With a special focus on SDG 13, Climate action, we integrate climate considerations in our organization and across our business areas. We further strengthen our climate action b y collaborating with private and public partners, in line with SDG 17, Partnerships for the goals. Examples of partnerships include our work with the U.N.-Convened Net-Zero alliances: Net-Zero Asset Owner Alliance (NZAOA), Net-Zero Insurance Alliance (NZIA). Allianz Global Investors is part of the Net-Zero Asset Manager initiative (NZAM, not U.N.-Convened). Our Climate Change Strategy Allianz has had a Climate Change Strategy in place since 2005. With the rapid development of knowledge on climate-related matters, we continually review our strategy to ensure it is in line with the latest science. The strategy is built around the three pillars, through which we can have an impact: Anticipate. Care. Enable. Anticipate the risks of a changing climate Our climate strategy aims to anticipate the risks of a changing climate and we systematically consider climate and sustainability criteria in our insurance and investment business. We constantly update and develop our appr oach to identifying and managing climate change risks and opportunities. We also systematically engage with investee companies and clients exposed to high climate and sustainability risks. Our engagement process includes advice and encouragement on how to define and pursue climate strategies in line with the latest science. Care for our customers We support our insurance customers in reducing their climate-related damage and risks through adaptation and low- carbon developments. This is particularly important as natural catastrophes increase due to climate change. We are piloting new approaches that c ombine insurance protection with measures that strengthen resilience and promote positive behavior change. This includes incentivizing people and businesses to reduce risk, for example through advice programs. On the insurance side, we invest in data and technolo gy to better understand the natural catastrophe perils that impact our clients. Because many people still do not have an y insurance, we also collaborate with our peers, governments and civil society to help close the protection gap in vulnerable parts of society. Finally, we support scientific research and inno vation that improves society’s understanding of climate-related risks, for example through the Allianz Climate Risk R esearch Award. Enable the low-carbon transition We aim to enable the journey to net-zero for our own operations, our investees, and our insurance customers. Our ambition is to be a trusted insurance and investment partner for a wide range of industries and customers at varying stages along their net-zero transformations. Our business strategy aims to s ystematically enable a low-carbon and climate-resilient future. We focus on key sectors with high emissions and the need for transformation. The energy and transportation sectors are prime e xamples. We aim to strategically invest in low-carbon assets and insure low-carbon technologies. Grounded in our belief in science-based decision making, w e support partners, investees, and clients along the path to net-zero. To be the change we want to see in the w orld, we also commit to pursuing net- zero emissions within our own operations. Find out more about climate in our business activities in sections 02.1 to 02.3 and in our own operations in section 02.6. Find our climate-related financial disclosure in chapter 03. 12 Allianz Group Sustainability Report 2022 > >

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Our climate commitments and contributions Our climate approach is an integral part of our core business. By committing to net- zero greenhouse gas (GHG) emissions by 2050, we are working to set long-term and intermediate targets across our operations and business lines in line with the 1.5°C ambition 1 of the Paris Climate Agreement. In view of our overall goal to create positive change for societies and economies, we will continue to integrate climate action across all business areas and markets to deliver on our net- zero commitments. • For our proprietary investment portfolio, we have committed to reduce GHG emissions to net-zero by 2050. Our intermediate 2025 targets initially covered listed equities, corporate bonds and real estate. We are constantly expanding the scope of targets in line with the Target Setting Protocol of the Net-Zero Asset Owner Alliance (NZAOA), of which Allianz was one of the founding organizations and holds the Chair. The initiative is led by the U.N. For full list of targets, please see section 02.2.2. 01.5 Our climate approach • For our insurance portfolio, we were one of the founding members of the Net-Zero Insurance Alliance (NZIA). We are working on the targets and methodologies within the NZIA. These methodologies were published in January 2023 and Allianz and other members will now set their first near- term targets. The initiative is led by the U.N. • In 2022, we published our new approach for the oil and gas sector, including targeted restrictions for oil and gas projects and unconventional practices, as well as expectations for companies in this sector. Find out more in section 03.2. Allianz statement on oil and gas business models. • We continue to gradually phase out coal-based business models across our proprietary investments and P&C portfolios, with a 2040 deadline at the latest. The milestones for this phase-out have been derived from leading climate scenarios which keep global warming by the end of this century to 1.5°C with limited temperature overshoot. The next step is the tightening of the exclusion threshold for coal-based business mo dels to 25 percent by December 31, 2022. For details see section 03.2. • For our own operations, we announced the acceleration of climate targets with reduction of GHG emissions by 50 % by 2025, versus 2019, and net-zero by 2030. We plan to achieve these targets by strengthening our environmental management and sourcing 100 % renewable electricity by 2023, shifting to electric corporate car fleet by 2030, and reducing GHG emissions from travel activities by 40 % by 2025. For details see section 02.6. • In addition, we advocate for strong climate policy. A supportive policy environment is crucial to ensure the viability of a socially-just transition to climate resilience and net-zero emissions. Without decisive action by governments, there will be insufficient frameworks and market incentives to bring down demand for emission- intensive products and to allocate capital in line with a 1.5°C trajectory. For details see section 03.2. • As part of our commitment to transparency, we apply the recommendations of the G20 Financial Stability Board’s Task Force on Climate- related Financial Disclosures (TCFD). We strive to continuously enhance our climate change-related reporting and business practices to drive best practice and we collaborate with and support others to do the same. For more information, see chapter 03. • In the fight against global warming, any additional unit of renewable energy is needed. Therefore, we are revising our thermal coal guideline to allow ring- fenced insurance of renewable energy projects not looking at legacy business of the utility. Find out more in our Energy guidelines. 1 We are managing towards 1.5°C in line with pathways which do not overshoot 1.5°C or only to a limited extent (so called low/no overshoot pathways). 13 Allianz Group Sustainability Report 2022 > > > > >

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.6 Our social approach Our ambition Our roots in insurance make us naturally focused on the social aspect of sustainability. Through the collective pooling and diversification of risk mitigates the impact that events can have on individuals, families, businesses and organizations. By mitigating risk and providing financial security, insurance becomes a prerequisite for sustainable social or economic activities like owning or renting a home, pursuing leisure activities or running a business. Through our core business of providing risk protection and investing funds for the long-term, we help lives, businesses and society to evolve by being more resilient. Our purpose and business experience led us to prioritize SDG 8, Decent Work and Economic growth, in our social approach with a particular focus on education and employability. Our work to support societies (SDG 8) and on climate (SDG 13) is linked and mutually enhances our positive impact. € 14.0 bn Paid in wages by Allianz in 2022 (2021: € 13.3 bn) € 19.5 bn Total tax contribution in 2022 (2021: € 17.9 bn) 45.2 Average training hours per employee contributed by Allianz in 2022 (2021: 34.7) Our social strategy Through our social strategy, we deliver to customers, employees and society: 1. Customers: Value delivered in insurance, investment and asset management. 2. Employees: Workplace and culture. 3. Corporate citizenship: Supporting social resilience for the people who live and work in the communities in which we operate. We focus especially on the support of next generations and people with disabilities. 1. Customers Our success is measured by the trust our customers, partners and society has in us to competently deliver our expertise. The essential nature of our expertise helps protect society, by providing recovery from unexpected shocks, peace of mind, and financial security that fuels growth. Across our value chain, we enable social resilience and positive social impact through our sustainable products and solutions in insurance and asset management, investments in sustainable projects and transformative public- private partnerships. By sharing our core business knowledge in insurance, investments and asset management, we work with others to create stronger social solutions to challenges. For example, we support our insurance customers to adapt to climate risks and minimize damage. And we encourage the net-zero transition by insuring low- carbon developments. This is particularly important as we see more frequent and damaging natural catastrophes due to climate change. We are also piloting new approaches that combine insurance offerings with measures that strengthen resilience and positive behavior change. We reach 122 million customers 1 globally. Our ambition is to earn and maintain their trust and loyalty by delivering quality products, services and expertise. Customer experience is extremely important and we measure customer loyalty using the globally recognized Net Promoter Score (NPS). Our digital NPS (dNPS) score of 58 % Loyalty Leader segments indicates that our customers trust us and are willing to recommend Allianz to others. To find out more on our approach to customer satisfaction, please see section 02.5. For more information about our approach to investors, please see our Analyst Presentation 2022 as well as our Group Annual Report 2022. 1 Including non-consolidated entities with Allianz customers and excluding emerging consumers. 14 Allianz Group Sustainability Report 2022 >

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles We also bring commercial expertise and global scale to the table for civil society, non-governmental organizations (NGOs) and investees. We listen to their feedback, needs, and recommendations and collaborate on creating social solutions and resilience. To find out more about our engagement with stakeholders, please see section 05.3. 2. Employees Only by working well together can we achieve good results, inside and outside of Allianz. Prioritizing employees in our sustainability efforts begins with creating a thriving and inclusive culture of continuous learning and development where employees are competent, confident and excited to grow and work. Our Inclusive Meritocracy Index of 79 % for 2022 ( see section 02.4 ) shows a high employee approval rating of Allianz’s culture. The rating affirms our efforts to create a work environment where people and performance matter, where there is mutual trust and empowered collaboration, where diversity is appreciated and where customer satisfaction is a high priority. To successfully deliver, we must attract, develop, and retain qualified talent. Our talent strategy enables a virtuous cycle of social resilience and economic prosperity in the markets in which we live and operate. To develop a thriving employee culture at Allianz, we prioritize the f ollowing areas 1 : Education Lifelong learning and professional training and development secures the competencies needed in a fast- changing world and work environment. We see upskilling and reskilling our workforce as a pre-requisite for long- term success, including through Strategic Workforce Planning. To drive excellence in our core business of insurance, Allianz offers professional development that helps create a high standard of underwriting, pricing and claims excellence. Through the Property & Casualty (P&C)-Academy accreditations which are adhering to international standards and are certified by the Chartered Insurance Institute (CII), we strengthen and support our ability to scale the global know-how and best practices for which Allianz is known. 01.6 Our social approach Our employees also educate us to better understand and fulfill the needs of our increasingly diverse customer base. Their feedback and engagement validate our investment in education and development programs. Diversity, equity and inclusion A thriving working environment is one that is welcoming and inclusive. We drive gender balance and promote an inclusive culture along other dimensions, such as disability, nationalities/ethnicities, generations and LGBTQ+. This is evidenced by our leading position in the Refinitiv Index for Diversity and Inclusion and in the German Diversity Index. Health, safety and well-being The health, safety and well-being of our employees is of utmost importance to support a thriving culture. With the pandemic casting a spotlight on the importance of physical health and mental well-being, we have introduced various new measures to support employees. In 2021, we launched our global Health in Action framework which aims to r educe work-related stress. In 2022, our Work Well Index Plus (WWi+) score was two percentage points above the 2021 result of 69 percent. For more details, please see section 02.4. For more details, please see the Allianz People Fact Book 2022. 3. Corporate citizenship Our social impact comes through our 122 million customers and over 159,000 employees living and working in their communities in more than 70 countries. Allianz’s social impact stems from the impact our business and global organization has on the w ell-being of the community – from global society to local communities. Through our employee compensation, healthcare and other benefit pro grams, Allianz serves an important stabilizing role in communities. Our tax payments support the local economies where we operate. As part of our social approach, our Corporate Citizenship Str ategy supports how we deliver our responsibility towards society. Many employees actively contribute in their communities. Allianz employees around the world take part in local corporate citizenship programs and volunteering through initiatives run by local operating entities and our twelve Allianz- affiliated foundations. For details see section 02.7. 1 Further key priorities: Employee Engagement (Allianz Engagement Survey) , Ways of Working (in particular hybrid working) , 02.4.2 Strategic workforce planning and 02.4.4 Talent acquisition and employee engagement . 15 Allianz Group Sustainability Report 2022 > > >

01.6 Our social approach 01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles This shows for example by the Managing Disability platform launched by Fondazione Allianz UMANA MENTE to promote a positive disability culture in Italy and foster a more inclusive workplace. Next generations and people with disabilities For next generations and people with disabilities we are focusing on SDG 8, supporting employability. We support this through our corporate citizenship approach which focuses on education and physical activity and deliver through our corporate citizenship areas MoveNow, OE initiatives, foundations, education and academic support as well as emergency relief. With that, we want to enable them with skills needed to enter the workforce with confidence. We believe these skills need a mental and physical foundation, which is why we think education and physical activity are key to enable the next generations to prosper. Through our academic partnerships, we offer various scholarships. And we support ground-breaking medical and climate research through awards every year. Leveraging our education, experience and partnerships in sports, we create programs that promote well-being, resilience and job-readiness for youth and people with disabilities. We are working closely with our partners including the International Olympic Committee, Bayern München and the International Paralympic Committee. For details see section 02.7. Activities for next generation and people with disabilities. Allianz corporate citizenship activities locally in the OEs and globally are being steered towards the Group strategy. MoveNow On a global level, the MoveNow Tr aining Series was launched in 2022 in partnership with the International Paralympic Committee, starting with twelve operating entities. MoveNow leverages the long history which Allianz has on engaging children/ youth and people with disabilities on physical activity, embedding educational elements. The series promotes accessible physical activity and educational elements, both in physical camps and in digital forms. At the local level, our operating entities implement next gener ations activities tailored to their specific markets. In 2022, 15 operating entities kicked off corporate citizenship projects with a clear SDG 8 focus on the next generations and people with disabilities. These programs were in addition to their existing social impact initiatives. Allianz foundations Our foundations around the world support next gener ations programs that enhance education, promote physical activity, and enable employability. In Germany, the Allianz Foundation in Berlin will fo cus on three new Next Generations flagship projects. More information can be found here. Education, academic support Allianz offers various scholarships, including for ESMT Berlin, Business Scho ol and MIB Trieste School of Management. We also support scientific research through visiting scholars or host internships. Emergency relief We aim to support communities where we live and w ork in times of need. This means aligning activities with local priorities and leveraging the expertise, resources and assets of our operating entities to support communities. Allianz responded to Ukraine war by donating € 10 million for the humanitarian supp ort. Our employees and tied agents from key markets globally, raised more than € 1 million. Allianz matched employee donations. Employee volunteering and donations Employee volunteering and donations take place through Allianz’s social impact programs locally in OEs and through our twelve Allianz-affiliated foundations. 16 Allianz Group Sustainability Report 2022 >

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Our commitments to human rights Respect for human rights is a fundamental requirement for responsible business within and beyond our direct operations. Allianz SE is a signatory of the United Nations Global Compact (UNGC) and we are committed to upholding human rights. Being a trusted industry leader and partner means protecting human rights in all our different roles – as an insurer, investor, asset manager, employer and in the supply chain. For more details, please see section 05.5. For more details, please see our UNGC Communication on Progress. Our governance approach Strong leadership is the key contributor to culture and governance of a company. Our purpose governs how we execute our business across all oper ating entities amongst others through a strong policy framework. We have control functions with three defense lev els in place (Three Lines of Defense Model). However, we are also human and errors can oc cur. When this happens, we strive to act quickly to correct, learn and communicate openly. Find out more about governance in sections 01.8 and 05.4. 01.6 Our social approach 17 Allianz Group Sustainability Report 2022 > >

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.7 Our sustainability integration approach Our commitment to tackling ESG topics – here referred to as sustainability – applies to our own operations and our insurance, investment and asset management activities. As a global insurer, investor and asset manager, understanding and managing sustainability issues allows us to reduce risks and capture opportunities in all areas of our business. As well as managing risks, sustainability integration directs us to create products and services that add value to society, collaborate with clients and investee companies to deliver real-world benefits, and direct capital flows towards sustainable outcomes for all stakeholders. 01.7.1 Sustainability opportunities and risks Holistic assessment of risk is important to Allianz as an insurance company that manages and carries risks ranging from single events to decades. In the Allianz Group Risk Policy, we define sustainability risks as events or conditions which, if they occur, could have significant negative impacts on the assets, profitability or reputation of Allianz Group or one of its companies. Examples include environmental and climate change risks, human rights violations, risks to local communities and workforce risks. If they are not identified and managed effectively, sustainability risks can have significant repercussions for Allianz and its customers, suppliers and investee companies. These span legal and reputational risks, supply chain and business disruption risks, quality and operational risks and financial risks. By scrutinizing insurance, investment and asset management projects from a sustainability perspective, Allianz extends its understanding of risks and seizes potential business opportunities to benefit shareholders, customers and other stakeholders. 01.7.2 Our group-wide rules and processes Our group-wide corporate rules and sustainability processes apply to all relevant underwriting, proprietary investment and operations activities. They require strong collaboration between relevant functions and business areas. Key processes include the internal Allianz Standard for Reputational Risk Management and other corporate rules such as the Allianz Standards for P&C Underwriting and Allianz ESG Functional Rule for Investments. The publicly available Allianz ESG Integration Framework provides transparency around our sustainability- related processes and guidelines. We published the fourth version of the Framework in 2021, available here. For more details, please see the Allianz ESG Integration Framework, version 4.0. Our asset management units have set up their own set of pr ocesses, rules and governance on sustainability integration in their investment activities. 18 Allianz Group Sustainability Report 2022 ~ I.... 0 s: OJ @ E I N 0 i:: .!!! I.... ~ LL [f)

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.7.3 Embedding sustainability Consistent application of sustainability processes in insurance and proprietary investment activities is crucial to mitigate risks and capture opportunities resulting from the needed transition to a sustainable economy and society, and also our transformation to a sustainable financial service provider. Further details on our sustainability integration approach in insurance, proprietary investments and asset management can be found in sections 02.1 to 02.3. Further details on our sustainability integration approach in insurance, proprietary investments and asset management can be found in the Allianz ESG Integration Framework. 01.7 Our sustainability integration approach Sustainability integration processes Business areas Details P&C Ins. Investments (listed) Investments (non-listed) Organization, Procurement ESG referral and assessment proc ess (including sensitive business areas, sensitive countries) Systematic integration of sustainability risks by conducting case-by-case due diligence of critical transactions. ESG scoring process (including carbon emissions, to xic emissions and waste, labor management, business ethics, etc.) Systematic integration of sustainability factors through sustainability scoring approach. ESG exclusions process (including coal , oil sands, controversial weapons, human rights) Exclusion of investment and insurance transactions in critical business areas. ESG engagement and risk dialogues (on sustainability , climate and human rights topics) Systematic engagement with investee companies and clients on sustainability- related matters. ESG in business partner selection (including asset managers, reinsurers, v endors, etc.) Inclusion of sustainability-related criteria in the selection, appointment and monitoring of business partners. 81.9 % of assessed transactions were proceeded and 15.6 % were approved subject to certain mitigation measures or conditions 2.4 % were declined or not pursued Further details see tables ESG-1 to ESG-3. 19 Allianz Group Sustainability Report 2022 > • • • • • • • • • • • • • •

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our f oundation 05 Our universal principles 01.7 Our sustainability integration approach Our sustainability risk management framework We continue to expand and strengthen our sustainability risk management approach. A key enabling factor is understanding the requirements and limitations of our operating entities to develop global sustainability processes that can be integrated into local processes and systems. We periodically review and update our sustainability risk management approach to ensure it is curr ent and relevant in context of our core businesses. 01.7.4 Regulation as a driver of sustainability integration Regulation is necessary to drive integration of sustainability considerations in a structured way. We welcome sustainability regulation as a major driver for fair competition and a level playing field. We actively engage in and support regulatory dev elopments. For example, we are a member of the European Commission’s Platform on Sustainable Finance and have contributed to the work of the European Financial Reporting Advisory Group (EFRAG) on EU sustainability reporting standards, via in-kind memberships in the Project Task Forc e on European Sustainability Reporting Standards (PTF-ESRS) until April 2022 and in the Sustainability Reporting Technical Expert Group (SR TEG) since May 2022. In this context, Allianz aims to contribute expert input with r espect to the insurance industry, such as on the dual role of insurers as preparers and users of sustainability information as well as on existing interconnected regulation. 1. Allianz contributes to the EU standard- setting activities of EFRAG, which has submitted its first set of technic al advice on the sector-agnostic EU sustainability reporting standards in late 2022, via an in-kind member, which represents the EU insurance industry in the EFRAG Sustainability Reporting Technical Expert Group (SR TEG). 2. Over two years since October 2020, we were the onl y insurer within the EU Platform on Sustainable Finance which acts as a permanent expert group of the European Commission to assist developing the EU’s sustainable finance policies, notably the further development of the EU taxonomy. We aim to leverage regulation on sustainability by ensuring consistent implementation across all A llianz businesses as well as building business opportunities in line with regulatory concepts. Allianz has established a Sustainable Finance Regulation implementation project at Gr oup level to drive this. In close interaction with Group Centers and Legal Entities, internal guidance is designed to ensure consistent interpretation and implementation. Beyond regulatory compliance, the concepts are used to guide internal standards for product and business development. See Regulatory and public affairs (section 04.2). A llianz Gr oup Sustainability R ep or t 2022 20

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Str engthening our foundation 05 Our universal principles 01.8 Our sustainability governance We are committed to clear and transparent governance principles. This extends to our governance of sustainability matters as we work to embed and deliver sustainable objectives across our global business and organization. Allianz has increased the importance of sustainability with the ambition to fully integrate sustainability acr oss the company. The Board of Management at Allianz SE is ultimately resp onsible for all matters related to sustainability and is supported by the Sustainability Board (formerly known as ESG Board). In 2021, Allianz established the Group Center Global Sustainability and the Sustainability C ommittee within the Supervisory Board to enable the sustainability strategy integration and implementation. Global Sustainability leads, coordinates and supports the Group functions and operating entities to effectively integrate the Group’s strategic sustainability approach and related objectives into their strategies and activities. Sustainability-related performance is integrated in our comp ensation systems through relevant targets incentivizing board members to act and decide according to E, S and G priorities. A fuller description of our sustainability governance can be found in section 05.4. Supervisory Board (incl. Sustainability Committee) Board of Management Group Sustainability Board Five BoM members Functional Heads: Global Sustainability Group Risk Group Communication Group Compliance • Regular reporting to SE Board of Management • Advising and aligning on all relevant Group Sustainability matters • Further elevate Sustainability topics in governance and decision-making processes of the Group Global Sustainability Full-time support to Sustainability Board Sustainability integration into organization and business Regular exchange and alignment with committees and Heads of Group functions on sustainability matters Regular exchange and alignment with repr esentatives from operating entities on sustainability matters 21 Allianz Group Sustainability Report 2022

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosur e 04 Strengthening our foundation 05 Our univ ersal principles 01.8 Our sustainability governance 01.8.1 Key bodies involved in sustainability governance Group Sustainability Board Ultimate responsibility for matters relating to sustainability resides with the Board of Management of Allianz SE as the Group’s parent company. To support the Board of Management in its decision-making, Allianz Gr oup established a dedicated Group Sustainability Board (known until January 2022 as the Group ESG Board). It is composed of members of the Board of Management of Allianz SE and Group Center heads and meets quarterly. The Group Sustainability Board is suppor ted by the Global Sustainability function in the execution of its responsibilities. The core objectives of the Group Sustainability Boar d are: • Preparing the overall framework for sustainability for the Allianz Group. • Integrating sustainability into the Group’s processes, into Allianz as an organization (operations and organization) and Allianz’s business (investment, insurance, asset management). • Maintaining oversight of and steering overarching sustainability matters, such as topics concerning the climate, society and governance. The core responsibilities of the Group Sustainability Boar d are: • Suggesting strategic ambitions and develop proposals for sustainability related targets for the sustainability performance management within Allianz Group. • Developing recommendations for Allianz’s positioning and viewpoints on critical sustainability related topics. • Regularly informing and advising the Allianz SE Board of Management on sustainability related topics and activities. • Striving to embed sustainability related matters in the strategy, activities and targets of Group Centers and OEs. • Aligning on sustainability related internal and external communication including reviewing the Group’s approach to rating and reporting. • Monitoring the progress to implement and execute the sustainability related strategic ambitions. Details on Sustainability Board and related targets linked to the remuneration of the Board of Management can be found in sections 01.8 and 05.4. Allianz SE Supervisory Board: Sustainability Committee The Supervisory Board of Allianz SE established its Sustainability Committee in 2021. Its core objectives include: • Advising the Supervisory Board on sustainability-related issues to support economically sound and sustainable development and positioning of Allianz Group. • Closely monitoring and supporting oversight of the Management Board’s sustainability strategy, in particular the management and execution of the strategic framework for Group-wide sustainability measures. • Preliminary examination of the sustainability-related statements of the Group’s non-financial statement in the Annual Report and the Sustainability Report including the Tax Transparency Report, as part of the Supervisory Board’s review. • Supporting the Personnel Committee in the preparation of the Sustainability- related target setting as well as the review of the set targets’ fulfillment for the Management Board’s remuneration. In 2022, the Sustainability Committee prep ared the recommendation of the sustainability related targets for the members of the Board of Management of Allianz SE, reviewed the respective achievements of the Board of Management and gave its recommendation to the Personnel Committee of the Supervisory Board. The Sustainability Committee was informed on the Sustainability Str ategy and provided advice and guidance on critical issues. Read more about the Sustainability Committee and its members in section 05.4. For further details about the remuneration system of Allianz Group, please see the Group Annual Report 2022, Remuneration Report, pages 26–52. A llianz Gr oup Sustainability R ep or t 2022 22

01.8 Our sustainability governance 01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Sustainability-related targets linked to the remuneration of the Board of Management In 2022 and for 2023 the targets for the Board of Management have been further developed to reflect the Sustainability priorities. Our targets 2022 2023 More details Overarching Ensure strong sustainability position (top ranks in DJSI, MSCI, Sustainalytics). 1 Achieve strong sustainability position (top performance in DJSI, MSCI). Sections 05.1 ; 05.2 Define approach and KPIs for sustainable claims management in retail P&C. Ensure sustainable solutions in proprietary investments and products. Section 02.1.3 Develop strategy for sustainability in asset management, leading to strong competitive positioning in sustainable product offering and ensuring strong sustainability reputation. Section 02.3 Define positioning on Social in line with Allianz purpose focusing on Sustainable Development Goal 8 (SDG 8). Sections 01.4 ; 01.6 ; 02.7 Environmental Decarbonisation Operations: 18% reduction of GHG (greenhouse gas) emissions per employee by 2022 (vs 2019) and 88% renewable electricity as share of total electricity consumption in 2022. Continue to decrease the GHG emissions from our own operations to achieve -50% by 2025 and net-zero by 2030. Section 02.6 Proprietary Investment: Establish a quantitative roadmap to reach minus 25% GHG emissions 2 (absolute reduction on public equity and listed corporate debt by year-end 2024 vs 2019). Follow through on net-zero ambition, in particular in line with our Net-Zero Alliances commitments. Sections 02.1 ; 02.2 ; 03.3 Social Customer Lo yalty Digital Net Promoter Score (dNPS). Digital Net Promoter Score (dNPS) development against previous year and overall ambition level. Section 02.5 Employee Engagement Inclusive Meritocracy Index (IMIX) and Work Well Index+ (WWI+). Inclusive Meritocracy Index (IMIX) and Work Well Index+ (WWI +) development against previous year and overall ambition level. Section 02.4 Governance Leadership Contribution with particular focus on Allianz People Attributes (Customer & Market Excellence, Collaborative Leadership, Entrepreneurship, and Trust). Leadership Contribution with particular focus on Allianz People Attributes (Customer & Market Excellence, Collaborative Leadership, Entrepreneurship and Trust). Section 02.4 1 Following a review, the Sustainalytics rating is out of scope of BoM target after 2022. 2 Scope 1 & 2 of investee companies according to GHG Protocol. GHG Protocol categorizes GHG emissions into three broad scopes: Scope 1: All Direct GHG emissions, which are emissions from sources that are owned or controlled by the reporting entity, Scope 2: Indirect GHG emissions, which are emissions from consumption of purchased electricity, heat or steam, Scope 3: Other indirect emissions, such as the extraction and production of purchased materials and fuels, transport-related activities in vehicles not owned or controlled by the reporting entity, electricity related activities (e.g. T&D losses) not covered in Scope 2, outsourced activities, waste disposal, etc. Reference for calculation to be found in Allianz Explanatory Notes . Emission-related data is provided by MSCI. 23 Allianz Group Sustainability Report 2022

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.8.2 Group Center Global Sustainability Since 01 January 2021, responsibility for Allianz’s sustainability agenda has been led by the Global Sustainability function (Group Center). The function is headed by the Chief Sustainability Officer (CSO) who reports to the Chairperson of the Group Sustainability Board. The Global Sustainability function suppor ts the Group Sustainability Board in the execution of its responsibilities. This includes prep aration, coordination and application of the decisions by the Group Sustainability Board. The Group Center Global Sustainability supports Allianz’s Group Centers and Operating Entities to effectivel y integrate the Group’s sustainability strategy into their business processes and policy framework. The Global Sustainability function drives the integration of sustainability-related matters across the organization and business to ensure Allianz plays a shaping role in the so cieties and economies in which it operates. Group Centers take responsibility for sustainability within their functions with the purpose to embed Sustainability across Allianz’s organization and business. Group Sustainability and Group Centers w ork with an expansive network of sustainability and business experts located acr oss Allianz’s operating entities globally providing guidance and setting minimum standards to ensure they embed sustainability in their strategies and approaches. This network supports implementation of the group-wide sustainability approach, share best practice and scale positive impacts across the organization. Several Group Committees play an important role in Allianz’s decision-making processes to embed Sustainability. See section 01.8 for more information on Group Committees , where sustainability related decisions are taken. Information on climate change business and management- level governance can be found in section 05.4. 01.8 Our sustainability governance 24 Allianz Group Sustainability Report 2022

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02 Measuring and managing sustainability In this chapter, we cover the material topics, public targets and commitments that are integrated across Allianz. We disclose our approaches to those topics, quantitative targets, KPIs and core performance data. Allianz Group Sustainability Report 2022 25

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Sustainability in our business activities We are embedding in our core business areas of insurance proprietary investments and asset management. Across these portfolios, we prioritize SDG 8, Decent Work and Economic Growth and SDG 13, Climate Action. In 2022, we focused on integrating climate aspects into products, processes and solutions. Allianz Group Sustainability Report 2022 26

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.1 Sustainability in insurance Core performance data Table ESG-1 ESG referrals and assessments: total numbers per sector 2022 2021 2020 Insurance # 730 850 430 Proceed with transaction with mitigation measures and/or conditions # 207 197 188 Proceed with transaction # 490 584 203 Do not proceed # 33 69 39 Investment # 53 71 65 Proceed with transaction with mitigation measures and/or conditions # 10 3 2 Proceed with transaction # 42 61 56 Do not proceed # 1 7 7 Procurement # 612 526 101 Proceed with transaction with mitigation measures and/or conditions # 1 2 0 Proceed with transaction # 611 522 101 Do not proceed # 0 2 0 Other # 0 0 1 Proceed with transaction # 0 0 1 Total # 1,395 1,447 597 Table ESG-2 ESG referrals and assessments: assessment outcomes % share of total referrals 1 As of December 31 2022 2021 2020 Proceed % 81.9 80.6 60.5 Proceed with mitigation or additional conditions % 15.6 14.0 31.8 Do not proceed % 2.4 5.4 7.7 1 Referral data includes referrals from insurance, investments and procurement. Allianz Group Sustainability Report 2022 27

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Table ESG-3 ESG referrals and assessments: sensitive business areas 1 As of December 31 2022 2021 2020 Proceed Proceed with mitigation Do not proceed Total Proceed Proceed with mitigation Do not proceed Total Proceed Proceed with mitigation Do not proceed Total Agriculture, fisheries and forestry 13 11 0 24 23 11 1 35 24 15 0 39 Animal testing 1 0 0 1 1 0 0 1 1 0 0 1 Animal welfare 6 0 0 6 3 0 1 4 0 0 0 0 Betting and gambling 6 0 0 6 4 1 0 5 2 1 0 3 Clinical trials 13 2 0 15 39 5 0 44 16 5 0 21 Defense 18 21 2 41 42 17 7 66 20 16 2 38 Human rights 12 24 6 42 13 20 13 46 15 14 3 32 Hydro-electric power 5 8 0 13 10 12 1 23 10 7 1 18 Infrastructure 82 30 2 114 97 18 17 132 42 20 12 74 Mining 21 24 2 47 26 26 9 61 21 34 12 67 Nuclear energy 7 0 0 7 8 1 0 9 9 6 0 15 Oil and gas 23 61 12 96 48 53 13 114 23 41 6 70 Sex industry 0 0 0 0 1 0 0 1 1 0 0 1 Procurement transactions 611 1 0 612 521 3 1 525 101 0 0 101 Other sustainability and reputational issues 325 36 10 371 331 35 15 381 76 31 10 117 Total 1,143 218 34 1,395 1,167 202 78 1,447 361 190 46 597 02.1 Sustainability in insurance Table ESG-4 Revenues from sustainable solutions 2 , 4 As of December 31 2022 2021 2020 Sustainable Insurance Solutions € mn 845.7 799.2 698.5 Insurance solutions with a sustainability component € mn 437.1 416.4 367.6 Total € mn 1,282.9 1,215.6 1,066.1 Table ESG-5 Number of sustainable solutions 3 , 5 As of December 31 2022 2021 2020 Sustainable Insurance Solutions # 76 83 89 Insurance solutions with a sustainability component # 27 35 35 Total # 103 118 124 1 Referral data includes referrals from insurance, investments and procurement. 2 Our current data collection process does not allow for a complete tracking of revenue data. Revenues are included subject to data availability. 3 Our current data collection process does not allow for a complete tracking of the number of sustainable solutions. Number of solutions data is included subject to data availability. 4 Sustainable solutions for Life products are excluded since this year, due to evolving regulation. Prior year figures have been restated accordingly. 5 Sustainable solutions for Life and Asset Management are excluded due to evolving regulation. Prior year figures have been restated accordingly. Allianz Group Sustainability Report 2022 28

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.1 Sustainability in insurance Table ESG-6 Emerging Consumers As of December 31 2022 2021 2020 Gross Written Premiums (GWP) € mn 557.8 510.2 452.2 thereof from consolidated entities € mn 68.1 45.2 56.1 thereof from non-consolidated entities € mn 489.7 465.0 396.1 No. of in-force insured people # 57,170,290 62,221,110 46,138,372 thereof from consolidated entities # 13,172,642 9,721,944 10,077,970 thereof from non-consolidated entities # 43,997,648 52,499,166 36,060,402 GWP per insured € 9.8 8.2 9.8 Emerging Consumers Solutions 1 # 31 30 26 Table ESG-17 Coal exemption requests 2 , 3 As of December 31 2022 2021 2020 Total Referrals 50 72 n/a Exemptions granted 22 20 n/a Exemptions not granted 28 52 n/a Table FIN-1 Economic Value generated, distributed and retained € mn As of December 31 Unit 2022 2021 Economic Value Generated € mn 122,715.1 100.0 122,238.9 100.0 Revenue from sale of goods € mn 83,911.5 68.4 77,656.2 63.5 Revenue from rendering of services € mn 13,981.2 11.4 13,998.1 11.5 Revenue from financial investments € mn 24,705.8 20.1 30,552.1 25.0 Other operating income € mn 116.7 0.1 32.5 0.0 Economic Value Distributed € mn 111,411.2 90.8 104,239.5 85.3 Operating expenses € mn 88,265.1 71.9 81,326.6 66.5 thereof: Claims and insurance benefits € mn 60,764.0 49.5 54,873.0 44.9 Claims P&C € mn 38,080.6 31.0 33,783.8 27.6 Claims L&H € mn 22,683.4 18.5 21,089.5 17.3 Wages and other payments to employees € mn 13,965.0 11.4 13,339.8 10.9 Payments to provider of capital € mn 6,461.9 5.3 5,475.3 4.5 Payment to shareholders € mn 5,683.3 4.6 4,705.6 3.8 Payments to creditors € mn 778.6 0.6 769.7 0.6 Payments to government € mn 2,584.9 2.1 3,985.9 3.3 thereof: income tax expense € mn 2,419.3 2.0 3,659.6 3.0 Community investments € mn 134.2 0.1 112.9 0.1 Economic Value not yet distributed € mn 11,822.8 9.6 17,295.4 14.1 Change in reserves € mn 3,242.0 2.6 13,716.2 11.2 Impairments € mn 6,520.9 5.3 1,331.0 1.1 Change in provisions € mn 2,059.8 1.7 2,248.2 1.8 Economic Value Retained € mn -518.9 -0.4 704.0 0.6 1 Number of solutions refers to solutions from consolidated entities only. 2 The coal exemption process was introduced in May 2021. 3 Data disclosed since 2022. Allianz Group Sustainability Report 2022 29