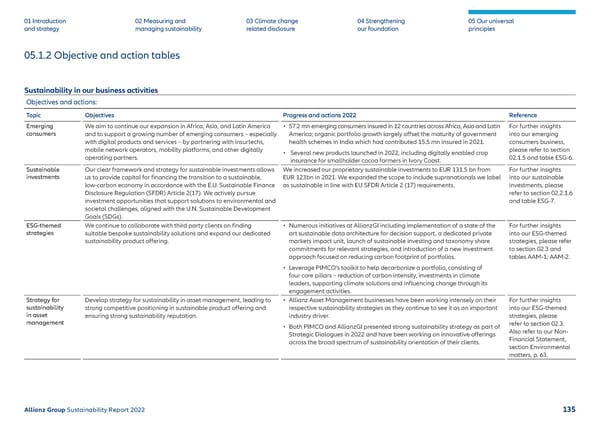

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 05.1.2 Objective and action tables Sustainability in our business activities Objectives and actions: Topic Objectives Progress and actions 2022 Reference Emerging consumers We aim to continue our expansion in Africa, Asia, and Latin America and to support a growing number of emerging consumers – especially with digital products and services – by partnering with insurtechs, mobile network operators, mobility platforms, and other digitally operating partners. • 57.2 mn emerging consumers insured in 12 countries across Africa, Asia and Latin America; organic portfolio growth largely offset the maturity of government health schemes in India which had contributed 15.5 mn insured in 2021. • Several new products launched in 2022, including digitally enabled crop insurance for smallholder cocoa farmers in Ivory Coast. For further insights into our emerging consumers business, please refer to section 02.1.5 and table ESG-6. Sustainable investments Our clear framework and strategy for sustainable investments allows us to provide capital for financing the transition to a sustainable, low-carbon economy in accordance with the E.U. Sustainable Finance Disclosure Regulation (SFDR) Article 2(17). We actively pursue investment opportunities that support solutions to environmental and societal challenges, aligned with the U.N. Sustainable Development Goals (SDGs). We increased our proprietary sustainable investments to EUR 131.5 bn from EUR 123bn in 2021. We expanded the scope to include supranationals we label as sustainable in line with EU SFDR Article 2 (17) requirements. For further insights into our sustainable investments, please refer to section 02.2.1.6 and table ESG-7. ESG-themed strategies We continue to collaborate with third party clients on finding suitable bespoke sustainability solutions and expand our dedicated sustainability product offering. • Numerous initiatives at AllianzGI including implementation of a state of the art sustainable data architecture for decision support, a dedicated private markets impact unit, launch of sustainable investing and taxonomy share commitments for relevant strategies, and introduction of a new investment approach focused on reducing carbon footprint of portfolios. • Leverage PIMCO’s toolkit to help decarbonize a portfolio, consisting of four core pillars – reduction of carbon intensity, investments in climate leaders, supporting climate solutions and influencing change through its engagement activities. For further insights into our ESG-themed strategies, please refer to section 02.3 and tables AAM-1; AAM-2. Strategy for sustainability in asset management Develop strategy for sustainability in asset management, leading to strong competitive positioning in sustainable product offering and ensuring strong sustainability reputation. • Allianz Asset Management businesses have been working intensely on their respective sustainability strategies as they continue to see it as an important industry driver. • Both PIMCO and AllianzGI presented strong sustainability strategy as part of Strategic Dialogues in 2022 and have been working on innovative offerings across the broad spectrum of sustainability orientation of their clients. For further insights into our ESG-themed strategies, please refer to section 02.3. Also refer to our Non- Financial Statement, section Environmental matters, p. 63. Allianz Group Sustainability Report 2022 135

Sustainability Report 2022 | Allianz Page 135 Page 137

Sustainability Report 2022 | Allianz Page 135 Page 137