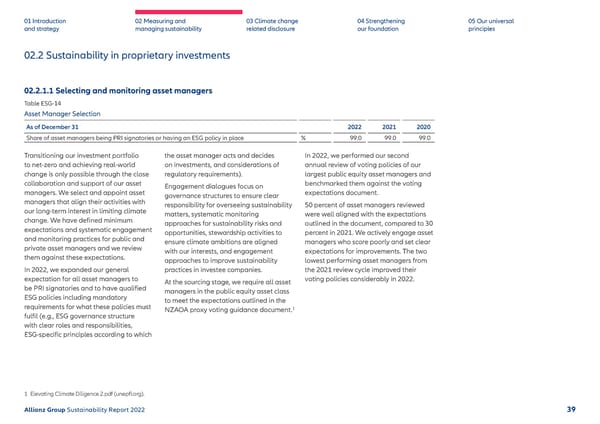

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.2 Sustainability in proprietary investments 02.2.1.1 Selecting and monitoring asset managers Table ESG-14 Asset Manager Selection As of December 31 2022 2021 2020 Share of asset managers being PRI signatories or having an ESG policy in place % 99.0 99.0 99.0 Transitioning our investment portfolio to net-zero and achieving real-world change is only possible through the close collaboration and support of our asset managers. We select and appoint asset managers that align their activities with our long-term interest in limiting climate change. We have defined minimum expectations and systematic engagement and monitoring practices for public and private asset managers and we review them against these expectations. In 2022, we expanded our general expectation for all asset managers to be PRI signatories and to have qualified ESG policies including mandatory requirements for what these policies must fulfil (e.g., ESG governance structure with clear roles and responsibilities, ESG-specific principles according to which the asset manager acts and decides on investments, and considerations of regulatory requirements). Engagement dialogues focus on governance structures to ensure clear responsibility for overseeing sustainability matters, systematic monitoring approaches for sustainability risks and opportunities, stewardship activities to ensure climate ambitions are aligned with our interests, and engagement approaches to improve sustainability practices in investee companies. At the sourcing stage, we require all asset managers in the public equity asset class to meet the expectations outlined in the NZAOA proxy voting guidance document. 1 In 2022, we performed our second annual review of voting policies of our largest public equity asset managers and benchmarked them against the voting expectations document. 50 percent of asset managers reviewed were well aligned with the expectations outlined in the document, compared to 30 percent in 2021. We actively engage asset managers who score poorly and set clear expectations for improvements. The two lowest performing asset managers from the 2021 review cycle improved their voting policies considerably in 2022. 1 Elevating Climate Diligence 2.pdf (unepfi.org) . Allianz Group Sustainability Report 2022 39

Sustainability Report 2022 | Allianz Page 39 Page 41

Sustainability Report 2022 | Allianz Page 39 Page 41