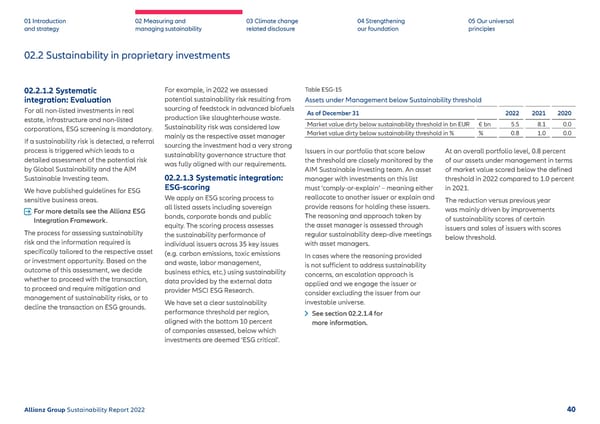

02.2 Sustainability in proprietary investments 01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.2.1.2 Systematic integration: Evaluation For all non-listed investments in real estate, infrastructure and non-listed corporations, ESG screening is mandatory. If a sustainability risk is detected, a referral process is triggered which leads to a detailed assessment of the potential risk by Global Sustainability and the AIM Sustainable Investing team. We have published guidelines for ESG sensitive business areas. For more details see the Allianz ESG Integration Framework. The process for assessing sustainability risk and the information required is specifically tailored to the respective asset or investment opportunity. Based on the outcome of this assessment, we decide whether to proceed with the transaction, to proceed and require mitigation and management of sustainability risks, or to decline the transaction on ESG grounds. For example, in 2022 we assessed potential sustainability risk resulting from sourcing of feedstock in advanced biofuels production like slaughterhouse waste. Sustainability risk was considered low mainly as the respective asset manager sourcing the investment had a very strong sustainability governance structure that was fully aligned with our requirements. 02.2.1.3 Systematic integration: ESG-scoring We apply an ESG scoring process to all listed assets including sovereign bonds, corporate bonds and public equity. The scoring process assesses the sustainability performance of individual issuers across 35 key issues (e.g. carbon emissions, toxic emissions and waste, labor management, business ethics, etc.) using sustainability data provided by the external data provider MSCI ESG Research. We have set a clear sustainability performance threshold per region, aligned with the bottom 10 percent of companies assessed, below which investments are deemed ‘ESG critical’. Table ESG-15 Assets under Management below Sustainability threshold As of December 31 2022 2021 2020 Market value dirty below sustainability threshold in bn EUR € bn 5.5 8.1 0.0 Market value dirty below sustainability threshold in % % 0.8 1.0 0.0 Issuers in our portfolio that score below the threshold are closely monitored by the AIM Sustainable Investing team. An asset manager with investments on this list must ‘comply-or-explain’ – meaning either reallocate to another issuer or explain and provide reasons for holding these issuers. The reasoning and approach taken by the asset manager is assessed through regular sustainability deep-dive meetings with asset managers. In cases where the reasoning provided is not sufficient to address sustainability concerns, an escalation approach is applied and we engage the issuer or consider excluding the issuer from our investable universe. See section 02.2.1.4 for more information. At an overall portfolio level, 0.8 percent of our assets under management in terms of market value scored below the defined threshold in 2022 compared to 1.0 percent in 2021. The reduction versus previous year was mainly driven by improvements of sustainability scores of certain issuers and sales of issuers with scores below threshold. Allianz Group Sustainability Report 2022 40

Sustainability Report 2022 | Allianz Page 40 Page 42

Sustainability Report 2022 | Allianz Page 40 Page 42