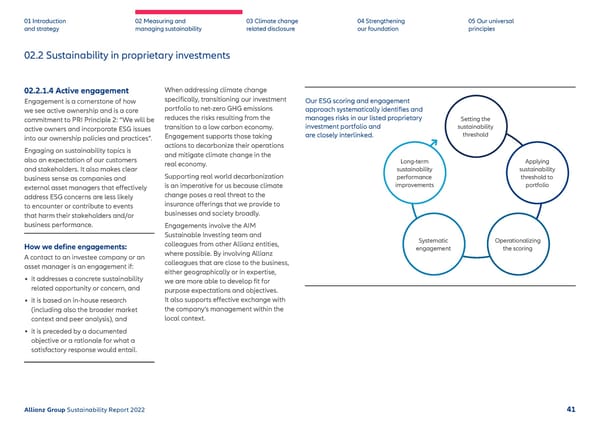

02.2 Sustainability in proprietary investments 01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.2.1.4 Active engagement Engagement is a cornerstone of how we see active ownership and is a core commitment to PRI Principle 2: “We will be active owners and incorporate ESG issues into our ownership policies and practices”. Engaging on sustainability topics is also an expectation of our customers and stakeholders. It also makes clear business sense as companies and external asset managers that effectively address ESG concerns are less likely to encounter or contribute to events that harm their stakeholders and/or business performance. How we define engagements: A contact to an investee company or an asset manager is an engagement if: • it addresses a concrete sustainability related opportunity or concern, and • it is based on in-house research (including also the broader market context and peer analysis), and • it is preceded by a documented objective or a rationale for what a satisfactory response would entail. When addressing climate change specifically, transitioning our investment portfolio to net-zero GHG emissions reduces the risks resulting from the transition to a low carbon economy. Engagement supports those taking actions to decarbonize their operations and mitigate climate change in the real economy. Supporting real world decarbonization is an imperative for us because climate change poses a real threat to the insurance offerings that we provide to businesses and society broadly. Engagements involve the AIM Sustainable Investing team and colleagues from other Allianz entities, where possible. By involving Allianz colleagues that are close to the business, either geographically or in expertise, we are more able to develop fit for purpose expectations and objectives. It also supports effective exchange with the company’s management within the local context. Our ESG scoring and engagement approach systematically identifies and manages risks in our listed proprietary investment portfolio and are closely interlinked. Setting the sustainability threshold Applying sustainability threshold to portfolio Operationalizing the sc oring Systematic engagement Long-term sustainability p erformance improvements Allianz Group Sustainability Report 2022 41

Sustainability Report 2022 | Allianz Page 41 Page 43

Sustainability Report 2022 | Allianz Page 41 Page 43