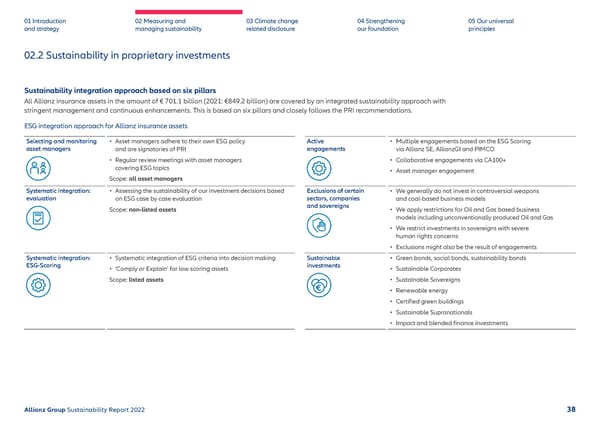

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.2 Sustainability in proprietary investments Sustainability integration approach based on six pillars All Allianz insurance assets in the amount of € 701.1 billion (2021: €849.2 billion) are covered by an integrated sustainability approach with stringent management and continuous enhancements. This is based on six pillars and closely follows the PRI recommendations. ESG integration approach for Allianz insurance assets Selecting and monitoring asset managers • Asset managers adhere to their own ESG policy and are signatories of PRI • Regular review meetings with asset managers covering ESG topics Scope: all asset managers Systematic integration: ev aluation • Assessing the sustainability of our investment decisions based on ESG case by case evaluation Scope: non-listed assets Systematic integration: ESG-Scoring • Systematic integration of ESG criteria into decision making • ‘Comply or Explain’ for low scoring assets Scope: listed assets Active engagements • Multiple engagements based on the ESG Scoring via Allianz SE, AllianzGI and PIMCO • Collaborative engagements via CA100+ • Asset manager engagement Exclusions of certain sectors, comp anies and sovereigns • We generally do not invest in controversial weapons and coal-based business models • We apply restrictions for Oil and Gas based business models including unc onventionally produced Oil and Gas • We restrict investments in sovereigns with severe human rights conc erns • Exclusions might also be the result of engagements Sustainable inv estments • Green bonds, social bonds, sustainability bonds • Sustainable Corporates • Sustainable Sovereigns • Renewable energy • Certified green buildings • Sustainable Supranationals • Impact and blended finance investments Allianz Group Sustainability Report 2022 38

Sustainability Report 2022 | Allianz Page 38 Page 40

Sustainability Report 2022 | Allianz Page 38 Page 40