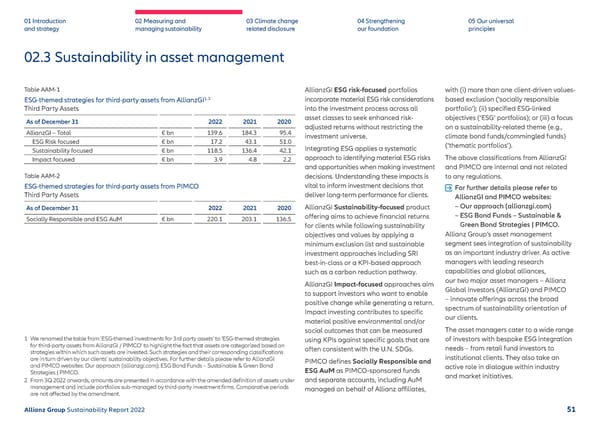

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.3 Sustainability in asset management Table AAM-1 ESG-themed strategies for third-party assets from AllianzGI 1 , 2 Third Party Assets As of December 31 2022 2021 2020 AllianzGI – Total € bn 139.6 184.3 95.4 ESG Risk focused € bn 17.2 43.1 51.0 Sustainability focused € bn 118.5 136.4 42.1 Impact focused € bn 3.9 4.8 2.2 Table AAM-2 ESG-themed strategies for third-party assets from PIMCO Third Party Assets As of December 31 2022 2021 2020 Socially Responsible and ESG AuM € bn 220.1 203.1 136.5 AllianzGI ESG risk-focused portfolios incorporate material ESG risk considerations into the investment process across all asset classes to seek enhanced risk- adjusted returns without restricting the investment universe. Integrating ESG applies a systematic approach to identifying material ESG risks and opportunities when making investment decisions. Understanding these impacts is vital to inform investment decisions that deliver long-term performance for clients. AllianzGI Sustainability-focused product offering aims to achieve financial returns for clients while following sustainability objectives and values by applying a minimum exclusion list and sustainable investment approaches including SRI best-in-class or a KPI-based approach such as a carbon reduction pathway. AllianzGI Impact-focused approaches aim to support investors who want to enable positive change while generating a return. Impact investing contributes to specific material positive environmental and/or social outcomes that can be measured using KPIs against specific goals that are often consistent with the U.N. SDGs. PIMCO defines Socially Responsible and ESG AuM as PIMCO-sponsored funds and separate accounts, including AuM managed on behalf of Allianz affiliates, with (i) more than one client-driven values- based exclusion (‘socially responsible portfolio’); (ii) specified ESG-linked objectives (‘ESG’ portfolios); or (iii) a focus on a sustainability-related theme (e.g., climate bond funds/commingled funds) (‘thematic portfolios’). The above classifications from AllianzGI and PIMCO are internal and not related to any regulations. For further details please refer to AllianzGI and PIMCO websites: – Our approach (allianzgi.com) – ESG Bond Funds – Sustainable & Green Bond Strategies | PIMC O. Allianz Group’s asset management segment sees integration of sustainability as an important industry driver. As active managers with leading research capabilities and global alliances, our two major asset managers – Allianz Global Investors (AllianzGI) and PIMCO – innovate offerings across the broad spectrum of sustainability orientation of our clients. The asset managers cater to a wide range of investors with b espoke ESG integration needs – from retail fund investors to institutional clients. They also take an active role in dialogue within industry and market initiatives. 1 We renamed the table from ‘ESG-themed investments for 3rd party assets’ to ‘ESG-themed strategies for third-party assets from AllianzGI / PIMCO’ to highlight the fact that assets are categorized based on strategies within which such assets are invested. Such strategies and their corresponding classifications are in turn driven by our clients’ sustainability objectives. For further details please refer to AllianzGI and PIMCO websites: Our approach (allianzgi.com) ; ESG Bond Funds – Sustainable & Green Bond Strategies | PIMCO. 2 From 3Q 2022 onwards, amounts are presented in accordance with the amended definition of assets under management and include portfolios sub-managed by third-party investment firms. Comparative periods are not affected by the amendment. Allianz Group Sustainability Report 2022 51

Sustainability Report 2022 | Allianz Page 51 Page 53

Sustainability Report 2022 | Allianz Page 51 Page 53