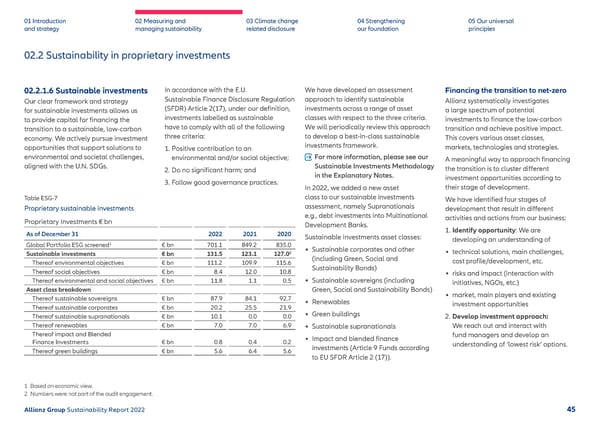

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.2 Sustainability in proprietary investments 02.2.1.6 Sustainable investments Our clear framework and strategy for sustainable investments allows us to provide capital for financing the transition to a sustainable, low-carbon economy. We actively pursue investment opportunities that support solutions to environmental and societal challenges, aligned with the U.N. SDGs. Table ESG-7 Proprietary sustainable investments Proprietary Investments € bn As of December 31 2022 2021 2020 Global Portfolio ESG screened 1 € bn 701.1 849.2 835.0 Sustainable investments € bn 131.5 123.1 127.0 2 Thereof environmental objectives € bn 111.2 109.9 115.6 Thereof social objectives € bn 8.4 12.0 10.8 Thereof environmental and social objectives € bn 11.8 1.1 0.5 Asset class breakdown Thereof sustainable sovereigns € bn 87.9 84.1 92.7 Thereof sustainable corporates € bn 20.2 25.5 21.9 Thereof sustainable supranationals € bn 10.1 0.0 0.0 Thereof renewables € bn 7.0 7.0 6.9 Thereof impact and Blended Finance Investments € bn 0.8 0.4 0.2 Thereof green buildings € bn 5.6 6.4 5.6 In accordance with the E.U. Sustainable Finance Disclosure Regulation (SFDR) Article 2(17), under our definition, investments labelled as sustainable have to comply with all of the following three criteria: 1. Positive contribution to an environmental and/or social objective; 2. Do no significant harm; and 3. Follow good governance practices. We have developed an assessment approach to identify sustainable investments across a range of asset classes with respect to the three criteria. We will periodically review this approach to develop a best-in-class sustainable investments framework. For more information, please see our Sustainable Investments Methodology in the Explanatory Notes. In 2022, we added a new asset class to our sustainable in vestments assessment, namely Supranationals e.g., debt investments into Multinational Development Banks. Sustainable investments asset classes: • Sustainable corporates and other (including Green, Social and Sustainability Bonds) • Sustainable sovereigns (including Green, Social and Sustainability Bonds) • Renewables • Green buildings • Sustainable supranationals • Impact and blended finance investments (Article 9 Funds according to EU SFDR Article 2 (17)). 1 Based on economic view. 2 Numbers were not part of the audit engagement. Financing the transition to net-zero Allianz systematically investigates a large spectrum of potential investments to finance the low-carbon transition and achieve positive impact. This covers various asset classes, markets, technologies and strategies. A meaningful way to approach financing the tr ansition is to cluster different investment opportunities according to their stage of development. We have identified four stages of dev elopment that result in different activities and actions from our business: 1. Identify opportunity : We are de veloping an understanding of • technical solutions, main challenges, cost profile/development, etc. • risks and impact (interaction with initiatives, NGOs, etc.) • market, main players and existing investment opportunities 2. Develop investment approach: W e reach out and interact with fund managers and develop an understanding of ‘lowest risk’ options. Allianz Group Sustainability Report 2022 45

Sustainability Report 2022 | Allianz Page 45 Page 47

Sustainability Report 2022 | Allianz Page 45 Page 47