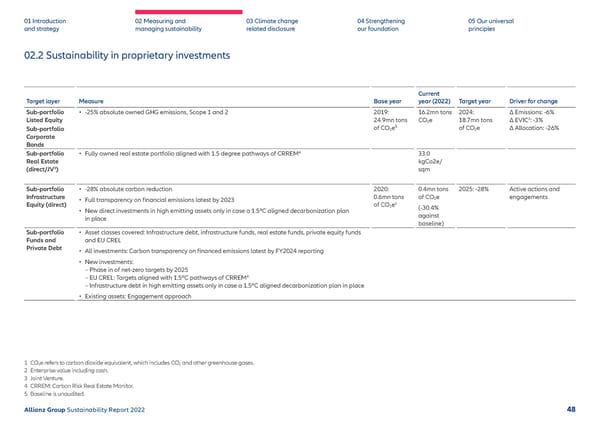

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 02.2 Sustainability in proprietary investments Target layer Measure Base year Current year (2022) Target year Driver for change Sub-portfolio Listed Equity Sub -portfolio Corporate Bonds • -25% absolute owned GHG emissions, Scope 1 and 2 2019: 24.9mn tons of CO 2 e ¹ 16.2mn tons CO 2 e 2024: 18.7mn tons of CO 2 e ∆ Emissions: -6% ∆ EVIC 2 : -3% ∆ Allocation: -26% Sub-portfolio Real Estate ( direct/JV 3 ) • Fully owned real estate portfolio aligned with 1.5 degree pathways of CRREM 4 33.0 kgCo2e/ sqm Sub-portfolio Infrastructure Equity (direct) • -28% absolute carbon reduction • Full transparency on financial emissions latest by 2023 • New direct investments in high emitting assets only in case a 1.5ºC aligned decarbonization plan in place 2020: 0.6mn tons of CO 2 e 5 0.4mn tons of CO 2 e ( -30.4% against baseline) 2025: -28% Active actions and engagements Sub-portfolio Funds and Private Debt • Asset classes covered: Infrastructure debt, infrastructure funds, real estate funds, private equity funds and EU CREL • All investments: Carbon transparency on financed emissions latest by FY2024 reporting • New investments: – Phase in of net-zero targets by 2025 – EU CREL: Targets aligned with 1.5ºC pathways of CRREM 4 – Infrastructure debt in high emitting assets only in case a 1.5ºC aligned decarbonization plan in place • Existing assets: Engagement approach 1 CO 2 e refers to carbon dioxide equivalent, which includes CO 2 and other greenhouse gases. 2 Enterprise value including cash. 3 Joint Venture. 4 CRREM: Carbon Risk Real Estate Monitor. 5 Baseline is unaudited. Allianz Group Sustainability Report 2022 48

Sustainability Report 2022 | Allianz Page 48 Page 50

Sustainability Report 2022 | Allianz Page 48 Page 50