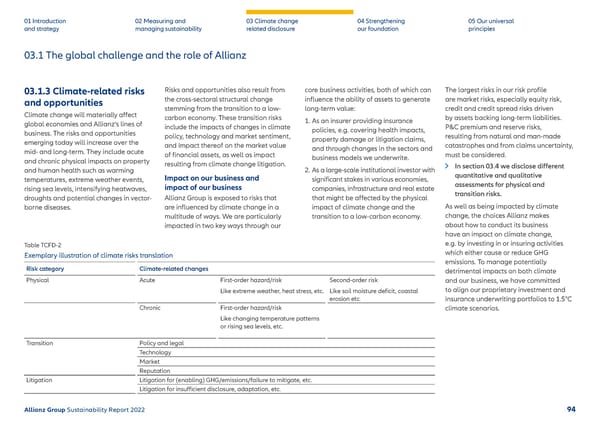

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 03.1 The global challenge and the role of Allianz 03.1.3 Climate-related risks and opportunities Climate change will materially affect global economies and Allianz’s lines of business. The risks and opportunities emerging today will increase over the mid- and long-term. They include acute and chronic physical impacts on property and human health such as warming temperatures, extreme weather events, rising sea levels, intensifying heatwaves, droughts and potential changes in vector- borne diseases. Risks and opportunities also result from the cross-sectoral structural change stemming from the transition to a low- carbon economy. These transition risks include the impacts of changes in climate policy, technology and market sentiment, and impact thereof on the market value of financial assets, as well as impact resulting from climate change litigation. Impact on our business and impact of our business Allianz Group is exposed to risks that are influenced by climate change in a multitude of ways. We are particularly impacted in two key ways through our core business activities, both of which can influence the ability of assets to generate long-term value: 1. As an insurer providing insurance policies, e.g. covering health impacts, property damage or litigation claims, and through changes in the sectors and business models we underwrite. 2. As a large-scale institutional investor with significant stakes in various economies, companies, infrastructure and real estate that might be affected by the physical impact of climate change and the transition to a low-carbon economy. Table TCFD-2 Exemplary illustration of climate risks translation Risk category Climate-related changes Physical Acute First-order hazard/risk Like extreme weather, heat stress, etc. Second-order risk Like soil moisture deficit, coastal erosion etc. Chronic First-order hazard/risk Like changing temperature patterns or rising sea levels, etc. Transition Policy and legal Technology Market Reputation Litigation Litigation for (enabling) GHG/emissions/failure to mitigate, etc. Litigation for insufficient disclosure, adaptation, etc. The largest risks in our risk profile are market risks, especially equity risk, credit and credit spread risks driven by assets backing long-term liabilities. P&C premium and reserve risks, resulting from natural and man-made catastrophes and from claims uncertainty, must be considered. In section 03.4 we disclose different quantitative and qualitative assessments for physical and transition risks. As well as being impacted by climate change, the choices Allianz mak es about how to conduct its business have an impact on climate change, e.g. by investing in or insuring activities which either cause or reduce GHG emissions. To manage potentially detrimental impacts on both climate and our business, we have committed to align our proprietary investment and insurance underwriting portfolios to 1.5°C climate scenarios. Allianz Group Sustainability Report 2022 94

Sustainability Report 2022 | Allianz Page 94 Page 96

Sustainability Report 2022 | Allianz Page 94 Page 96