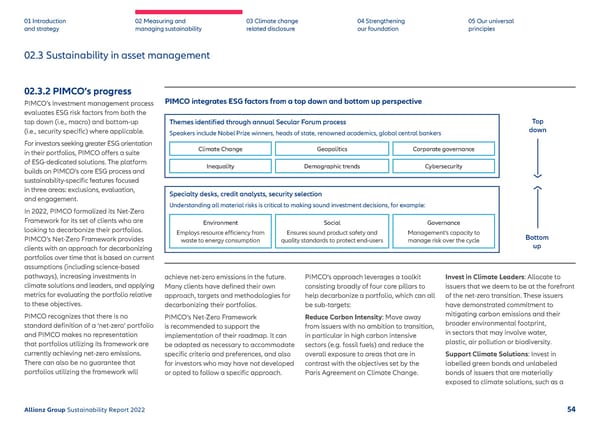

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change r elated disclosure 04 Strengthening our f oundation 05 Our universal principles 02.3 Sustainability in asset management 02.3.2 PIMCO’s progress PIMCO’s investment management process evaluates ESG risk factors from both the top down (i.e., macro) and bottom-up (i.e., security specific) where applicable. For investors seeking greater ESG orientation in their p ortfolios, PIMCO offers a suite of ESG-dedicated solutions. The platform builds on PIMCO’s core ESG process and sustainability-specific features focused in three areas: exclusions, evaluation, and engagement. In 2022, PIMCO formalized its Net-Zero F ramework for its set of clients who are looking to decarbonize their portfolios. PIMCO’s Net-Zero Framework provides clients with an approach for decarbonizing portfolios over time that is based on current assumptions (including science-based pathways), increasing investments in climate solutions and leaders, and applying metrics for evaluating the portfolio relative to these objectives. PIMCO recognizes that there is no standar d definition of a ‘net-zero’ portfolio and PIMCO makes no representation that portfolios utilizing its framework are currently achieving net-zero emissions. There can also be no guarantee that portfolios utilizing the framework will achieve net-zero emissions in the future. Many clients have defined their own approach, targets and methodologies for decarbonizing their portfolios. PIMCO integrates ESG factors from a top down and bottom up perspective Top down Themes identified through annual Secular Forum process Speakers include Nobel Prize winners, heads of state, renowned academics, global central bankers Climate Change Inequality Geopolitics Demographic trends Corporate governance Cybersecurity Bottom up Specialty desks, credit analysts, security selection Understanding all material risks is critical to making sound investment decisions, for example: Environment Emplo ys resource efficiency from waste to energy consumption Social Ensur es sound product safety and quality standards to protect end-users Governance Management’ s capacity to manage risk over the cycle PIMCO’s Net-Zero Framework is recommended to support the implementation of their roadmap. It can be adapted as necessary to accommodate specific criteria and preferences, and also for investors who may have not developed or opted to follow a specific approach. PIMCO’s approach leverages a toolkit c onsisting broadly of four core pillars to help decarbonize a portfolio, which can all be sub-targets: Reduce Carbon Intensity : Move away fr om issuers with no ambition to transition, in particular in high carbon intensive sectors (e.g. fossil fuels) and reduce the overall exposure to areas that are in contrast with the objectives set by the Paris Agreement on Climate Change. Invest in Climate Leaders : Allocate to issuers that w e deem to be at the forefront of the net-zero transition. These issuers have demonstrated commitment to mitigating carbon emissions and their broader environmental footprint, in sectors that may involve water, plastic, air pollution or biodiversity. Support Climate Solutions : Invest in lab elled green b onds and unlabeled bonds of issuers that are materially exposed to climate solutions, such as a Allianz Group Sustainability Report 2022 54

Sustainability Report 2022 | Allianz Page 54 Page 56

Sustainability Report 2022 | Allianz Page 54 Page 56