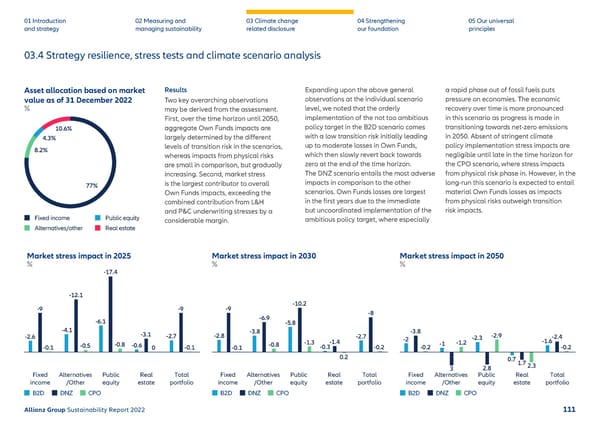

03.4 Strategy resilience, stress tests and climate scenario analysis Fixed income Alternatives/other Public equity Real estate 77% 8.2% 4.3% 10.6% 01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Asset allocation based on market value as of 31 December 2022 % Results Two key overarching observations may be deriv ed from the assessment. First, over the time horizon until 2050, aggregate Own Funds impacts are largely determined by the different levels of transition risk in the scenarios, whereas impacts from physical risks are small in comparison, but gradually increasing. Second, market stress is the largest contributor to overall Own Funds impacts, exceeding the combined contribution from L&H and P&C underwriting stresses by a considerable margin. Expanding upon the above general observ ations at the individual scenario level, we noted that the orderly implementation of the not too ambitious policy target in the B2D scenario comes with a low transition risk initially leading up to moderate losses in Own Funds, which then slowly revert back towards zero at the end of the time horizon. The DNZ scenario entails the most adverse impacts in comparison to the other scenarios. Own Funds losses are largest in the first years due to the immediate but uncoordinated implementation of the ambitious policy target, where especially a rapid phase out of fossil fuels puts pressure on economies. The economic recovery over time is more pronounced in this scenario as progress is made in transitioning towards net-zero emissions in 2050. Absent of stringent climate policy implementation stress impacts are negligible until late in the time horizon for the CPO scenario, where stress impacts from physical risk phase in. However, in the long-run this scenario is expected to entail material Own Funds losses as impacts from physical risks outweigh transition risk impacts. -9 -0.1 -12.1 -4.1 -0.5 -17.4 -6.1 -0.6 -0.8 -3.1 -2.7 0 -9 -0.1 B2D DNZ CPO -2.6 Alternatives /Other Public equity Real estate Total portfolio Fixed income Market stress impact in 2025 % -9 -6.9 -0.8 -10.2 -1.3 -1.4 -0.3 -5.8 0.2 -8 -2.7 B2D DNZ CPO -3.8 -2.8 Alternatives /Other Public equity Real estate Total portfolio Fixed income -0.2 -0.1 Market stress impact in 2030 % -3.8 -2 -0.2 3 -1.2 2.8 -2.9 0.7 -2.3 1.7 2.3 -2.4 -1.6 -0.2 B2D DNZ CPO -1 Alternatives /Other Public equity Real estate Total portfolio Fixed income Market stress impact in 2050 % Allianz Group Sustainability Report 2022 111

Sustainability Report 2022 | Allianz Page 111 Page 113

Sustainability Report 2022 | Allianz Page 111 Page 113