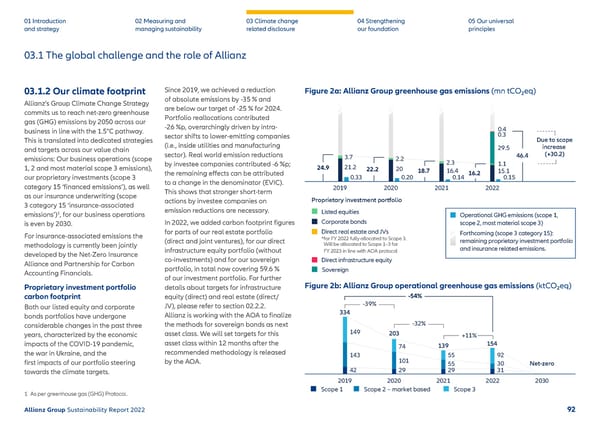

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Str engthening our foundation 05 Our universal principles 03.1 The global challenge and the role of Allianz 03.1.2 Our climate footprint Allianz’s Group Climate Change Strategy commits us to reach net-zero greenhouse gas (GHG) emissions by 2050 across our business in line with the 1.5°C pathway. This is translated into dedicated strategies and targets across our value chain emissions: Our business operations (scope 1, 2 and most material scope 3 emissions), our proprietary investments (scope 3 category 15 ‘financed emissions’), as well as our insurance underwriting (scope 3 category 15 ‘insurance-associated emissions’) 1 , for our business operations is even by 2030. For insurance-associated emissions the methodology is curr ently been jointly developed by the Net-Zero Insurance Alliance and Partnership for Carbon Accounting Financials. Proprietary investment portfolio carbon footprint Both our listed equity and corporate bonds portfolios have undergone considerable changes in the past three years, characterized by the economic impacts of the COVID-19 pandemic, the war in Ukraine, and the first impacts of our portfolio steering towards the climate targets. Since 2019, we achieved a reduction of absolute emissions by -35 % and are below our target of -25 % for 2024. Portfolio reallocations contributed -26 %p, overarchingly driven by intra- sector shifts to lower-emitting companies (i.e., inside utilities and manufacturing sector). Real world emission reductions by investee companies contributed -6 %p; the remaining effects can be attributed to a change in the denominator (EVIC). This shows that stronger short-term actions by investee companies on emission reductions are necessary. In 2022, we added carbon footprint figures f or parts of our real estate portfolio (direct and joint ventures), for our direct infrastructure equity portfolio (without co-investments) and for our sovereign portfolio, in total now covering 59.6 % of our investment portfolio. For further details about targets for infrastructure equity (direct) and real estate (direct/ JV), please refer to section 02.2.2. Allianz is working with the A OA to finalize the methods for sovereign bonds as next asset class. We will set targets for this asset class within 12 months after the recommended methodology is released by the AOA. Due to scope increase (+30.2) 2019 2020 2021 2022 3.7 21.2 2.2 20 2.3 16.4 1.1 29.5 0.3 15.1 24.9 22.2 18.7 16.2 0.4 46.4 Corporate bonds Proprietary investment portfolio Sovereign Listed equities Direct real estate and JVs *for FY 2022 fully allocated to Scope 3. Will be allocated to Scope 1–3 for FY 2023 in line with AOA protocol Direct infrastructure equity Operational GHG emissions (scope 1, scope 2, most material scope 3) Forthcoming (scope 3 category 15): remaining proprietary investment portfolio and insurance related emissions. 0.330.200.140.15 Scope 1 Scope 3 Scope 2 – market based -39% 334 203 139 154 Net-zero 20192020202120222030 -54% -32% +11% 42 143 149 29 101 74 29 55 55 31 30 92 Figure 2a: Allianz Group greenhouse gas emissions (mn tCO₂eq) Figure 2b: Allianz Group operational greenhouse gas emissions (ktCO₂eq) 1 As per greenhouse gas (GHG) Protocol. Allianz Group Sustainability Report 2022 92

Sustainability Report 2022 | Allianz Page 92 Page 94

Sustainability Report 2022 | Allianz Page 92 Page 94