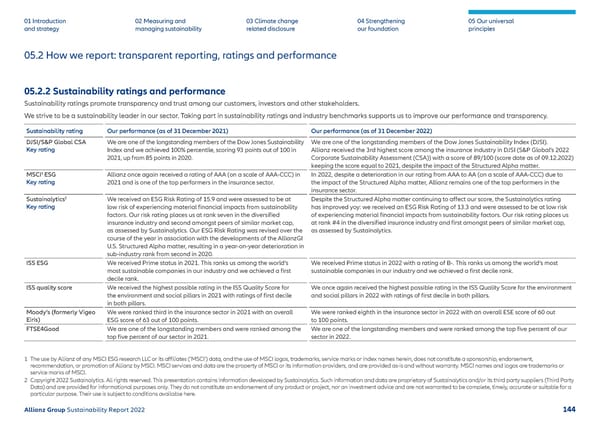

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 05.2.2 Sustainability ratings and performance Sustainability ratings promote transparency and trust among our customers, investors and other stakeholders. We strive to be a sustainability leader in our sector. Taking part in sustainability ratings and industry benchmarks supports us to improve our performance and transparency. Sustainability rating Our performance (as of 31 December 2021) Our performance (as of 31 December 2022) DJSI/S&P Global CSA Key rating We are one of the longstanding members of the Dow Jones Sustainability Index and we achieved 100% percentile, scoring 93 points out of 100 in 2021, up from 85 points in 2020. We are one of the longstanding members of the Dow Jones Sustainability Index (DJSI). Allianz received the 3rd highest score among the insurance industry in DJSI (S&P Global’s 2022 Corporate Sustainability Assessment (CSA)) with a score of 89/100 (score date as of 09.12.2022) keeping the score equal to 2021, despite the impact of the Structured Alpha matter. MSCI 1 ESG Key rating Allianz once again received a rating of AAA (on a scale of AAA-CCC) in 2021 and is one of the top performers in the insurance sector. In 2022, despite a deterioration in our rating from AAA to AA (on a scale of AAA-CCC) due to the impact of the Structured Alpha matter, Allianz remains one of the top performers in the insurance sector. Sustainalytics 2 Key rating We received an ESG Risk Rating of 15.9 and were assessed to be at low risk of experiencing material financial impacts from sustainability factors. Our risk rating places us at rank seven in the diversified insurance industry and second amongst peers of similar market cap, as assessed by Sustainalytics. Our ESG Risk Rating was revised over the course of the year in association with the developments of the AllianzGI U.S. Structured Alpha matter, resulting in a year-on-year deterioration in sub-industry rank from second in 2020. Despite the Structured Alpha matter continuing to affect our score, the Sustainalytics rating has improved yoy: we received an ESG Risk Rating of 13.3 and were assessed to be at low risk of experiencing material financial impacts from sustainability factors. Our risk rating places us at rank #4 in the diversified insurance industry and first amongst peers of similar market cap, as assessed by Sustainalytics. ISS ESG We received Prime status in 2021. This ranks us among the world’s most sustainable companies in our industry and we achieved a first decile rank. We received Prime status in 2022 with a rating of B-. This ranks us among the world’s most sustainable companies in our industry and we achieved a first decile rank. ISS quality score We received the highest possible rating in the ISS Quality Score for the environment and social pillars in 2021 with ratings of first decile in both pillars. We once again received the highest possible rating in the ISS Quality Score for the environment and social pillars in 2022 with ratings of first decile in both pillars. Moody’s (formerly Vigeo Eiris) We were ranked third in the insurance sector in 2021 with an overall ESG score of 63 out of 100 points. We were ranked eighth in the insurance sector in 2022 with an overall ESE score of 60 out to 100 points. FTSE4Good We are one of the longstanding members and were ranked among the top five percent of our sector in 2021. We are one of the longstanding members and were ranked among the top five percent of our sector in 2022. 05.2 How we report: transparent reporting, ratings and performance 1 The use by Allianz of any MSCI ESG research LLC or its affiliates (‘MSCI’) data, and the use of MSCI logos, trademarks, service marks or index names herein, does not constitute a sponsorship, endorsement, recommendation, or promotion of Allianz by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided as-is and without warranty. MSCI names and logos are trademarks or service marks of MSCI. 2 Copyright 2022 Sustainalytics. All rights reserved. This presentation contains information developed by Sustainalytics . Such information and data are proprietary of Sustainalytics and/or its third party suppliers (Third Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an investment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available here . Allianz Group Sustainability Report 2022 144

Sustainability Report 2022 | Allianz Page 144 Page 146

Sustainability Report 2022 | Allianz Page 144 Page 146