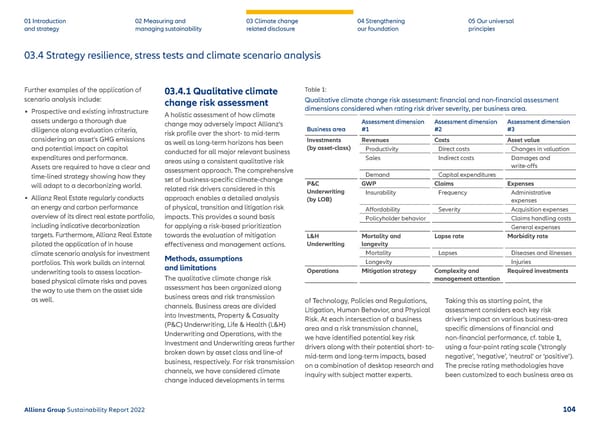

03.4 Strategy resilience, stress tests and climate scenario analysis 01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our f oundation 05 Our universal principles Further examples of the application of scenario analysis include: • Prospective and existing infrastructure assets undergo a thorough due diligence along evaluation criteria, considering an asset’s GHG emissions and potential impact on capital expenditures and performance. Assets are required to have a clear and time-lined strategy showing how they will adapt to a decarbonizing world. • Allianz Real Estate regularly conducts an energy and carbon performance overview of its direct real estate portfolio, including indicative decarbonization targets. Furthermore, Allianz Real Estate piloted the application of in house climate scenario analysis for investment portfolios. This work builds on internal underwriting tools to assess location- based physical climate risks and paves the way to use them on the asset side as well. 03.4.1 Qualitative climate change risk assessment A holistic assessment of how climate change may adversely impact Allianz’s risk profile over the short- to mid-term as well as long-term horizons has been conducted for all major relevant business areas using a consistent qualitative risk assessment approach. The comprehensive set of business-specific climate-change related risk drivers considered in this approach enables a detailed analysis of physical, transition and litigation risk impacts. This provides a sound basis for applying a risk-based prioritization towards the evaluation of mitigation effectiveness and management actions. Methods, assumptions and limitations The qualitative climate change risk assessment has been organized along business areas and risk transmission channels. Business areas are divided into Investments, Property & Casualty (P&C) Underwriting, Life & Health (L&H) Underwriting and Operations, with the Investment and Underwriting areas further broken down by asset class and line-of business, respectively. For risk transmission channels, we have considered climate change induced developments in terms of Technology, Policies and Regulations, Litigation, Human Behavior, and Physic al Risk. At each intersection of a business area and a risk transmission channel, we have identified potential key risk drivers along with their potential short- to- mid-term and long-term impacts, based on a combination of desktop research and inquiry with subject matter experts. Table 1: Qualitative climate change risk assessment: financial and non-financial assessment dimensions considered when rating risk driver severity, per business area. Business area Assessment dimension #1 Assessment dimension #2 Assessment dimension #3 Investments (by asset-class) R evenues Costs Asset value Productivity Direct costs Changes in valuation Sales Indirect costs Damages and write-offs Demand Capital e xpenditures P&C Underwriting (by LOB) GWP Claims Exp enses Insurability Frequency Administrative expenses Affor dability Severity Acquisition expenses Policyholder behavior Claims handling costs General expenses L&H Underwriting Mortality and longevity Lapse rate Morbidity r ate Mortality Lapses Diseases and illnesses Longevity Injuries Operations Mitigation strategy Complexity and management attention Required in vestments Taking this as starting point, the assessment considers each key risk driver’s impact on various business-area specific dimensions of financial and non-financial performance, cf. table 1, using a four-point rating scale (‘strongly negative’, ‘negative’, ‘neutral’ or ‘positive’). The precise rating methodologies have been customized to each business area as Allianz Group Sustainability Report 2022 104

Sustainability Report 2022 | Allianz Page 104 Page 106

Sustainability Report 2022 | Allianz Page 104 Page 106