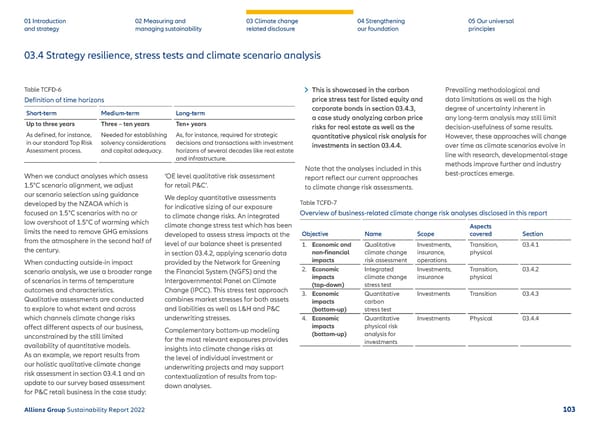

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles Table TCFD-6 Definition of time horizons Short-term Medium-term Long-term Up to three years As defined, for instance, in our standard Top Risk Assessment process. Three – ten years Needed for establishing solvency considerations and capital adequacy. Ten+ years As, for instance, required for strategic decisions and transactions with investment horizons of several decades like real estate and infrastructure. When we conduct analyses which assess 1.5°C scenario alignment, we adjust our scenario selection using guidance developed by the NZAOA which is focused on 1.5°C scenarios with no or low overshoot of 1.5°C of warming which limits the need to remove GHG emissions from the atmosphere in the second half of the century. When conducting outside-in impact scenario analysis, we use a broader range of scenarios in terms of temperature outcomes and characteristics. Qualitative assessments are conducted to explore to what extent and across which channels climate change risks affect different aspects of our business, unconstrained by the still limited availability of quantitative models. As an example, we report results from our holistic qualitative climate change risk assessment in section 03.4.1 and an update to our survey based assessment for P&C retail business in the case study: ‘OE level qualitative risk assessment for retail P&C’. We deploy quantitative assessments for indicative sizing of our exposure to climate change risks. An integrated climate change stress test which has been developed to assess stress impacts at the level of our balance sheet is presented in section 03.4.2 , applying scenario data provided by the Network for Greening the Financial System (NGFS) and the Intergovernmental Panel on Climate Change (IPCC). This stress test approach combines market stresses for both assets and liabilities as well as L&H and P&C underwriting stresses. Complementary bottom-up modeling for the most relevant exposures provides insights into climate change risks at the level of individual investment or underwriting projects and may support contextualization of results from top- down analyses. This is showcased in the carbon price stress test for listed equity and corporate bonds in section 03.4.3 , a case study analyzing carbon price risks for real estate as well as the quantitative physical risk analysis for investments in section 03.4.4 . Note that the analyses included in this report reflect our current approaches to climate change risk assessments. Prevailing methodological and data limitations as well as the high degree of uncertainty inherent in any long-term analysis may still limit decision-usefulness of some results. However, these approaches will change over time as climate scenarios evolve in line with research, developmental-stage methods improve further and industry best-practices emerge. 03.4 Strategy resilience, stress tests and climate scenario analysis Table TCFD-7 Overview of business-related climate change risk analyses disclosed in this report Objective Name Scope Aspects covered Section 1. Economic and non-financial impacts Qualitative climate change risk assessment Investments, insurance, operations Transition, physical 03.4.1 2. Economic impacts (top-down) Integrated climate change stress test Investments, insurance Transition, physical 03.4.2 3. Economic impacts (bottom-up) Quantitative carbon stress test Investments Transition 03.4.3 4. Economic impacts (bottom-up) Quantitative physical risk analysis for investments Investments Physical 03.4.4 Allianz Group Sustainability Report 2022 103

Sustainability Report 2022 | Allianz Page 103 Page 105

Sustainability Report 2022 | Allianz Page 103 Page 105