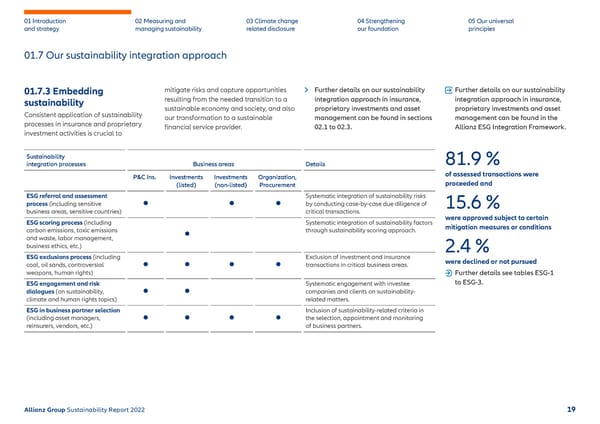

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosure 04 Strengthening our foundation 05 Our universal principles 01.7.3 Embedding sustainability Consistent application of sustainability processes in insurance and proprietary investment activities is crucial to mitigate risks and capture opportunities resulting from the needed transition to a sustainable economy and society, and also our transformation to a sustainable financial service provider. Further details on our sustainability integration approach in insurance, proprietary investments and asset management can be found in sections 02.1 to 02.3. Further details on our sustainability integration approach in insurance, proprietary investments and asset management can be found in the Allianz ESG Integration Framework. 01.7 Our sustainability integration approach Sustainability integration processes Business areas Details P&C Ins. Investments (listed) Investments (non-listed) Organization, Procurement ESG referral and assessment proc ess (including sensitive business areas, sensitive countries) Systematic integration of sustainability risks by conducting case-by-case due diligence of critical transactions. ESG scoring process (including carbon emissions, to xic emissions and waste, labor management, business ethics, etc.) Systematic integration of sustainability factors through sustainability scoring approach. ESG exclusions process (including coal , oil sands, controversial weapons, human rights) Exclusion of investment and insurance transactions in critical business areas. ESG engagement and risk dialogues (on sustainability , climate and human rights topics) Systematic engagement with investee companies and clients on sustainability- related matters. ESG in business partner selection (including asset managers, reinsurers, v endors, etc.) Inclusion of sustainability-related criteria in the selection, appointment and monitoring of business partners. 81.9 % of assessed transactions were proceeded and 15.6 % were approved subject to certain mitigation measures or conditions 2.4 % were declined or not pursued Further details see tables ESG-1 to ESG-3. 19 Allianz Group Sustainability Report 2022 > • • • • • • • • • • • • • •

Sustainability Report 2022 | Allianz Page 19 Page 21

Sustainability Report 2022 | Allianz Page 19 Page 21