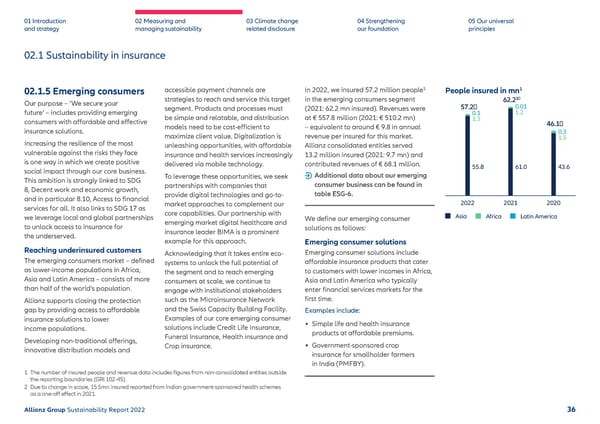

01 Introduction and strategy 02 Measuring and managing sustainability 03 Climate change related disclosur e 04 Strengthening our foundation 05 Our univ ersal principles 02.1 Sustainability in insurance 02.1.5 Emerging consumers Our purpose – ‘We secure your future’ – includes providing emerging consumers with affordable and effective insurance solutions. Increasing the resilience of the most vulnerable against the risks the y face is one way in which we create positive social impact through our core business. This ambition is strongly linked to SDG 8, Decent work and economic growth, and in particular 8.10, Access to financial services for all. It also links to SDG 17 as we leverage local and global partnerships to unlock access to insurance for the underserved. Reaching underinsured customers The emerging consumers market – defined as lower-income populations in Africa, Asia and Latin America – consists of more than half of the world’s population. Allianz supports closing the protection gap by pr oviding access to affordable insurance solutions to lower income populations. Developing non-traditional offerings, innov ative distribution models and Asia Latin America Africa 57.2 62.2 2 46.1 2022 55.8 1.3 0.1 61.0 1.2 0.01 43.6 1.5 0.3 2021 2020 accessible payment channels are strategies to reach and service this target segment. Products and processes must be simple and relatable, and distribution models need to be cost-efficient to maximize client value. Digitalization is unleashing opportunities, with affordable insurance and health services increasingly delivered via mobile technology. To leverage these opportunities, we seek par tnerships with companies that provide digital technologies and go-to- market approaches to complement our core capabilities. Our partnership with emerging market digital healthcare and insurance leader BIMA is a prominent example for this approach. Acknowledging that it takes entire eco- sy stems to unlock the full potential of the segment and to reach emerging consumers at scale, we continue to engage with institutional stakeholders such as the Microinsurance Network and the Swiss Capacity Building Facility. Examples of our core emerging consumer solutions include Credit Life Insurance, Funeral Insurance, Health insurance and Crop insurance. In 2022, we insured 57.2 million people 1 in the emerging consumers segment (2021: 62.2 mn insured). Revenues were at € 557.8 million (2021: € 510.2 mn) – equivalent to around € 9.8 in annual revenue per insured for this market. Allianz consolidated entities served 13.2 million insured (2021: 9.7 mn) and contributed revenues of € 68.1 million. Additional data about our emerging consumer business can be found in table ESG-6. We define our emerging consumer solutions as follows: Emerging consumer solutions Emerging consumer solutions include affordable insurance products that cater to customers with lower incomes in Africa, Asia and Latin America who typically enter financial services markets for the first time. Examples include: • Simple life and health insurance products at affordable premiums. • Government-sponsored crop insurance for smallholder farmers in India (PMFBY). People insured in mn 1 1 The number of insured people and revenue data includes figures from non-consolidated entities outside the rep orting boundaries (GRI 102-45). 2 Due to change in scope, 15.5mn insured reported from Indian government-sponsored health schemes as a one-off eff ect in 2021. Allianz Group Sustainability Report 2022 36

Sustainability Report 2022 | Allianz Page 36 Page 38

Sustainability Report 2022 | Allianz Page 36 Page 38