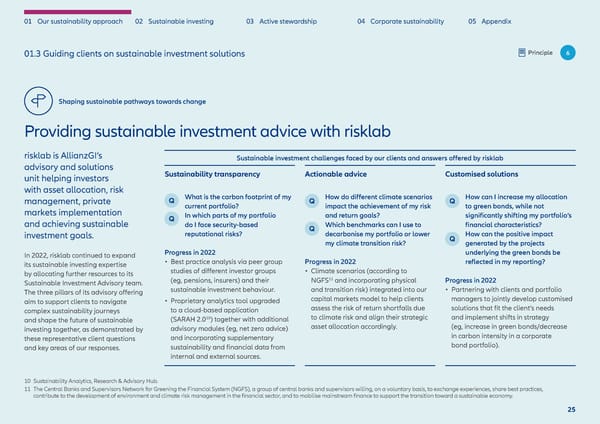

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 Shaping sustainable pathways towards change Providing sustainable investment advice with risklab risklab is AllianzGI’s Sustainable investment challenges faced by our clients and answers offered by risklab advisory and solutions Sustainability transparency Actionable advice Customised solutions unit helping investors with asset allocation, risk management, private What is the carbon footprint of my How do different climate scenarios How can I increase my allocation markets implementation current portfolio? impact the achievement of my risk to green bonds, while not In which parts of my portfolio and return goals? significantly shifting my portfolio’s and achieving sustainable do I face security-based Which benchmarks can I use to financial characteristics? investment goals. reputational risks? decarbonise my portfolio or lower How can the positive impact my climate transition risk? generated by the projects In 2022, risklab continued to expand Progress in 2022 underlying the green bonds be its sustainable investing expertise • Best practice analysis via peer group Progress in 2022 reflected in my reporting? by allocating further resources to its studies of different investor groups • Climate scenarios (according to Sustainable Investment Advisory team. (eg, pensions, insurers) and their NGFS11 and incorporating physical Progress in 2022 The three pillars of its advisory offering sustainable investment behaviour. and transition risk) integrated into our • Partnering with clients and portfolio aim to support clients to navigate • Proprietary analytics tool upgraded capital markets model to help clients managers to jointly develop customised complex sustainability journeys to a cloud-based application assess the risk of return shortfalls due solutions that fit the client’s needs and shape the future of sustainable (SARAH 2.010) together with additional to climate risk and align their strategic and implement shifts in strategy investing together, as demonstrated by advisory modules (eg, net zero advice) asset allocation accordingly. (eg, increase in green bonds/decrease these representative client questions and incorporating supplementary in carbon intensity in a corporate and key areas of our responses. sustainability and financial data from bond portfolio). internal and external sources. 10 Sustainability Analytics, Research & Advisory Hub. 11 The Central Banks and Supervisors Network for Greening the Financial System (NGFS), a group of central banks and supervisors willing, on a voluntary basis, to exchange experiences, share best practices, contribute to the development of environment and climate risk management in the financial sector, and to mobilise mainstream finance to support the transition toward a sustainable economy. 25

Sustainability & Stewardship Report | AllianzGI Page 25 Page 27

Sustainability & Stewardship Report | AllianzGI Page 25 Page 27