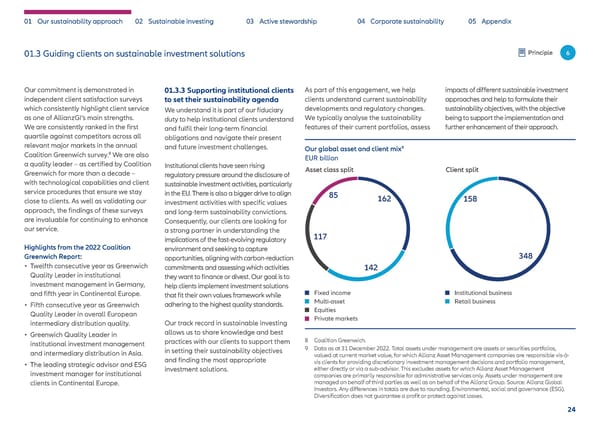

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 01.3 Guiding clients on sustainable investment solutions Principle 6 Our commitment is demonstrated in 01.3.3 Supporting institutional clients As part of this engagement, we help impacts of different sustainable investment independent client satisfaction surveys to set their sustainability agenda clients understand current sustainability approaches and help to formulate their which consistently highlight client service We understand it is part of our fiduciary developments and regulatory changes. sustainability objectives, with the objective as one of AllianzGI’s main strengths. duty to help institutional clients understand We typically analyse the sustainability being to support the implementation and We are consistently ranked in the first and fulfil their long-term financial features of their current portfolios, assess further enhancement of their approach. quartile against competitors across all obligations and navigate their present relevant major markets in the annual and future investment challenges. 9 Coalition Greenwich survey.8 We are also Our global asset and client mix a quality leader – as certified by Coalition EUR billion Institutional clients have seen rising Asset class split Client split Greenwich for more than a decade – regulatory pressure around the disclosure of with technological capabilities and client sustainable investment activities, particularly service procedures that ensure we stay in the EU. There is also a bigger drive to align 85 162 158 close to clients. As well as validating our investment activities with specific values approach, the findings of these surveys and long-term sustainability convictions. are invaluable for continuing to enhance Consequently, our clients are looking for our service. a strong partner in understanding the implications of the fast-evolving regulatory 117 Highlights from the 2022 Coalition environment and seeking to capture Greenwich Report: opportunities, aligning with carbon-reduction 348 • Twelfth consecutive year as Greenwich commitments and assessing which activities 142 Quality Leader in institutional they want to finance or divest. Our goal is to investment management in Germany, help clients implement investment solutions and fifth year in Continental Europe. that fit their own values framework while Fixed income Institutional business • Fifth consecutive year as Greenwich adhering to the highest quality standards. Multi-asset Retail business Quality Leader in overall European Equities intermediary distribution quality. Our track record in sustainable investing Private markets • Greenwich Quality Leader in allows us to share knowledge and best institutional investment management practices with our clients to support them 8 Coalition Greenwich. and intermediary distribution in Asia. in setting their sustainability objectives 9 Data as at 31 December 2022. Total assets under management are assets or securities portfolios, and finding the most appropriate valued at current market value, for which Allianz Asset Management companies are responsible vis-à- • The leading strategic advisor and ESG vis clients for providing discretionary investment management decisions and portfolio management, investment manager for institutional investment solutions. either directly or via a sub-advisor. This excludes assets for which Allianz Asset Management companies are primarily responsible for administrative services only. Assets under management are clients in Continental Europe. managed on behalf of third parties as well as on behalf of the Allianz Group. Source: Allianz Global Investors. Any differences in totals are due to rounding. Environmental, social and governance (ESG). Diversification does not guarantee a profit or protect against losses. 24

Sustainability & Stewardship Report | AllianzGI Page 24 Page 26

Sustainability & Stewardship Report | AllianzGI Page 24 Page 26