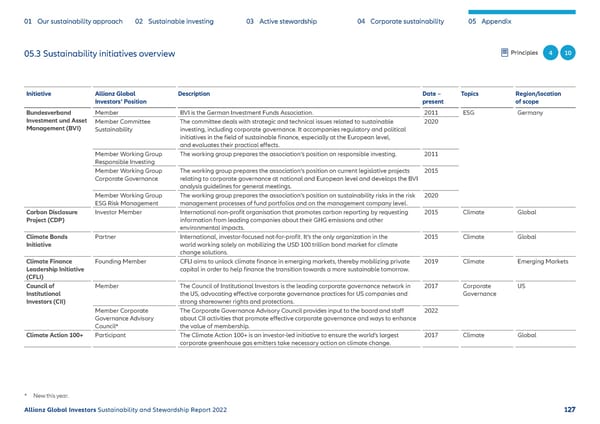

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 05.3 Sustainability initiatives overview Principles 4 10 Initiative Allianz Global Description Date – Topics Region/location Investors‘ Position present of scope Bundesverband Member BVI is the German Investment Funds Association. 2011 ESG Germany Investment und Asset Member Committee The committee deals with strategic and technical issues related to sustainable 2020 Management (BVI) Sustainability investing, including corporate governance. It accompanies regulatory and political initiatives in the field of sustainable finance, especially at the European level, and evaluates their practical effects. Member Working Group The working group prepares the association’s position on responsible investing. 2011 Responsible Investing Member Working Group The working group prepares the association’s position on current legislative projects 2015 Corporate Governance relating to corporate governance at national and European level and develops the BVI analysis guidelines for general meetings. Member Working Group The working group prepares the association’s position on sustainability risks in the risk 2020 ESG Risk Management management processes of fund portfolios and on the management company level. Carbon Disclosure Investor Member International non-profit organisation that promotes carbon reporting by requesting 2015 Climate Global Project (CDP) information from leading companies about their GHG emissions and other environmental impacts. Climate Bonds Partner International, investor-focused not-for-profit. It’s the only organization in the 2015 Climate Global Initiative world working solely on mobilizing the USD 100 trillion bond market for climate change solutions. Climate Finance Founding Member CFLI aims to unlock climate finance in emerging markets, thereby mobilizing private 2019 Climate Emerging Markets Leadership Initiative capital in order to help finance the transition towards a more sustainable tomorrow. (CFLI) Council of Member The Council of Institutional Investors is the leading corporate governance network in 2017 Corporate US Institutional the US, advocating effective corporate governance practices for US companies and Governance Investors (CII) strong shareowner rights and protections. Member Corporate The Corporate Governance Advisory Council provides input to the board and staff 2022 Governance Advisory about CII activities that promote effective corporate governance and ways to enhance Council* the value of membership. Climate Action 100+ Participant The Climate Action 100+ is an investor-led initiative to ensure the world’s largest 2017 Climate Global corporate greenhouse gas emitters take necessary action on climate change. * New this year. Allianz Global Investors Sustainability and Stewardship Report 2022 127

Sustainability & Stewardship Report | AllianzGI Page 127 Page 129

Sustainability & Stewardship Report | AllianzGI Page 127 Page 129