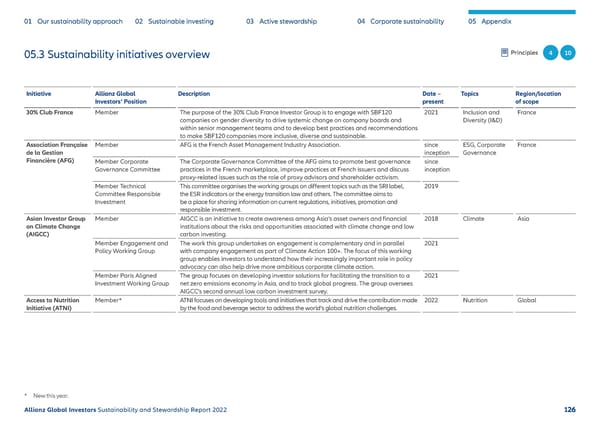

01 Our sustainability approach 02 Sustainable investing 03 Active stewardship 04 Corporate sustainability 05 Appendix 05.3 Sustainability initiatives overview Principles 4 10 Initiative Allianz Global Description Date – Topics Region/location Investors‘ Position present of scope 30% Club France Member The purpose of the 30% Club France Investor Group is to engage with SBF120 2021 Inclusion and France companies on gender diversity to drive systemic change on company boards and Diversity (I&D) within senior management teams and to develop best practices and recommendations to make SBF120 companies more inclusive, diverse and sustainable. Association Française Member AFG is the French Asset Management Industry Association. since ESG, Corporate France de la Gestion inception Governance Financière (AFG) Member Corporate The Corporate Governance Committee of the AFG aims to promote best governance since Governance Committee practices in the French marketplace, improve practices at French issuers and discuss inception proxy-related issues such as the role of proxy advisors and shareholder activism. Member Technical This committee organises the working groups on different topics such as the SRI label, 2019 Committee Responsible the ESR indicators or the energy transition law and others. The committee aims to Investment be a place for sharing information on current regulations, initiatives, promotion and responsible investment. Asian Investor Group Member AIGCC is an initiative to create awareness among Asia’s asset owners and financial 2018 Climate Asia on Climate Change institutions about the risks and opportunities associated with climate change and low (AIGCC) carbon investing. Member Engagement and The work this group undertakes on engagement is complementary and in parallel 2021 Policy Working Group with company engagement as part of Climate Action 100+. The focus of this working group enables investors to understand how their increasingly important role in policy advocacy can also help drive more ambitious corporate climate action. Member Paris Aligned The group focuses on developing investor solutions for facilitating the transition to a 2021 Investment Working Group net zero emissions economy in Asia, and to track global progress. The group oversees AIGCC’s second annual low carbon investment survey. Access to Nutrition Member* ATNI focuses on developing tools and initiatives that track and drive the contribution made 2022 Nutrition Global Initiative (ATNI) by the food and beverage sector to address the world’s global nutrition challenges. * New this year. Allianz Global Investors Sustainability and Stewardship Report 2022 126

Sustainability & Stewardship Report | AllianzGI Page 126 Page 128

Sustainability & Stewardship Report | AllianzGI Page 126 Page 128