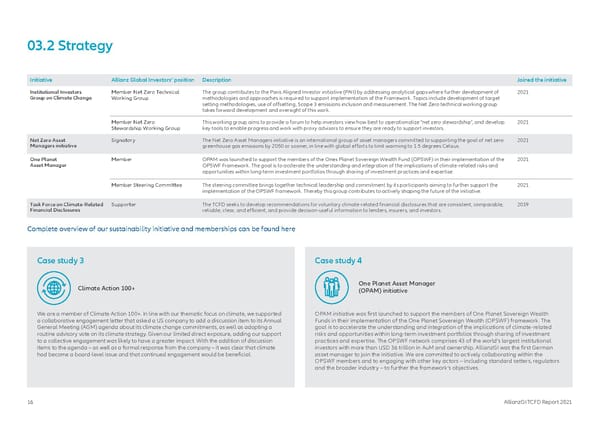

03.2 Strategy Initiative Allianz Global Investors‘ position Description Joined the initiative Institutional Investors Member Net Zero Technical The group contributes to the Paris Aligned Investor initiative (PAII) by addressing analytical gaps where further development of 2021 Group on Climate Change Working Group methodologies and approaches is required to support implementation of the Framework. Topics include development of target setting methodologies, use of offsetting, Scope 3 emissions inclusion and measurement. The Net Zero technical working group takes forward development and oversight of this work. Member Net Zero This working group aims to provide a forum to help investors view how best to operationalize “net zero stewardship”, and develop 2021 Stewardship Working Group key tools to enable progress and work with proxy advisors to ensure they are ready to support investors. Net Zero Asset Signatory The Net Zero Asset Managers initiative is an international group of asset managers committed to supporting the goal of net zero 2021 Managers initiative greenhouse gas emissions by 2050 or sooner, in line with global efforts to limit warming to 1.5 degrees Celsius. One Planet Member OPAM was launched to support the members of the Ones Planet Sovereign Wealth Fund (OPSWF) in their implementation of the 2021 Asset Manager OPSWF Framework. The goal is to acclerate the understanding and integration of the implications of climate-related risks and opportunities within long-term investment portfolios through sharing of investment practices and expertise. Member Steering Committee The steering committee brings together technical leadership and commitment by its participants aiming to further support the 2021 implementation of the OPSWF framework. Thereby this group contributes to actively shaping the future of the initiative. Task Force on Climate-Related Supporter The TCFD seeks to develop recommendations for voluntary climate-related financial disclosures that are consistent, comparable, 2019 Financial Disclosures reliable, clear, and efficient, and provide decision-useful information to lenders, insurers, and investors. Complete overview of our sustainability initiative and memberships can be found here Case study 3 Case study 4 Climate Action 100+ One Planet Asset Manager (OPAM) initiative We are a member of Climate Action 100+. In line with our thematic focus on climate, we supported OPAM initiative was first launched to support the members of One Planet Sovereign Wealth a collaborative engagement letter that asked a US company to add a discussion item to its Annual Funds in their implementation of the One Planet Sovereign Wealth (OPSWF) framework. The General Meeting (AGM) agenda about its climate change commitments, as well as adopting a goal is to accelerate the understanding and integration of the implications of climate-related routine advisory vote on its climate strategy. Given our limited direct exposure, adding our support risks and opportunities within long-term investment portfolios through sharing of investment to a collective engagement was likely to have a greater impact. With the addition of discussion practices and expertise. The OPSWF network comprises 43 of the world’s largest institutional items to the agenda – as well as a formal response from the company – it was clear that climate investors with more than USD 36 trillion in AuM and ownership. AllianzGI was the first German had become a board-level issue and that continued engagement would be beneficial. asset manager to join the initiative. We are committed to actively collaborating within the OPSWF members and to engaging with other key actors – including standard setters, regulators and the broader industry – to further the framework’s objectives. 16 AllianzGI TCFD Report 2021

TCFD Report Page 15 Page 17

TCFD Report Page 15 Page 17