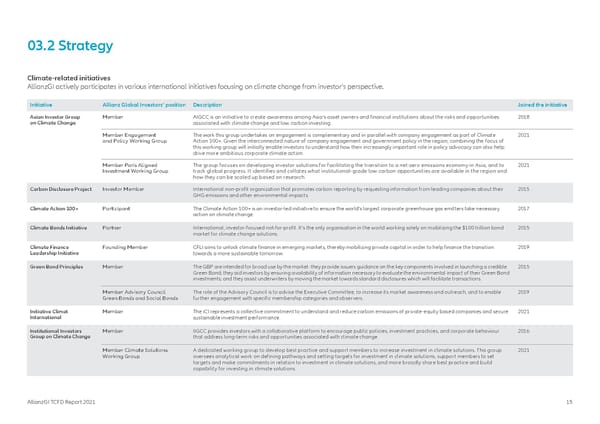

03.2 Strategy Climate-related initiatives AllianzGI actively participates in various international initiatives focusing on climate change from investor’s perspective. Initiative Allianz Global Investors‘ position Description Joined the initiative Asian Investor Group Member AIGCC is an initiative to create awareness among Asia’s asset owners and financial institutions about the risks and opportunities 2018 on Climate Change associated with climate change and low carbon investing. Member Engagement The work this group undertakes on engagement is complementary and in parallel with company engagement as part of Climate 2021 and Policy Working Group Action 100+. Given the interconnected nature of company engagement and government policy in the region, combining the focus of this working group will initially enable investors to understand how their increasingly important role in policy advocacy can also help drive more ambitious corporate climate action. Member Paris Aligned The group focuses on developing investor solutions for facilitating the transition to a net-zero emissions economy in Asia, and to 2021 Investment Working Group track global progress. It identifies and collates what institutional-grade low carbon opportunities are available in the region and how they can be scaled up based on research. Carbon Disclosure Project Investor Member International non-profit organization that promotes carbon reporting by requesting information from leading companies about their 2015 GHG emissions and other environmental impacts. Climate Action 100+ Participant The Climate Action 100+ is an investor-led initiative to ensure the world's largest corporate greenhouse gas emitters take necessary 2017 action on climate change. Climate Bonds Initiative Partner International, investor-focused not-for-profit. It's the only organisation in the world working solely on mobilizing the $100 trillion bond 2015 market for climate change solutions. Climate Finance Founding Member CFLI aims to unlock climate finance in emerging markets, thereby mobilizing private capital in order to help finance the transition 2019 Leadership Initiative towards a more sustainable tomorrow. Green Bond Principles Member The GBP are intended for broad use by the market: they provide issuers guidance on the key components involved in launching a credible 2015 Green Bond; they aid investors by ensuring availability of information necessary to evaluate the environmental impact of their Green Bond investments; and they assist underwriters by moving the market towards standard disclosures which will facilitate transactions. Member Advisory Council The role of the Advisory Council is to advise the Executive Committee, to increase its market awareness and outreach, and to enable 2019 Green Bonds and Social Bonds further engagement with specific membership categories and observers. Initiative Climat Member The iCI represents a collective commitment to understand and reduce carbon emissions of private-equity based companies and secure 2021 International sustainable investment performance. Institutional Investors Member IIGCC provides investors with a collaborative platform to encourage public policies, investment practices, and corporate behaviour 2016 Group on Climate Change that address long-term risks and opportunities associated with climate change. Member Climate Solutions A dedicated working group to develop best practice and support members to increase investment in climate solutions. This group 2021 Working Group oversees analytical work on defining pathways and setting targets for investment in climate solutions, support members to set targets and make commitments in relation to investment in climate solutions, and more broadly share best practice and build capability for investing in climate solutions. AllianzGI TCFD Report 2021 15

TCFD Report Page 14 Page 16

TCFD Report Page 14 Page 16