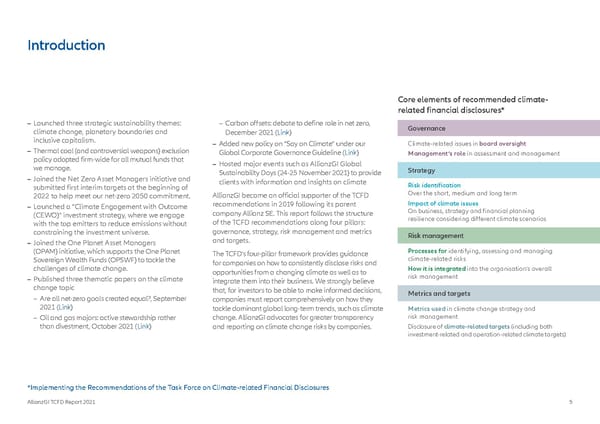

Introduction Core elements of recommended climate- related financial disclosures* – Launched three strategic sustainability themes: – Carbon offsets: debate to define role in net zero, Governance climate change, planetary boundaries and December 2021 (Link) inclusive capitalism. – Added new policy on “Say on Climate” under our Climate-related issues in board oversight – Thermal coal (and controversial weapons) exclusion Global Corporate Governance Guideline (Link) Management’s role in assessment and management policy adopted firm-wide for all mutual funds that – Hosted major events such as AllianzGI Global we manage. Sustainability Days (24-25 November 2021) to provide Strategy – Joined the Net Zero Asset Managers initiative and clients with information and insights on climate submitted first interim targets at the beginning of Risk identification 2022 to help meet our net-zero 2050 commitment. AllianzGI became an official supporter of the TCFD Over the short, medium and long term – Launched a “Climate Engagement with Outcome recommendations in 2019 following its parent Impact of climate issues (CEWO)” investment strategy, where we engage company Allianz SE. This report follows the structure On business, strategy and financial planning with the top emitters to reduce emissions without of the TCFD recommendations along four pillars: resilience considering different climate scenarios constraining the investment universe. governance, strategy, risk management and metrics Risk management – Joined the One Planet Asset Managers and targets. (OPAM) initiative, which supports the One Planet The TCFD’s four-pillar framework provides guidance Processes for identifying, assessing and managing Sovereign Wealth Funds (OPSWF) to tackle the for companies on how to consistently disclose risks and climate-related risks challenges of climate change. opportunities from a changing climate as well as to How it is integrated into the organisation’s overall – Published three thematic papers on the climate integrate them into their business. We strongly believe risk management change topic that, for investors to be able to make informed decisions, Metrics and targets – Are all net-zero goals created equal?, September companies must report comprehensively on how they 2021 (Link) tackle dominant global long-term trends, such as climate Metrics used in climate change strategy and – Oil and gas majors: active stewardship rather change. AllianzGI advocates for greater transparency risk management than divestment, October 2021 (Link) and reporting on climate change risks by companies. Disclosure of climate-related targets (including both investment-related and operation-related climate targets) *Implementing the Recommendations of the Task Force on Climate-related Financial Disclosures AllianzGI TCFD Report 2021 5

TCFD Report Page 4 Page 6

TCFD Report Page 4 Page 6