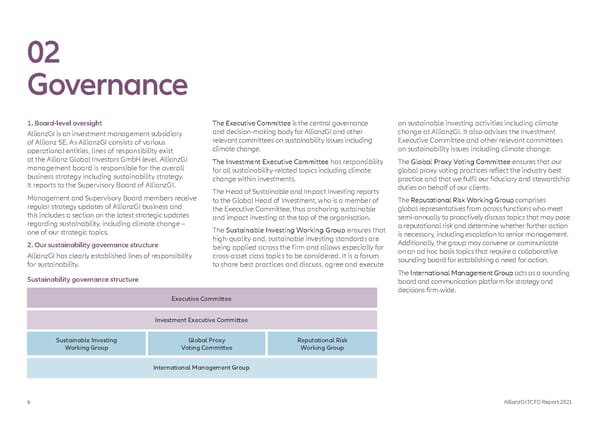

02 Governance 1. Board-level oversight The Executive Committee is the central governance on sustainable investing activities including climate AllianzGI is an investment management subsidiary and decision-making body for AllianzGI and other change at AllianzGI. It also advises the Investment of Allianz SE. As AllianzGI consists of various relevant committees on sustainability issues including Executive Committee and other relevant committees operational entities, lines of responsibility exist climate change. on sustainability issues including climate change. at the Allianz Global Investors GmbH level. AllianzGI The Investment Executive Committee has responsibility The Global Proxy Voting Committee ensures that our management board is responsible for the overall for all sustainability-related topics including climate global proxy voting practices reflect the industry best business strategy including sustainability strategy. change within investments. practice and that we fulfil our fiduciary and stewardship It reports to the Supervisory Board of AllianzGI. duties on behalf of our clients. Management and Supervisory Board members receive The Head of Sustainable and Impact Investing reports to the Global Head of Investment, who is a member of The Reputational Risk Working Group comprises regular strategy updates of AllianzGI business and the Executive Committee, thus anchoring sustainable global representatives from across functions who meet this includes a section on the latest strategic updates and impact investing at the top of the organisation. semi-annually to proactively discuss topics that may pose regarding sustainability, including climate change – a reputational risk and determine whether further action one of our strategic topics. The Sustainable Investing Working Group ensures that is necessary, including escalation to senior management. 2. Our sustainability governance structure high-quality and, sustainable investing standards are Additionally, the group may convene or communicate being applied across the firm and allows especially for on an ad hoc basis topics that require a collaborative AllianzGI has clearly established lines of responsibility cross-asset class topics to be considered. It is a forum sounding board for establishing a need for action. for sustainability. to share best practices and discuss, agree and execute The International Management Group acts as a sounding Sustainability governance structure board and communication platform for strategy and decisions firm-wide. Executive Committee Investment Executive Committee Sustainable Investing Global Proxy Reputational Risk Working Group Voting Committee Working Group International Management Group 6 AllianzGI TCFD Report 2021

TCFD Report Page 5 Page 7

TCFD Report Page 5 Page 7