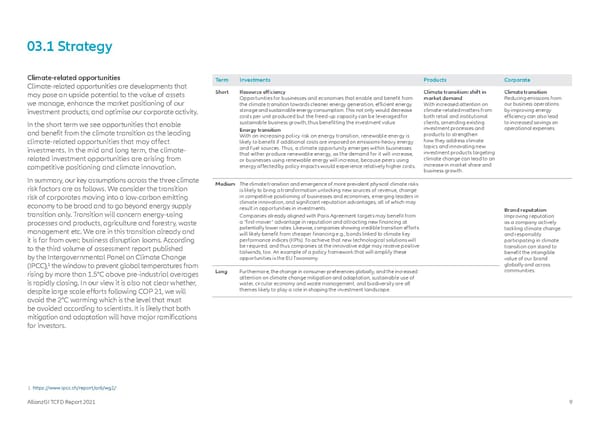

03.1 Strategy Climate-related opportunities Term Investments Products Corporate Climate-related opportunities are developments that may pose an upside potential to the value of assets Short Resource efficiency Climate transition: shift in Climate transition we manage, enhance the market positioning of our Opportunities for businesses and economies that enable and benefit from market demand Reducing emissions from the climate transition towards cleaner energy generation, efficient energy With increased attention on our business operations investment products, and optimise our corporate activity. storage and sustainable energy consumption. This not only would decrease climate-related matters from by improving energy costs per unit produced but the freed-up capacity can be leveraged for both retail and institutional efficiency can also lead In the short term we see opportunities that enable sustainable business growth, thus benefitting the investment value. clients, amending existing to increased savings on and benefit from the climate transition as the leading Energy transition investment processes and operational expenses. With an increasing policy risk on energy transition, renewable energy is products to strengthen climate-related opportunities that may affect likely to benefit if additional costs are imposed on emissions-heavy energy how they address climate investments. In the mid and long term, the climate- and fuel sources. Thus, a climate opportunity emerges within businesses topics and innovating new that either produce renewable energy, as the demand for it will increase, investment products targeting related investment opportunities are arising from or businesses using renewable energy will increase, because peers using climate change can lead to an competitive positioning and climate innovation. energy affected by policy impacts would experience relatively higher costs. increase in market share and business growth. In summary, our key assumptions across the three climate Medium The climate transition and emergence of more prevalent physical climate risks risk factors are as follows. We consider the transition is likely to bring a transformation unlocking new sources of revenue, change risk of corporates moving into a low-carbon emitting in competitive positioning of businesses and economies, emerging leaders in economy to be broad and to go beyond energy supply climate innovation, and significant reputation advantages, all of which may result in opportunities in investments. Brand reputation transition only. Transition will concern energy-using Companies already aligned with Paris Agreement targets may benefit from Improving reputation processes and products, agriculture and forestry, waste a “first-mover” advantage in reputation and attracting new financing at as a company actively management etc. We are in this transition already and potentially lower rates. Likewise, companies showing credible transition efforts tackling climate change will likely benefit from cheaper financing e.g., bonds linked to climate key and responsibly it is far from over; business disruption looms. According performance indices (KPIs). To achieve that new technological solutions will participating in climate to the third volume of assessment report published be required, and thus companies at the innovative edge may receive positive transition can stand to by the Intergovernmental Panel on Climate Change tailwinds, too. An example of a policy framework that will amplify these benefit the intangible opportunities is the EU Taxonomy. value of our brand 1 globally and across (IPCC), the window to prevent global temperatures from communities. rising by more than 1.5°C above pre-industrial averages Long Furthermore, the change in consumer preferences globally, and the increased is rapidly closing. In our view it is also not clear whether, attention on climate change mitigation and adaptation, sustainable use of water, circular economy and waste management, and biodiversity are all despite large scale efforts following COP 21, we will themes likely to play a role in shaping the investment landscape. avoid the 2°C warming which is the level that must be avoided according to scientists. It is likely that both mitigation and adaptation will have major ramifications for investors. 1. https://www.ipcc.ch/report/ar6/wg2/ AllianzGI TCFD Report 2021 9

TCFD Report Page 8 Page 10

TCFD Report Page 8 Page 10