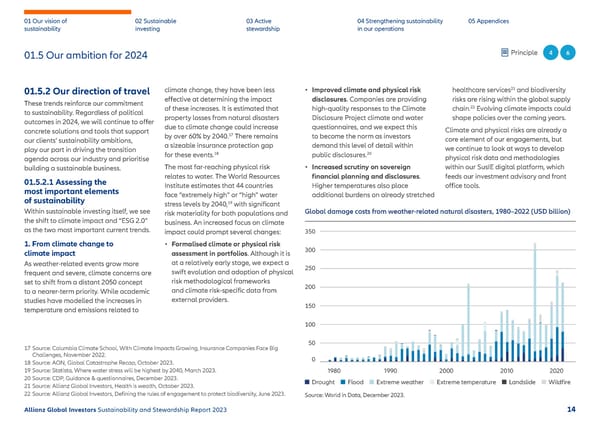

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 01.5 Our ambition for 2024 Principle 4 6 • Improved climate and physical risk 21 and biodiversity 01.5.2 Our direction of travel climate change, they have been less healthcare services These trends reinforce our commitment e昀昀ective at determining the impact disclosures. Companies are providing risks are rising within the global supply of these increases. It is estimated that high-quality responses to the Climate chain.22 Evolving climate impacts could to sustainability. Regardless of political property losses from natural disasters Disclosure Project climate and water shape policies over the coming years. outcomes in 2024, we will continue to o昀昀er due to climate change could increase questionnaires, and we expect this concrete solutions and tools that support Climate and physical risks are already a by over 60% by 2040.17 There remains to become the norm as investors core element of our engagements, but our clients’ sustainability ambitions, a sizeable insurance protection gap demand this level of detail within play our part in driving the transition we continue to look at ways to develop 18 20 agenda across our industry and prioritise for these events. public disclosures. physical risk data and methodologies building a sustainable business. The most far-reaching physical risk • Increased scrutiny on sovereign within our SusIE digital platform, which 01.5.2.1 Assessing the relates to water. The World Resources financial planning and disclosures. feeds our investment advisory and front most important elements Institute estimates that 44 countries Higher temperatures also place o昀케ce tools. of sustainability face “extremely high” or “high” water additional burdens on already stretched 19 stress levels by 2040, with signi昀椀cant Within sustainable investing itself, we see risk materiality for both populations and Global damage costs from weather-related natural disasters, 1980–2022 (USD billion) the shift to climate impact and “ESG 2.0” business. An increased focus on climate as the two most important current trends. impact could prompt several changes: 350 1. From climate change to • Formalised climate or physical risk 300 climate impact assessment in portfolios. Although it is As weather-related events grow more at a relatively early stage, we expect a 250 frequent and severe, climate concerns are swift evolution and adoption of physical set to shift from a distant 2050 concept risk methodological frameworks 200 to a nearer-term priority. While academic and climate risk-specific data from studies have modelled the increases in external providers. temperature and emissions related to 150 100 17 Source: Columbia Climate School, With Climate Impacts Growing, Insurance Companies Face Big 50 Challenges, November 2022. 0 18 Source: AON, Global Catastrophe Recap, October 2023. 19 Source: Statista, Where water stress will be highest by 2040, March 2023. 980 990 2000 20 0 2020 20 Source: CDP, Guidance & questionnaires, December 2023. Drought Flood Extreme weather Extreme temperature Landslide Wildfire 21 Source: Allianz Global Investors, Health is wealth, October 2023. 22 Source: Allianz Global Investors, De昀椀ning the rules of engagement to protect biodiversity, June 2023. Source: World in Data, December 2023. Allianz Global Investors Sustainability and Stewardship Report 2023 14

2023 | Sustainability Report Page 14 Page 16

2023 | Sustainability Report Page 14 Page 16