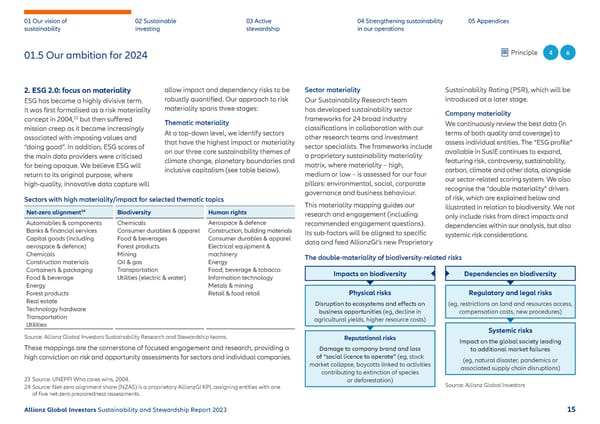

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 01.5 Our ambition for 2024 Principle 4 6 2. ESG 2.0: focus on materiality allow impact and dependency risks to be Sector materiality Sustainability Rating (PSR), which will be ESG has become a highly divisive term. robustly quanti昀椀ed. Our approach to risk Our Sustainability Research team introduced at a later stage. It was 昀椀rst formalised as a risk materiality materiality spans three stages: has developed sustainability sector Company materiality 23 frameworks for 24 broad industry concept in 2004, but then su昀昀ered Thematic materiality We continuously review the best data (in mission creep as it became increasingly At a top-down level, we identify sectors classi昀椀cations in collaboration with our terms of both quality and coverage) to associated with imposing values and that have the highest impact or materiality other research teams and investment assess individual entities. The “ESG pro昀椀le” “doing good”. In addition, ESG scores of on our three core sustainability themes of sector specialists. The frameworks include available in SusIE continues to expand, the main data providers were criticised climate change, planetary boundaries and a proprietary sustainability materiality featuring risk, controversy, sustainability, for being opaque. We believe ESG will inclusive capitalism (see table below). matrix, where materiality – high, carbon, climate and other data, alongside return to its original purpose, where medium or low – is assessed for our four our sector-related scoring system. We also high-quality, innovative data capture will pillars: environmental, social, corporate recognise the “double materiality” drivers governance and business behaviour. of risk, which are explained below and Sectors with high materiality/impact for selected thematic topics This materiality mapping guides our 24 illustrated in relation to biodiversity. We not Net-zero alignment Biodiversity Human rights research and engagement (including only include risks from direct impacts and Automobiles & components Chemicals Aerospace & defence recommended engagement questions). dependencies within our analysis, but also Banks & 昀椀nancial services Consumer durables & apparel Construction, building materials Its sub-factors will be aligned to speci昀椀c systemic risk considerations. Capital goods (including Food & beverages Consumer durables & apparel data and feed AllianzGI’s new Proprietary aerospace & defence) Forest products Electrical equipment & Chemicals Mining machinery The double-materiality of biodiversity-related risks Construction materials Oil & gas Energy Containers & packaging Transportation Food, beverage & tobacco Impacts on biodiversity Dependencies on biodiversity Food & beverage Utilities (electric & water) Information technology Energy Metals & mining Forest products Retail & food retail Physical risks Regulatory and legal risks Real estate Disruption to ecosystems and e昀昀ects on (eg, restrictions on land and resources access, Technology hardware business opportunities (eg, decline in compensation costs, new procedures) Transportation agricultural yields, higher resource costs) Utilities Systemic risks Source: Allianz Global Investors Sustainability Research and Stewardship teams. Reputational risks Impact on the global society leading These mappings are the cornerstone of focused engagement and research, providing a Damage to company brand and loss to additional market failures high conviction on risk and opportunity assessments for sectors and individual companies. of “social licence to operate” (eg, stock (eg, natural disaster, pandemics or market collapse, boycotts linked to activities associated supply chain disruptions) contributing to extinction of species 23 Source: UNEPFI Who cares wins, 2004. or deforestation) 24 Source: Net-zero alignment share (NZAS) is a proprietary AllianzGI KPI, assigning entities with one Source: Allianz Global Investors of 昀椀ve net-zero preparedness assessments. Allianz Global Investors Sustainability and Stewardship Report 2023 15

2023 | Sustainability Report Page 15 Page 17

2023 | Sustainability Report Page 15 Page 17