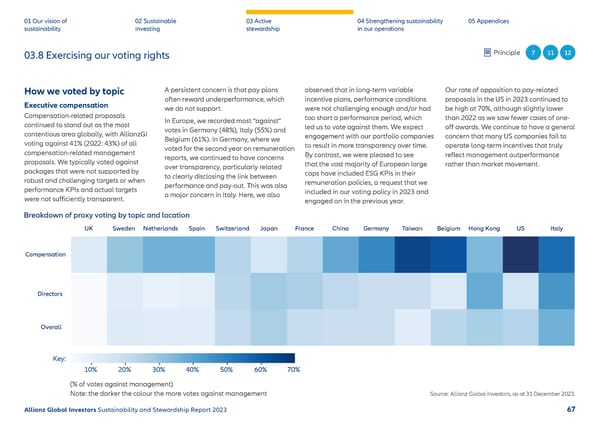

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 03.8 Exercising our voting rights Principle 7 11 12 How we voted by topic A persistent concern is that pay plans observed that in long-term variable Our rate of opposition to pay-related Executive compensation often reward underperformance, which incentive plans, performance conditions proposals in the US in 2023 continued to we do not support. were not challenging enough and/or had be high at 70%, although slightly lower Compensation-related proposals In Europe, we recorded most “against” too short a performance period, which than 2022 as we saw fewer cases of one- continued to stand out as the most votes in Germany (48%), Italy (55%) and led us to vote against them. We expect o昀昀 awards. We continue to have a general contentious area globally, with AllianzGI Belgium (61%). In Germany, where we engagement with our portfolio companies concern that many US companies fail to voting against 41% (2022: 43%) of all voted for the second year on remuneration to result in more transparency over time. operate long-term incentives that truly compensation-related management reports, we continued to have concerns By contrast, we were pleased to see re昀氀ect management outperformance proposals. We typically voted against over transparency, particularly related that the vast majority of European large rather than market movement. packages that were not supported by to clearly disclosing the link between caps have included ESG KPIs in their robust and challenging targets or when performance and pay-out. This was also remuneration policies, a request that we performance KPIs and actual targets a major concern in Italy. Here, we also included in our voting policy in 2023 and were not su昀케ciently transparent. engaged on in the previous year. Breakdown of proxy voting by topic and location UK Sweden Netherlands Spain Switzerland Japan France China Germany Taiwan Belgium Hong Kong US Italy Compensation Directors Overall Key: 10% 20% 30% 40% 50% 60% 70% (% of votes against management) Note: the darker the colour the more votes against management Source: Allianz Global Investors, as at 31 December 2023. Allianz Global Investors Sustainability and Stewardship Report 2023 67

2023 | Sustainability Report Page 67 Page 69

2023 | Sustainability Report Page 67 Page 69