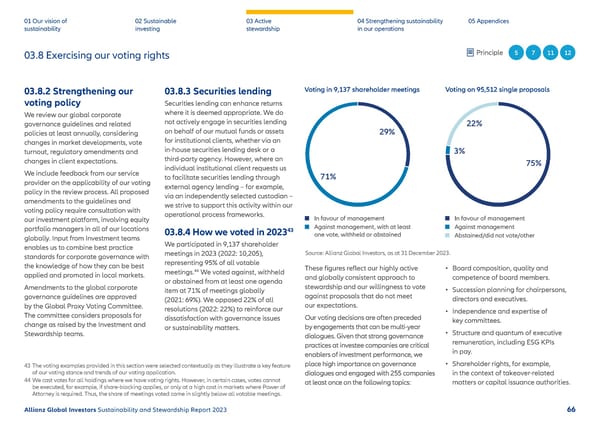

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 03.8 Exercising our voting rights Principle 5 7 11 12 03.8.2 Strengthening our 03.8.3 Securities lending Voting in 9,137 shareholder meetings Voting on 95,512 single proposals voting policy Securities lending can enhance returns We review our global corporate where it is deemed appropriate. We do governance guidelines and related not actively engage in securities lending 22% policies at least annually, considering on behalf of our mutual funds or assets 29% changes in market developments, vote for institutional clients, whether via an turnout, regulatory amendments and in-house securities lending desk or a 3% changes in client expectations. third-party agency. However, where an 75% We include feedback from our service individual institutional client requests us provider on the applicability of our voting to facilitate securities lending through 71% policy in the review process. All proposed external agency lending – for example, amendments to the guidelines and via an independently selected custodian – voting policy require consultation with we strive to support this activity within our our investment platform, involving equity operational process frameworks. In favour of management In favour of management portfolio managers in all of our locations 03.8.4 How we voted in 202343 Against management, with at least Against management globally. Input from Investment teams one vote, withheld or abstained Abstained/did not vote/other enables us to combine best practice We participated in 9,137 shareholder standards for corporate governance with meetings in 2023 (2022: 10,205), Source: Allianz Global Investors, as at 31 December 2023. the knowledge of how they can be best representing 95% of all votable These 昀椀gures re昀氀ect our highly active • Board composition, quality and 44 applied and promoted in local markets. meetings. We voted against, withheld and globally consistent approach to competence of board members. Amendments to the global corporate or abstained from at least one agenda stewardship and our willingness to vote item at 71% of meetings globally against proposals that do not meet • Succession planning for chairpersons, governance guidelines are approved (2021: 69%). We opposed 22% of all directors and executives. by the Global Proxy Voting Committee. resolutions (2022: 22%) to reinforce our our expectations. • Independence and expertise of The committee considers proposals for dissatisfaction with governance issues Our voting decisions are often preceded key committees. change as raised by the Investment and or sustainability matters. by engagements that can be multi-year Stewardship teams. dialogues. Given that strong governance • Structure and quantum of executive practices at investee companies are critical remuneration, including ESG KPIs enablers of investment performance, we in pay. 43 The voting examples provided in this section were selected contextually as they illustrate a key feature place high importance on governance • Shareholder rights, for example, of our voting stance and trends of our voting application. dialogues and engaged with 255 companies in the context of takeover-related 44 We cast votes for all holdings where we have voting rights. However, in certain cases, votes cannot at least once on the following topics: matters or capital issuance authorities. be executed, for example, if share-blocking applies, or only at a high cost in markets where Power of Attorney is required. Thus, the share of meetings voted came in slightly below all votable meetings. Allianz Global Investors Sustainability and Stewardship Report 2023 66

2023 | Sustainability Report Page 66 Page 68

2023 | Sustainability Report Page 66 Page 68