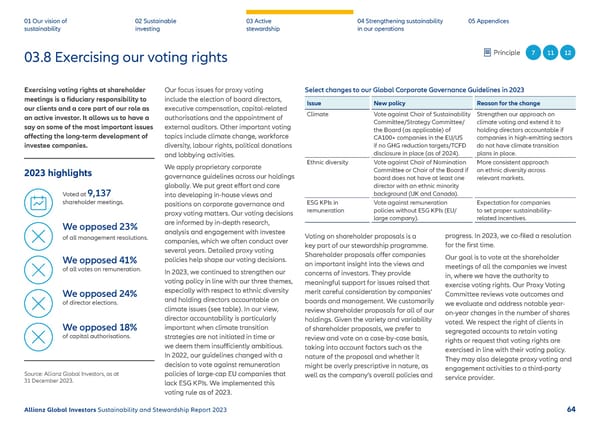

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 03.8 Exercising our voting rights Principle 7 11 12 Exercising voting rights at shareholder Our focus issues for proxy voting Select changes to our Global Corporate Governance Guidelines in 2023 meetings is a 昀椀duciary responsibility to include the election of board directors, Issue New policy Reason for the change our clients and a core part of our role as executive compensation, capital-related Climate Vote against Chair of Sustainability Strengthen our approach on an active investor. It allows us to have a authorisations and the appointment of Committee/Strategy Committee/ climate voting and extend it to say on some of the most important issues external auditors. Other important voting the Board (as applicable) of holding directors accountable if a昀昀ecting the long-term development of topics include climate change, workforce CA100+ companies in the EU/US companies in high-emitting sectors investee companies. diversity, labour rights, political donations if no GHG reduction targets/TCFD do not have climate transition and lobbying activities. disclosure in place (as of 2024). plans in place. We apply proprietary corporate Ethnic diversity Vote against Chair of Nomination More consistent approach 2023 highlights Committee or Chair of the Board if on ethnic diversity across governance guidelines across our holdings board does not have at least one relevant markets. globally. We put great e昀昀ort and care director with an ethnic minority Voted at 9,137 into developing in-house views and background (UK and Canada). shareholder meetings. positions on corporate governance and ESG KPIs in Vote against remuneration Expectation for companies proxy voting matters. Our voting decisions remuneration policies without ESG KPIs (EU/ to set proper sustainability- are informed by in-depth research, large company). related incentives. We opposed 23% analysis and engagement with investee of all management resolutions. companies, which we often conduct over Voting on shareholder proposals is a progress. In 2023, we co-昀椀led a resolution several years. Detailed proxy voting key part of our stewardship programme. for the 昀椀rst time. We opposed 41% policies help shape our voting decisions. Shareholder proposals o昀昀er companies Our goal is to vote at the shareholder of all votes on remuneration. an important insight into the views and meetings of all the companies we invest In 2023, we continued to strengthen our concerns of investors. They provide in, where we have the authority to voting policy in line with our three themes, meaningful support for issues raised that exercise voting rights. Our Proxy Voting We opposed 24% especially with respect to ethnic diversity merit careful consideration by companies’ Committee reviews vote outcomes and of director elections. and holding directors accountable on boards and management. We customarily we evaluate and address notable year- climate issues (see table). In our view, review shareholder proposals for all of our on-year changes in the number of shares director accountability is particularly holdings. Given the variety and variability voted. We respect the right of clients in We opposed 18% important when climate transition of shareholder proposals, we prefer to segregated accounts to retain voting of capital authorisations. strategies are not initiated in time or review and vote on a case-by-case basis, rights or request that voting rights are we deem them insu昀케ciently ambitious. taking into account factors such as the exercised in line with their voting policy. In 2022, our guidelines changed with a nature of the proposal and whether it They may also delegate proxy voting and decision to vote against remuneration might be overly prescriptive in nature, as engagement activities to a third-party Source: Allianz Global Investors, as at policies of large-cap EU companies that well as the company’s overall policies and service provider. 31 December 2023. lack ESG KPIs. We implemented this voting rule as of 2023. Allianz Global Investors Sustainability and Stewardship Report 2023 64

2023 | Sustainability Report Page 64 Page 66

2023 | Sustainability Report Page 64 Page 66