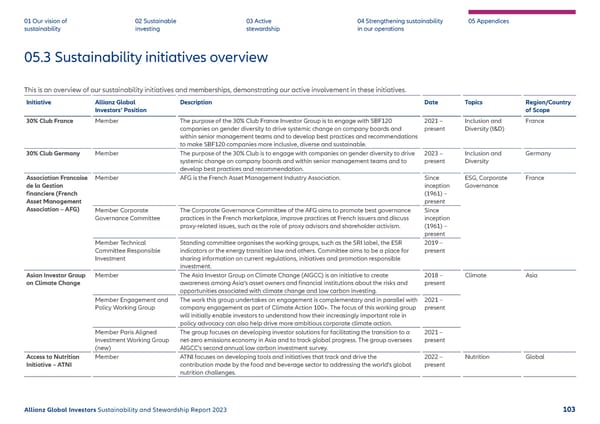

01 Our vision of 02 Sustainable 03 Active 04 Strengthening sustainability 05 Appendices sustainability investing stewardship in our operations 05.3 Sustainability initiatives overview This is an overview of our sustainability initiatives and memberships, demonstrating our active involvement in these initiatives. Initiative Allianz Global Description Date Topics Region/Country Investors‘ Position of Scope 30% Club France Member The purpose of the 30% Club France Investor Group is to engage with SBF120 2021 – Inclusion and France companies on gender diversity to drive systemic change on company boards and present Diversity (I&D) within senior management teams and to develop best practices and recommendations to make SBF120 companies more inclusive, diverse and sustainable. 30% Club Germany Member The purpose of the 30% Club is to engage with companies on gender diversity to drive 2023 – Inclusion and Germany systemic change on company boards and within senior management teams and to present Diversity develop best practices and recommendation. Association Francaise Member AFG is the French Asset Management Industry Association. Since ESG, Corporate France de la Gestion inception Governance 昀椀nanciere (French (1961) – Asset Management present Association – AFG) Member Corporate The Corporate Governance Committee of the AFG aims to promote best governance Since Governance Committee practices in the French marketplace, improve practices at French issuers and discuss inception proxy-related issues, such as the role of proxy advisors and shareholder activism. (1961) – present Member Technical Standing committee organises the working groups, such as the SRI label, the ESR 2019 – Committee Responsible indicators or the energy transition law and others. Committee aims to be a place for present Investment sharing information on current regulations, initiatives and promotion responsible investment. Asian Investor Group Member The Asia Investor Group on Climate Change (AIGCC) is an initiative to create 2018 – Climate Asia on Climate Change awareness among Asia’s asset owners and 昀椀nancial institutions about the risks and present opportunities associated with climate change and low carbon investing. Member Engagement and The work this group undertakes on engagement is complementary and in parallel with 2021 – Policy Working Group company engagement as part of Climate Action 100+. The focus of this working group present will initially enable investors to understand how their increasingly important role in policy advocacy can also help drive more ambitious corporate climate action. Member Paris Aligned The group focuses on developing investor solutions for facilitating the transition to a 2021 – Investment Working Group net-zero emissions economy in Asia and to track global progress. The group oversees present (new) AIGCC’s second annual low carbon investment survey. Access to Nutrition Member ATNI focuses on developing tools and initiatives that track and drive the 2022 – Nutrition Global Initiative – ATNI contribution made by the food and beverage sector to addressing the world’s global present nutrition challenges. Allianz Global Investors Sustainability and Stewardship Report 2023 103

2023 | Sustainability Report Page 103 Page 105

2023 | Sustainability Report Page 103 Page 105