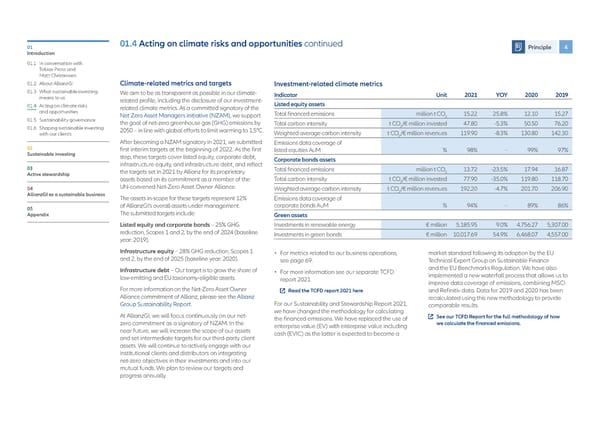

01 01.4 Acting on climate risks and opportunities continued Principle 4 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Climate-related metrics and targets Investment-related climate metrics 01.3 W hat sustainable investing We aim to be as transparent as possible in our climate- Indicator Unit 2021 YOY 2020 2019 means to us related profile, including the disclosure of our investment- 01.4 Acting on climate risks related climate metrics. As a committed signatory of the Listed equity assets and opportunities Net Zero Asset Managers initiative (NZAM), we support Total financed emissions million t CO 15.22 25.8% 12.10 15.27 01.5 Sustainability governance 2 the goal of net-zero greenhouse gas (GHG) emissions by Total carbon intensity t CO /€ million invested 47.80 -5.3% 50.50 76.20 01.6 Shaping sustainable investing 2050 – in line with global efforts to limit warming to 1.5°C. 2 with our clients Weighted average carbon intensity t CO /€ million revenues 119.90 -8.3% 130.80 142.30 2 After becoming a NZAM signatory in 2021, we submitted Emissions data coverage of 02 first interim targets at the beginning of 2022. As the first listed equities AuM % 98% – 99% 97% Sustainable investing step, these targets cover listed equity, corporate debt, infrastructure equity, and infrastructure debt, and reflect Corporate bonds assets 03 Total financed emissions million t CO 13.72 -23.5% 17.94 16.87 Active stewardship the targets set in 2021 by Allianz for its proprietary 2 assets based on its commitment as a member of the Total carbon intensity t CO /€ million invested 77.90 -35.0% 119.80 118.70 2 04 UN-convened Net-Zero Asset Owner Alliance. Weighted average carbon intensity t CO /€ million revenues 192.20 -4.7% 201.70 206.90 AllianzGI as a sustainable business 2 The assets in-scope for these targets represent 12% Emissions data coverage of 05 of AllianzGI’s overall assets under management. corporate bonds AuM % 94% – 89% 86% Appendix The submitted targets include: Green assets Listed equity and corporate bonds – 25% GHG Investments in renewable energy € million 5,185.95 9.0% 4,756.27 5,307.00 reduction, Scopes 1 and 2, by the end of 2024 (baseline Investments in green bonds € million 10,017.69 54.9% 6,468.07 4,557.00 year: 2019). Infrastructure equity – 28% GHG reduction, Scopes 1 • For metrics related to our business operations, market standard following its adoption by the EU and 2, by the end of 2025 (baseline year: 2020). see page 69. Technical Expert Group on Sustainable Finance Infrastructure debt – Our target is to grow the share of • For more information see our separate TCFD and the EU Benchmarks Regulation. We have also low-emitting and EU taxonomy-eligible assets. report 2021 implemented a new waterfall process that allows us to improve data coverage of emissions, combining MSCI For more information on the Net-Zero Asset Owner Read the TCFD report 2021 here and Refinitiv data. Data for 2019 and 2020 has been Alliance commitment of Allianz, please see the Allianz recalculated using this new methodology to provide Group Sustainability Report. For our Sustainability and Stewardship Report 2021, comparable results. At AllianzGI, we will focus continuously on our net- we have changed the methodology for calculating the financed emissions. We have replaced the use of See our TCFD Report for the full methodology of how zero commitment as a signatory of NZAM. In the enterprise value (EV) with enterprise value including we calculate the financed emissions. near future, we will increase the scope of our assets cash (EVIC) as the latter is expected to become a and set intermediate targets for our third-party client assets. We will continue to actively engage with our institutional clients and distributors on integrating net-zero objectives in their investments and into our mutual funds. We plan to review our targets and progress annually.

Allianz GI Sustainability and Stewardship Report 2021 Page 13 Page 15

Allianz GI Sustainability and Stewardship Report 2021 Page 13 Page 15