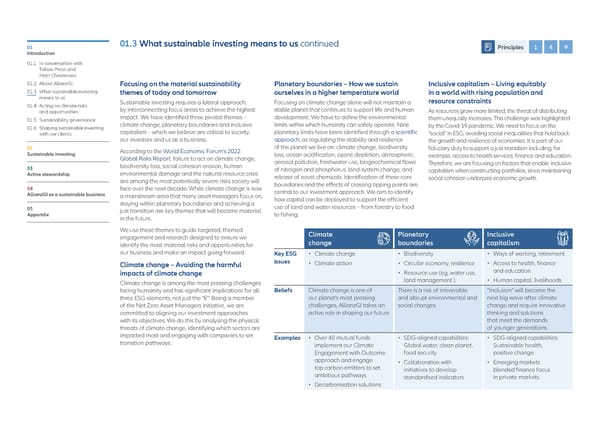

01 01.3 What sustainable investing means to us continued Principles 1 4 9 Introduction 01.1 In conversation with Tobias Pross and Matt Christensen 01.2 About AllianzGI Focusing on the material sustainability Planetary boundaries – How we sustain Inclusive capitalism – Living equitably 01.3 What sustainable investing themes of today and tomorrow ourselves in a higher temperature world in a world with rising population and means to us Sustainable investing requires a lateral approach, Focusing on climate change alone will not maintain a resource constraints 01.4 Acting on climate risks by interconnecting focus areas to achieve the highest stable planet that continues to support life and human and opportunities As resources grow more limited, the threat of distributing 01.5 Sustainability governance impact. We have identified three pivotal themes – development. We have to define the environmental them unequally increases. This challenge was highlighted 01.6 Shaping sustainable investing climate change, planetary boundaries and inclusive limits within which humanity can safely operate. Nine by the Covid-19 pandemic. We need to focus on the with our clients capitalism – which we believe are critical to society, planetary limits have been identified through a scientific “social” in ESG, avoiding social inequalities that hold back our investors and us as a business. approach, as regulating the stability and resilience the growth and resilience of economies. It is part of our 02 According to the World Economic Forum’s 2022 of the planet we live on: climate change, biodiversity fiduciary duty to support a just transition including, for Sustainable investing Global Risks Report, failure to act on climate change, loss, ocean acidification, ozone depletion, atmospheric example, access to health services, finance and education. biodiversity loss, social cohesion erosion, human aerosol pollution, freshwater use, biogeochemical flows Therefore, we are focusing on factors that enable inclusive 03 of nitrogen and phosphorus, land-system change, and capitalism when constructing portfolios, since maintaining Active stewardship environmental damage and the natural resource crisis release of novel chemicals. Identification of these core social cohesion underpins economic growth. are among the most potentially severe risks society will boundaries and the effects of crossing tipping points are 04 face over the next decade. While climate change is now central to our investment approach. We aim to identify AllianzGI as a sustainable business a mainstream area that many asset managers focus on, how capital can be deployed to support the efficient staying within planetary boundaries and achieving a use of land and water resources – from forestry to food 05 just transition are key themes that will become material Appendix in the future. to fishing. We use these themes to guide targeted, themed Climate Planetary Inclusive engagement and research designed to ensure we change boundaries capitalism identify the most material risks and opportunities for our business and make an impact going forward. Key ESG • Climate change • Biodiversity • Ways of working, retirement Climate change – Avoiding the harmful issues • Climate action • Circular economy, resilience • Access to health, finance impacts of climate change • Resource use (eg, water use, and education Climate change is among the most pressing challenges land management ) • Human capital, livelihoods facing humanity and has significant implications for all Beliefs Climate change is one of There is a risk of irreversible “Inclusion” will become the three ESG elements, not just the “E”. Being a member our planet’s most pressing and abrupt environmental and next big wave after climate of the Net Zero Asset Managers initiative, we are challenges, AllianzGI takes an social changes change and require innovative committed to aligning our investment approaches active role in shaping our future thinking and solutions with its objectives. We do this by analysing the physical that meet the demands threats of climate change, identifying which sectors are of younger generations impacted most and engaging with companies to set Examples • Over 40 mutual funds • SDG-aligned capabilities: • SDG-aligned capabilities: transition pathways. implement our Climate Global water, clean planet, Sustainable health, Engagement with Outcome food security positive change approach and engage • Collaboration with • Emerging markets top carbon emitters to set initiatives to develop blended finance focus ambitious pathways standardised indicators in private markets • Decarbonisation solutions

Allianz GI Sustainability and Stewardship Report 2021 Page 10 Page 12

Allianz GI Sustainability and Stewardship Report 2021 Page 10 Page 12