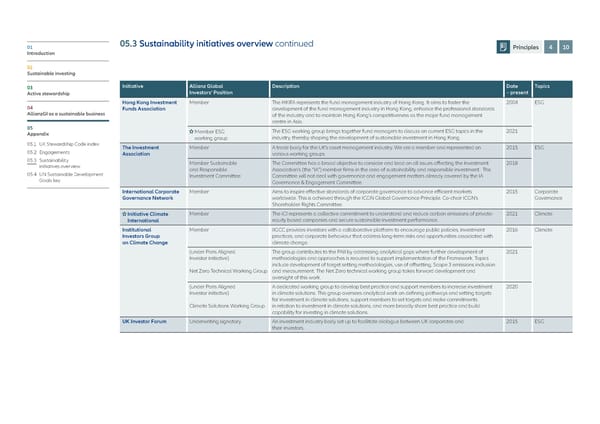

01 05.3 Sustainability initiatives overview continued Principles 4 10 Introduction 02 Sustainable investing 03 Initiative Allianz Global Description Date Topics Active stewardship Investors‘ Position – present Hong Kong Investment Member The HKIFA represents the fund management industry of Hong Kong. It aims to foster the 2004 ESG 04 Funds Association development of the fund management industry in Hong Kong, enhance the professional standards AllianzGI as a sustainable business of the industry and to maintain Hong Kong's competitiveness as the major fund management centre in Asia. 05 Member ESG The ESG working group brings together fund managers to discuss on current ESG topics in the 2021 Appendix working group industry, thereby shaping the development of sustainable investment in Hong Kong. 05.1 UK Stewardship Code index The Investment Member A trade body for the UK's asset management industry. We are a member and represented on 2015 ESG 05.2 Engagements Association various working groups. 05.3 Sustainability Member Sustainable The Committee has a broad objective to consider and lead on all issues affecting the Investment 2018 initiatives overview and Responsible Association’s (the “IA”) member firms in the area of sustainability and responsible investment. The 05.4 U N Sustainable Development Investment Committee Committee will not deal with governance and engagement matters already covered by the IA Goals key Governance & Engagement Committee. International Corporate Member Aims to inspire effective standards of corporate governance to advance efficient markets 2015 Corporate Governance Network worldwide. This is achieved through the ICGN Global Governance Principle. Co-chair ICGN's Governance Shareholder Rights Committee. Initiative Climate Member The iCI represents a collective commitment to understand and reduce carbon emissions of private- 2021 Climate International equity based companies and secure sustainable investment performance. Institutional Member IIGCC provides investors with a collaborative platform to encourage public policies, investment 2016 Climate Investors Group practices, and corporate behaviour that address long-term risks and opportunities associated with on Climate Change climate change. (under Paris Aligned The group contributes to the PAII by addressing analytical gaps where further development of 2021 Investor initiative) methodologies and approaches is required to support implementation of the Framework. Topics include development of target setting methodologies, use of offsetting, Scope 3 emissions inclusion Net Zero Technical Working Group and measurement. The Net Zero technical working group takes forward development and oversight of this work. (under Paris Aligned A dedicated working group to develop best practice and support members to increase investment 2020 Investor initiative) in climate solutions. This group oversees analytical work on defining pathways and setting targets for investment in climate solutions, support members to set targets and make commitments Climate Solutions Working Group in relation to investment in climate solutions, and more broadly share best practice and build capability for investing in climate solutions. UK Investor Forum Underwriting signatory An investment industry body set up to facilitate dialogue between UK corporates and 2015 ESG their investors.

Allianz GI Sustainability and Stewardship Report 2021 Page 86 Page 88

Allianz GI Sustainability and Stewardship Report 2021 Page 86 Page 88