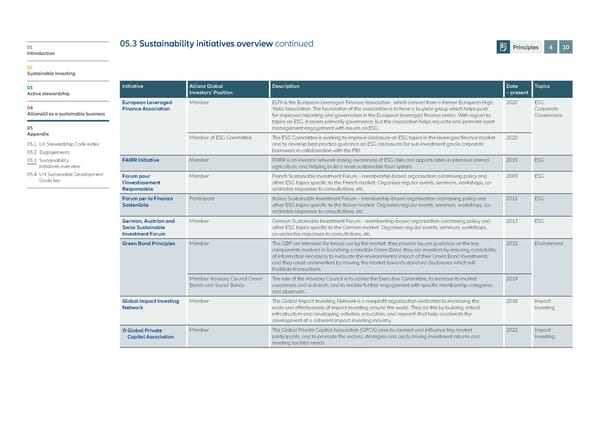

01 05.3 Sustainability initiatives overview continued Principles 4 10 Introduction 02 Sustainable investing 03 Initiative Allianz Global Description Date Topics Active stewardship Investors‘ Position – present European Leveraged Member ELFA is the European Leveraged Finance Association , which derived from a former European High 2020 ESG, 04 Finance Association Yield Association. The foundation of the association is to have a buyside group which helps push Corporate AllianzGI as a sustainable business for improved reporting and governance in the European leveraged finance arena. With regard to Governance topics on ESG, it covers primarily governance, but the association helps educate and promote asset 05 management engagement with issuers on ESG. Appendix Member of ESG Committee The ESG Committee is working to improve disclosure on ESG topics in the leveraged finance market 2020 05.1 UK Stewardship Code index and to develop best practice guidance on ESG disclosures for sub-investment grade corporate 05.2 Engagements borrowers in collaboration with the PRI. 05.3 Sustainability FAIRR Initiative Member FAIRR is an investor network raising awareness of ESG risks and opportunities in intensive animal 2019 ESG initiatives overview agriculture, and helping build a more sustainable food system. 05.4 U N Sustainable Development Forum pour Member French Sustainable Investment Forum – membership-based organisation addressing policy and 2009 ESG Goals key I´Investissement other ESG topics specific to the French market. Organises regular events, seminars, workshops, co- Responsable ordinates responses to consultations, etc. Forum per la Finanza Participant Italian Sustainable Investment Forum – membership-based organisation addressing policy and 2011 ESG Sostenibile other ESG topics specific to the Italian market. Organises regular events, seminars, workshops, co- ordinates responses to consultations, etc. German, Austrian and Member German Sustainable Investment Forum – membership-based organisation addressing policy and 2013 ESG Swiss Sustainable other ESG topics specific to the German market. Organises regular events, seminars, workshops, Investment Forum co-ordinates responses to consultations, etc. Green Bond Principles Member The GBP are intended for broad use by the market: they provide issuers guidance on the key 2015 Environment components involved in launching a credible Green Bond; they aid investors by ensuring availability of information necessary to evaluate the environmental impact of their Green Bond investments; and they assist underwriters by moving the market towards standard disclosures which will facilitate transactions. Member Advisory Council Green The role of the Advisory Council is to advise the Executive Committee, to increase its market 2019 Bonds and Social Bonds awareness and outreach, and to enable further engagement with specific membership categories and observers. Global Impact Investing Member The Global Impact Investing Network is a nonprofit organisation dedicated to increasing the 2018 Impact Network scale and effectiveness of impact investing around the world. They do this by building critical Investing infrastructure and developing activities, education, and research that help accelerate the development of a coherent impact investing industry. Global Private Member The Global Private Capital Association (GPCA) aims to connect and influence key market 2021 Impact Capital Association participants, and to promote the sectors, strategies and deals driving investment returns and Investing meeting societal needs.

Allianz GI Sustainability and Stewardship Report 2021 Page 85 Page 87

Allianz GI Sustainability and Stewardship Report 2021 Page 85 Page 87